In financial management,business inventory accounting đóng một vai trò quan trọng, chức năng này giúp doanh nghiệp không chỉ ghi nhận giá trị của sản phẩm lưu trữ trong kho của mình mà còn tạo ra cơ sở dữ liệu quan trọng cho việc lập kế hoạch tài chính, dài hạn. Hãy cùng AccNet tìm hiểu về method of accounting and inventory details just below this article!

1. Accounting what is inventory?

Inventory Accounting is the process of recording all transactions related to purchasing, selling, inventory management, tracking details. This is considered an important part of the accounting system of the business. The purpose of accounting and inventory details is to assist businesses understand the value, the change of inventory over time.

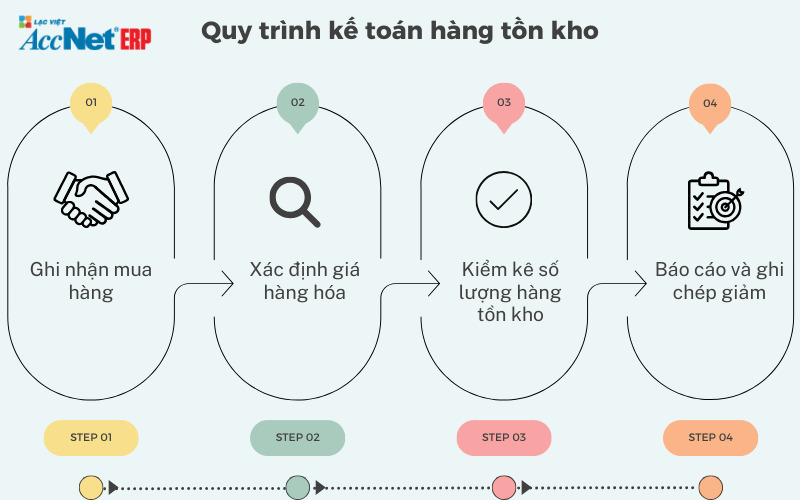

2. Quy trình kế toán chi tiết hàng tồn kho mới nhất 2025

Step 1: Record a purchase

When a company purchase, the first step in the process accounting is recorded transactions. This involves creating a contract purchase order, enter the information such as quantity, cost,... through the accounting system, this information is accumulated, automatic update, create the foundation for the calculation of price, inventory tracking.

Record purchase full not only useful in determining the actual cost, but also provide the foundation for the steps inventory management next.

Step 2: Determine the price of goods in inventory accounting

One of the basic steps in the management of inventory is the cost of goods sold. Methods of FIFO, LIFO, or average price used to determine the price of capital of each shipment entering.

This creates favorable conditions for determining the exact price of inventory sold, as well as calculate the net profit from the sale. Create favorable conditions for the calculation of costs, preparation of the decision related to the cost of capital of a business.

Read more:

- Hệ thống kế toán kiểm soát kho vật tư giúp tránh chênh lệch tồn thực

- Instructions how to calculate inventory cuối kỳ theo phương pháp nhập trước xuất trước

- The method of calculating the price of stock nhất quán theo kỳ kế toán

Step 3: inventory inventory number

To ensure the legality of the data accounting system, companies often perform the audit inventory. This procedure is related to the verification of quantity and value of the physical property compared with information in the system.

All differences will be recorded, accounted for in the accounting system. Inventory not only create conditions for maintaining the data correctly, but also detect and fix the errors in the data recording immediately.

Step 4: reporting and recording reduced inventory accounting

If any inventory of any lost, damaged or diminished in-process inventory, the company will record the amount of inventory decreased. It helps to accurately reflect the status of the repository.

Finally, the company create a report accounting include the final value of the inventory, the amount of inventory has decreased in the business process, the appropriate information other business efficiency. This report not only have important implications for the management but also the role is to inform the other parties (such as shareholders, bank) about the financial situation of the company.

3. The method of inventory accounting popular today

In business, only one of the two method of accounting and inventory details used: method declaration, regular, or method of inventory periodically.

Methods of inventory management được lựa chọn phải căn cứ vào tính chất, số lượng, chủng loại hàng hóa, dịch vụ, yêu cầu của cấp quản lý để áp dụng phù hợp. Nó phải được sử dụng nhất quán trong suốt kỳ kế toán. Cùng AccNet tìm hiểu ngay 2 phương pháp này dưới đây:

Read more:

- Accounting for inventory giúp doanh nghiệp kiểm soát vật tư hiệu quả

- Accounting standards inventory: hướng dẫn áp dụng doanh nghiệp

- Method of inventory accounting chuẩn theo quy định kế toán

3.1. Method of

| Elements | Content details |

| Learn about methods | - Track on a regular basis, continuous, reasonable. - Indicates the amount of inventory that are imported, exported, stored. - The value of goods is calculated at any time during the accounting period. |

| Vouchers to be used | - Receipt, warehouse. - Record inventory of supplies and goods. |

| How accounting | - Export, import, warehouse, quality raw materials, goods available can be credited to the account reflects inventory (TK151,152,153,154,156,157). |

| Benefits of this method of inventory accounting | - Can find out quickly the number, the inventory value at different times if the company should assess. - The control, inventory management on a regular basis will constantly contribute to change the timely production activities of the enterprise. - Reduce errors in recording |

| Applicable objects | - This method is usually applied at the unit of production (industry, agriculture...). - The unit specializes in items of high value such as machinery, equipment, technical expertise, quality,... |

3.2. Method of inventory accounting inventory periodically

| Elements | Content details |

| Learn about methods | - No reviews, track regular, continuous. - Only show inventory first period, last period, not the current situation import goods incurred during the period. - The value of goods that are exported in this period, known only as the end states. - The estimated value of goods, investment goods in the states is done through the following formula: value goods stock in the period = inventory value, beginning of period + Total value of the goods enter the warehouse in usa - inventory value, end of period. |

| Vouchers to be used in the accounting and inventory details | - Receipt, warehouse. - Record inventory of supplies and goods. - End business accounting, get the documents related to the export, import goods from the warehouse, the stock from this is to check the accuracy, classified by type, then accounting will be recorded, accounting |

| How accounting | - Any changes of raw material, goods warehouses are not recorded, reflect on the account related to inventory. - Value materials, goods purchased inventory during this time are recorded, recorded on a financial account private (TK 611: “Purchase”). - Method of inventory periodically is applied only at the beginning of the accounting period (to transfer the balance to the beginning of the period), the end of the accounting period (to express the actual value) |

| Benefits of this method of inventory accounting | - Do not need to record too much - Reduce the hassle of having to track everything on the business ledger. |

| Applicable objects | - Method of inventory periodically in accordance with the company exchange the items are low value, bulk product category diversity... - For example, a company manufacturing garments have many raw materials (such as needles, thread, buttons,... ), or retail stores... |

Learn more:

- Provision for diminution in value of inventory theo chuẩn mực kế toán

- The coefficient of inventory turnover: công thức và cách tính chi tiết

- Hàng tồn kho bình quân và cách tính trong kế toán doanh nghiệp

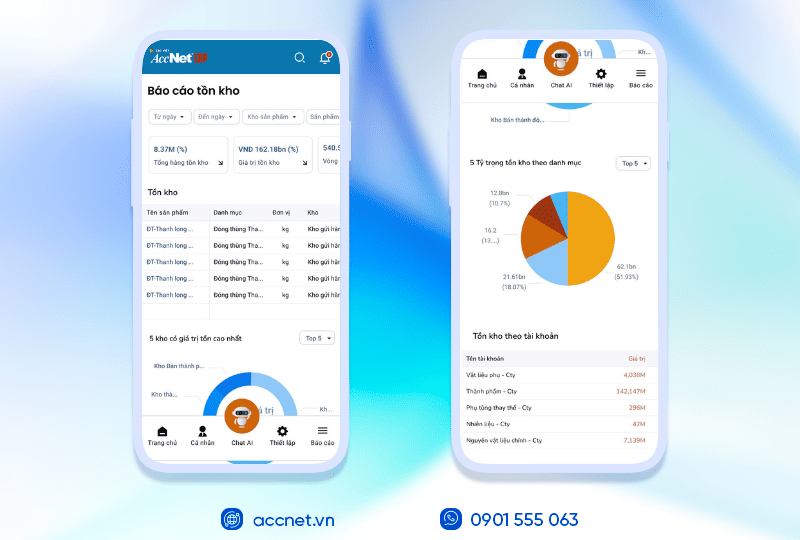

4. Giải pháp quản lý hàng tồn kho hiệu quả với phần mềm AccNet ERP

Quản lý hàng tồn kho bằng cách thủ công thường gây ra nhiều vấn đề: số liệu chênh lệch, tồn kho ảo, khó kiểm soát chi tiết theo lô, hạn dùng hay vị trí lưu trữ. Đây là lúc doanh nghiệp cần một hệ thống phần mềm chuyên nghiệp để tối ưu vận hành.

AccNet ERP với module quản lý kho (AccNet Inventory) được thiết kế để giải quyết triệt để những khó khăn trên. Phần mềm giúp:

- Theo dõi tồn kho theo thời gian thực: Mọi nhập – xuất – chuyển kho đều được cập nhật ngay lập tức.

- Tự động tính giá vốn: Hỗ trợ nhiều phương pháp như FIFO, bình quân gia quyền, đích danh.

- Quản lý chi tiết đa chiều: Theo lô, hạn sử dụng, màu sắc, kích cỡ hoặc vị trí lưu kho.

- Tích hợp kế toán – tài chính: Bút toán phát sinh được cập nhật đồng bộ vào hệ thống kế toán.

- Hỗ trợ AI phân tích: Cảnh báo hàng tồn đọng, đưa ra dự báo nhập – xuất để tối ưu dòng tiền.

Với AccNet ERP, doanh nghiệp giảm đáng kể thời gian nhập liệu, nâng cao độ chính xác dữ liệu, đồng thời dễ dàng kiểm soát chi phí và hiệu quả tồn kho. Đây chính là giải pháp toàn diện cho quản lý kho trong kỷ nguyên số.

PHẦN MỀM QUẢN LÝ KHO ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” Không chỉ là một phần mềm nhập – xuất thông thường, AccNet ERP chính là nền tảng quản lý kho thông minh, tích hợp thiết bị, kết nối dữ liệu, cảnh báo tức thời, giúp doanh nghiệp: AccNet ERP mở ra một bước tiến mới trong quản lý kho khi tích hợp trợ lý tài chính AI, giúp doanh nghiệp vận hành chủ động và ra quyết định chính xác hơn. ✅ Quản lý kho chủ động – Không còn “tồn kho ảo, thất thoát khó kiểm soát” ✅ Hiệu quả rõ rệt khi ứng dụng quản lý kho tích hợp AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Hàng tồn kho giảm nói lên điều gì về hiệu quả quản lý kho

On this is the whole information about the method inventory accounting mà AccNet chia sẻ tới bạn đọc. Phương pháp này giúp doanh nghiệp hiểu được giá trị của hàng tồn kho, các chi phí liên quan, doanh nghiệp có thể cải thiện quy trình sản xuất, giảm rủi ro về hàng tồn kho, tăng khả năng cạnh tranh trên thị trường.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: