Excel is one of the tools provide invaluable support to the accounting department in the business. Use the sample excel file internal accounting help business perform the operations correctly and optimized more time. Let's Accnet find out right under article later!

1. Sample Excel file internal accounting what is?

Sample Excel file internal accounting is a tool to help management accounting vouchers, bills, internal activities that take place daily in the business.

With the sample excel file internal accounting, the work of accountant will become easier and more convenient. The number of data is statistics specific and calculated according to the formula available, from which minimize the working time, increase accuracy, the general performance.

Read more:

- Hướng dẫn làm sổ kế toán trên Excel cho người không chuyên

- Cách làm sổ cái trên Excel nhanh, chuẩn, không sai sót

2. Download 5 Template Excel file internal accounting exact and the most common 2024 (Download now)

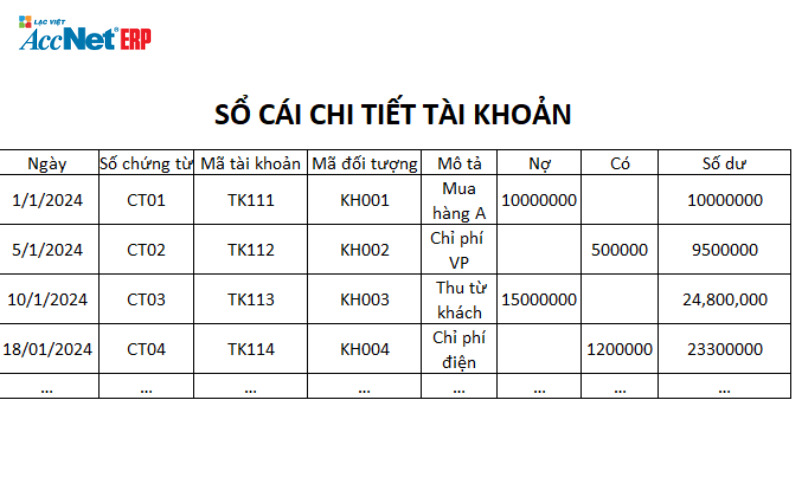

2.1. Sample Excel file ledger account details

Sample Excel file window, the details of the account is a document information record the transactions on the account details, the economic and financial arise in specific time, and is specified in the system account in the accounting business.

With each number that excel includes information about the date, voucher number, account code, object code, description, amount owed, the amount of money available, and your account balance after each transaction.

For each school in the sample excel file internal accounting of the account details will be shown specifically, the information belongs to the transaction. Take out the visual look, detailed for personal, relevant, easily track and evaluate.

Explain components details in excel template ledger account details:

- Date: Date of transaction.

- Number of vouchers: voucher Codes financing related to the transaction.

- Account code: Code account accounting.

- Object code: the Code number of objects related to transactions (for example: customer code, employee code).

- Description: brief description about the content of the transaction.

- Debt: debt amount corresponding to the transaction.

- Available: the amount that corresponds to the transaction.

- Balance: the account balance after the transaction.

|

Download excel file internal accounting ledger account details |

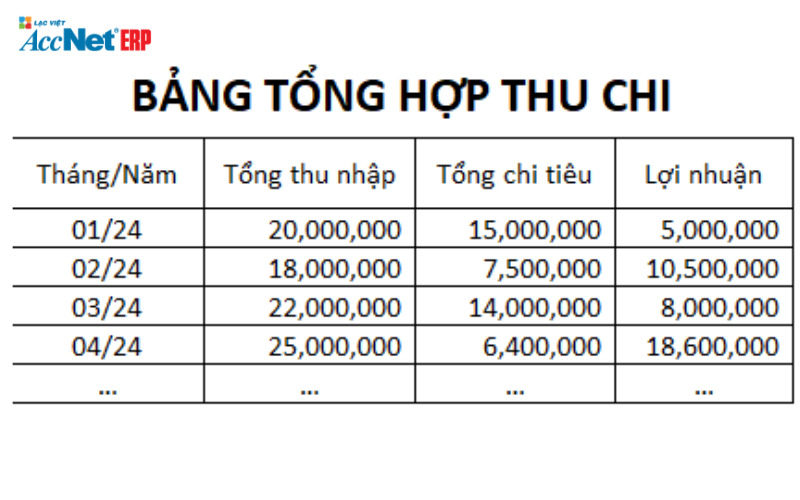

2.2. Sample Excel file internal accounting general income and expenditure

Revenue and expenditure management is an important activity in the process of enterprise management. The catch the funds collected on, branch out to help businesses control cash flow, from which it plans to distribute the budget rationally. Most businesses use a template excel file internal accounting general income and expenditure to reviews.

The composite panel revenue and expenses showing the total income, total expenditure and profit in each month. Data is aggregated from detailed transactions in the general ledger or other data sources to provide an overview about the financial situation of monthly organization.

Component details in Excel template:

- Month/Year: Month and year of data, income and expenditure.

- Total income: the Total amount of income during the month.

- Total spending: the Total amount spent for the month.

- Profit: the amount Of profit (income minus expenditure) in January.

- Object code: the Code number of objects (e.g., customers, employees).

- Object name: the Name of the object.

- Debt the beginning of the period: the amount Of debt the beginning of the period (amount of debt from the previous period).

- Debt: the amount Of debt incurred in the period.

- Arise are: amount arising during the period (if any).

- The debt end of the period: the amount Of debt remaining after the implementation of the transactions in the period.

|

Download excel file internal accounting general income and expenditure |

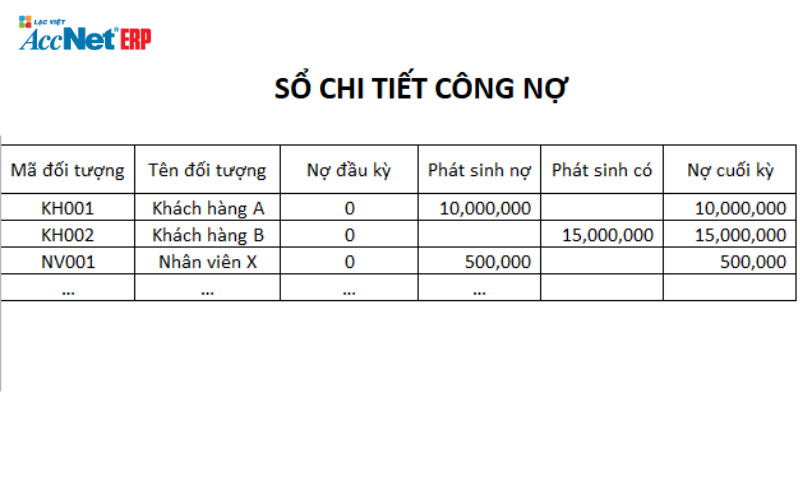

2.3. Sample Excel file details window public debt

Details window public debt is the denominator used to record the transaction of public debt, receivables and payables arising in a time tracking certain with each customer and supplier.

The information in the sample excel file details window public debt, including the code object, the object name, the amount of debt the beginning of the period, the amount of debt incurred and the amount of debt at maturity. With the recording of this information helps track and manage the debt with respect to the parties involved.

Component details in Excel template:

- Object code: the Code number of objects (e.g., customers, employees).

- Object name: the Name of the object.

- Debt the beginning of the period: the amount Of debt the beginning of the period (amount of debt from the previous period).

- Debt: the amount Of debt incurred in the period.

- Arise are: amount arising during the period (if any).

- The debt end of the period: the amount Of debt remaining after the implementation of the transactions in the period.

| Download Excel file details window public debt |

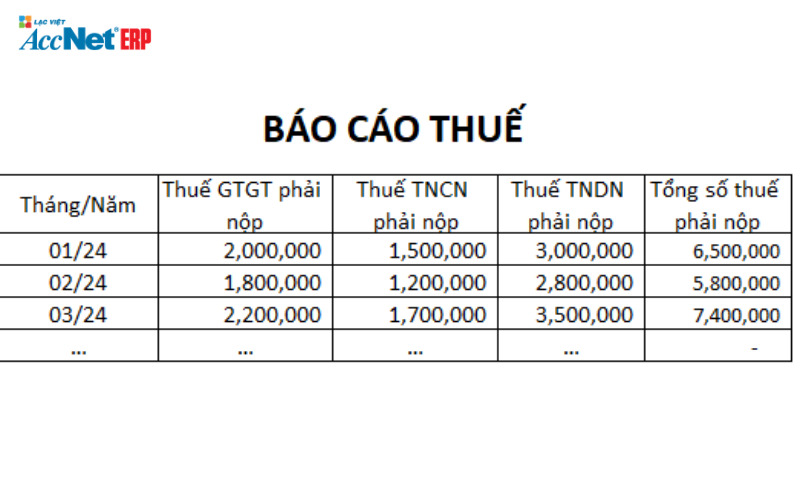

2.4. Sample Excel file internal accounting tax reporting

Sample excel file tax report provides the information related to the taxes according to month cycle, including value added tax, personal income tax, corporate income tax.

Sample Excel file internal accounting reports, tax, business easily control the tax need to pay monthly, which helps to ensure compliance with the stipulated time of tax filing and optimal activity financial management.

Component details in Excel template:

- Month/Year: Month and year of report.

- VAT payable: the amount Of VAT payable for the month.

- Personal income tax payable: the amount Of personal income tax payable in the month.

- INCOME tax payable: amount Of corporate income tax payable in the month.

- Total tax to be paid: the Total amount of tax payable in the month.

| Download Excel file tax reports |

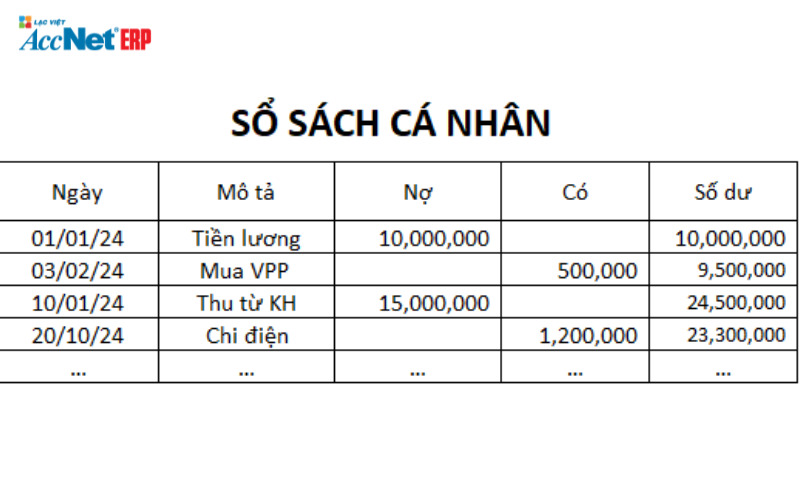

2.5. Sample Excel file books personal

Sample Excel file books personal help record the transactions of the individual or a specific account. This is also a tool to help keep track of your spending, income and balances of the individual.

Component details in Excel template:

- Date: Date of transaction.

- Description: brief description about the content of the transaction.

- Debt: debt amount corresponding to the transaction.

- Available: the amount that corresponds to the transaction.

- Balance: the account balance after the transaction.

| Download Excel file books personal |

3. Note when using Excel file internal accounting business

When using excel, accounting, internal business needs note:

- Security information: material accounting is the important information of the enterprise, contain sensitive information that should be confidential. With the file contains important documents need to set a password, and only provides access for individuals with authority.

- Periodically backup: Make backup of accounting documents according to the periodic time. In particular, for the important documents need to backup before perform editing or need to transfer to another department.

- Version control: the control of different versions of the template excel file internal accounting helps to maintain the transparency, easy access to information when necessary. Business need to save the edited version, use the control function or notes, track the revision process to ensure all work activities of the accounting department are accurate.

- Check data integrity: Use the sample excel file internal accounting need to ensure the calculation formula in the spreadsheet correctly. By checking the calculation formula on excel with formula on accounting system official.

- Reduce risks from input errors: Need to check and compare information many times in the process of data entry to ensure the absolute accuracy. Use test tool, use the features in excel to limit the error wrong input.

4. Chuyển từ file Excel sang tự động — Nâng tầm kế toán nội bộ với AccNet ERP

Mẫu file Excel kế toán nội bộ là công cụ phổ biến giúp kế toán quản lý sổ cái chi tiết, tổng hợp thu-chi, công nợ, báo cáo thuế hay sổ sách cá nhân nhanh chóng—như các mẫu được chia sẻ trong bài “TẢI NGAY 5 Mẫu file Excel kế toán nội bộ chính xác nhất 2024” từ AccNet. Tuy nhiên, phương pháp này tiềm ẩn nhiều rủi ro: dễ sai sót do nhập liệu thủ công, khó kiểm soát phiên bản, bảo mật không cao, không phù hợp với doanh nghiệp quy mô lớn.

Vì sao nên chọn AccNet ERP thay vì gắn bó với Excel?

Không chỉ đơn thuần là phần mềm kế toán, AccNet ERP là nền tảng quản trị toàn diện, giúp doanh nghiệp tự động hóa hiệu quả hơn 80% nghiệp vụ kế toán nội bộ—bao gồm sổ cái, thu-chi, công nợ, ngân sách, tài sản, báo cáo—nhờ đó giảm lỗi, tăng tốc xử lý, thống nhất dữ liệu xuyên suốt hệ thống.

Với AccNet ERP, mỗi chứng từ, giao dịch đều được ghi nhận tự động, phần mềm tự tính số dư, công nợ, phân bổ, cập nhật báo cáo động theo thời gian thực. Mọi thao tác đều có audit trail rõ ràng: bạn biết ai làm, khi nào làm, nội dung gì—giúp nâng cao độ tin cậy, hỗ trợ kiểm toán nội bộ hiệu quả.

Ngoài ra, AccNet ERP tích hợp trực tiếp với các phân hệ như Mua hàng, Tồn kho, Ngân sách, Tài sản cố định, BI Dashboards... Nhờ đó, kế toán nội bộ không phải làm việc rời rạc với nhiều file; toàn bộ dữ liệu đều thống nhất, dễ truy vấn, khai thác cho các báo cáo phân tích thông minh.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Here is the detail information about the sample excel file internal accounting that Vietnam would like to share to the business. With the document template on, hope will be of help for accounting personnel to more easily deploy, monitor, service in internal business.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: