The supplement is an integral part to update the changes on the property or income in the process of business activities, help the authorities capture timely information, avoid these flaws should not be. This article AccNet will provide samples, the latest addition, accompanied by the concept, the important note, to help businesses easily complete this obligation is most effective.

1. Sample declaration of assets what is additionality?

Sample declaration of assets supplement is a form used to record, report the change information about the property/income since the last declaration before that. This is an important document to ensure that information about the assets of the business/individual is always fully updated and accurate.

The purpose of the template declaration and the additional property:

- Update the change on the property or income transparency.

- Meet the requirements of the law on management, declaration of assets.

- Form the basis of accurate data to support the inspection and supervision from the authorities.

Distinguish the additions and initial declaration:

- Original declaration: Recorded information assets and income at the time of the first declaration.

- Declare additional: recognition of the changes arising from property, income, or property values declared earlier.

2. Mẫu kê khai tài sản bổ sung mới nhất 2025

Dưới đây là mẫu hoàn chỉnh của Bản kê khai tài sản, thu nhập bổ sung theo quy định tại Phụ lục II của Nghị định 130/2020/NĐ-CP:

THE REPUBLIC SOCIALIST OF VIETNAM

Independence - freedom - happiness

DECLARATION OF ASSETS, INCOME SUPPLEMENTS

1. General information

Name the declarant: .............................................................

Date of birth: ..............................................................

Position/title work: ....................................................

Agency/work unit: .........................................................

Place of permanent residence: .................................................................

Number of CCCD/ID card: ............................ Date of issue: .................. Place of issue: ...................

2. Wife or husband of the declaration

Name: .................................................................

Date of birth: .............................................................

Career: .................................................................

Work: .................................................................

Place of permanent residence: .................................................................

Number of CCCD/ID card: ............................ Date of issue: .................. Place of issue: ...................

3. Minor children (son, daughter, adopted under the provisions of the law)4. Volatility assets, and income; explain the origin of assets, increased income

STT Name Date of birth Place of permanent residence Number of CCCD/ID card 1 .............. .............. .............. .............. 2 .............. .............. .............. ..............

STT Property type income Increase/decrease Property value, income The origin of assets increase and total income 1 Right practical use for the land .............. .............. .............. 2 Housing, construction other .............. .............. .............. 3 Other assets attached to the land .............. .............. .............. 4 Gold, diamonds, platinum and other precious metals .............. .............. .............. 5 Cash, bank deposits .............. .............. .............. 6 Stocks, bonds, equity .............. .............. .............. 7 Property abroad .............. .............. .............. 8 Total income between the two times declaration .............. .............. .............. 5. Descriptive information about assets, income increase

Detailed description: .................................................................................. ........................................................................................................... ...........................................................................................................

6. The commitment of the declarant

I hereby certify that the information declared above is true, complete and responsible before the substantive law was declared.

Date .... months .... 20 years...

Declaration

(Signature and name)

3. The legal regulations related to the sample, the additional

3.1. Legal grounds main

The declaration of additional property is specified in the text of the legislation below:

- The law on anti-corruption 2018

- Decree 130/2020/ND-CP

- Circular of the Ministry of Finance

3.2. Object, the time limit using the form declaration of assets additions

Objects need to declare additional:

Business:

- The state enterprise responsible for managing public property.

- Private enterprise when the property or income related to the operation management, public property or state budget.

Personal:

- Legal representative or senior manager in the business.

- The individual has the responsibility to declare the property in accordance with the law.

Period, frequency, apply the template to declare additional property:

The declaration when they arise, change the property or income: payment Time is within 30 days since have changed.

Declaration which states: Made annually or at the request of authorities.

Read more:

- Báo cáo kết quả kiểm kê tài sản phản ánh số lượng chênh lệch rõ ràng

- Tài sản và nguồn vốn trong kế toán quyết định cấu trúc tài chính ổn định

- Nội dung pháp lý nghị định 130 về kê khai tài sản

4. The note when you use the template to declare the additional property

4.1. Identify the right property in need of additional

- Only the declaration of assets or income that can change or arising new compared with the first declaration ago.

- Avoid declaration duplicate or omissions.

4.2. Check the accuracy and validity of information

- Information in the template declaration must match the stock from reality.

- Ensure asset value is calculated, accurately recorded.

4.3. Regulatory compliance deadlines using the form declaration of assets additions

- Submit form to declare additional correct term according to the requirements of regulatory authorities.

- Avoid administrative penalties due to late payment or declaration is wrong.

4.4. Handle errors or violations of

- If errors are detected after the submission template declaration, need to submit a declaration to supplement, explain to the authorities.

- Serious violations can subject to financial sanctions or prosecution legal.

Read more:

- Assets from loan funds ngân hàng phải định danh rõ nguồn vốn

- Guide and declaration of assets, income đảm bảo đúng chuẩn pháp lý

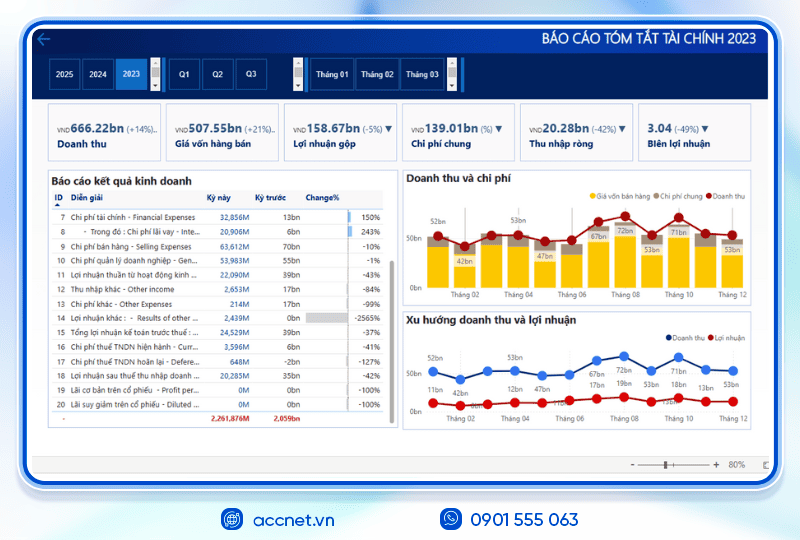

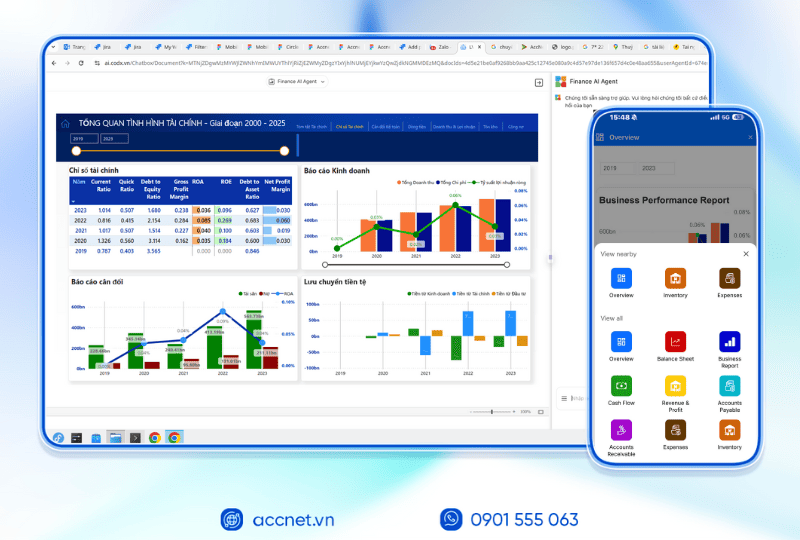

5. Quản lý kê khai tài sản bổ sung chuyên nghiệp với AccNet ERP

Trong bài “Mẫu kê khai tài sản bổ sung”, bạn đã được giới thiệu mẫu biểu mới nhất, quy định pháp lý, cũng như những lưu ý khi kê khai tài sản phát sinh hoặc thay đổi giá trị tài sản. Tuy nhiên, với cách làm thủ công — điền mẫu, kiểm tra số liệu – doanh nghiệp dễ gặp rủi ro sai sót, chậm trễ, khó theo dõi lịch sử biến động tài sản.

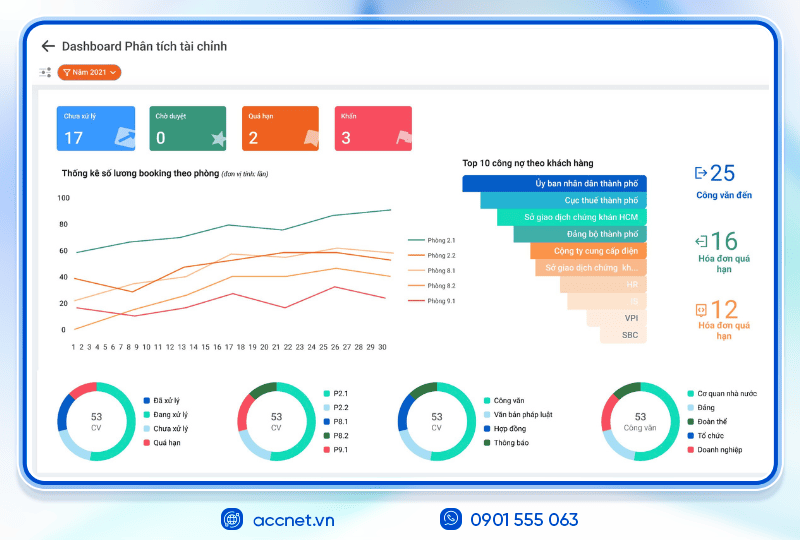

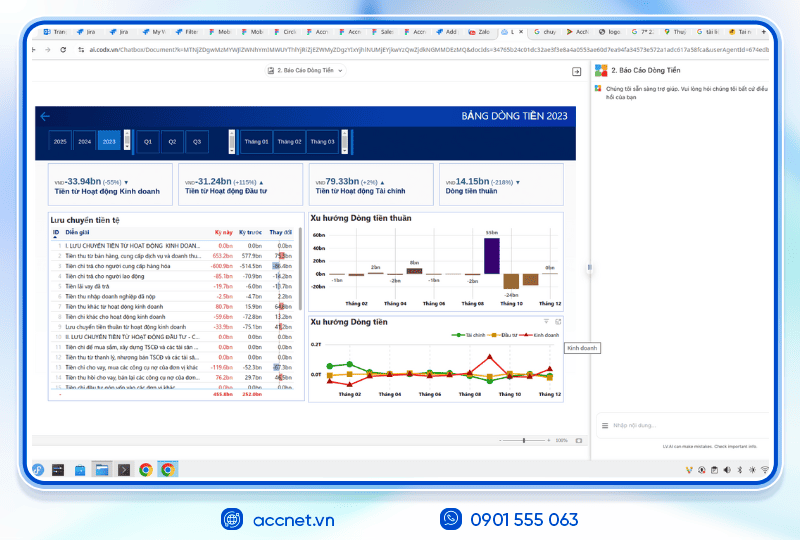

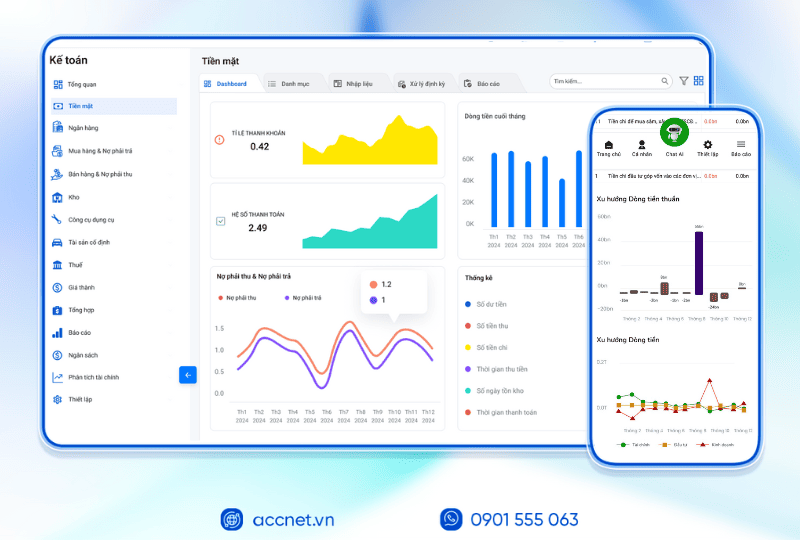

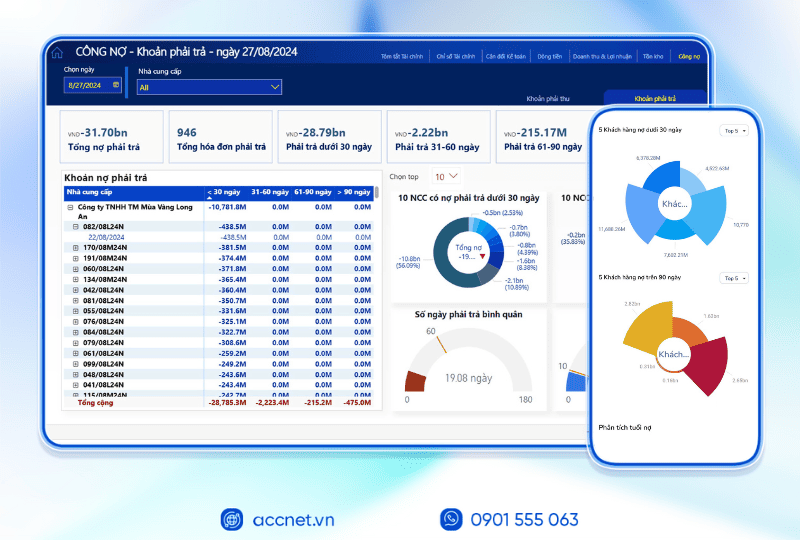

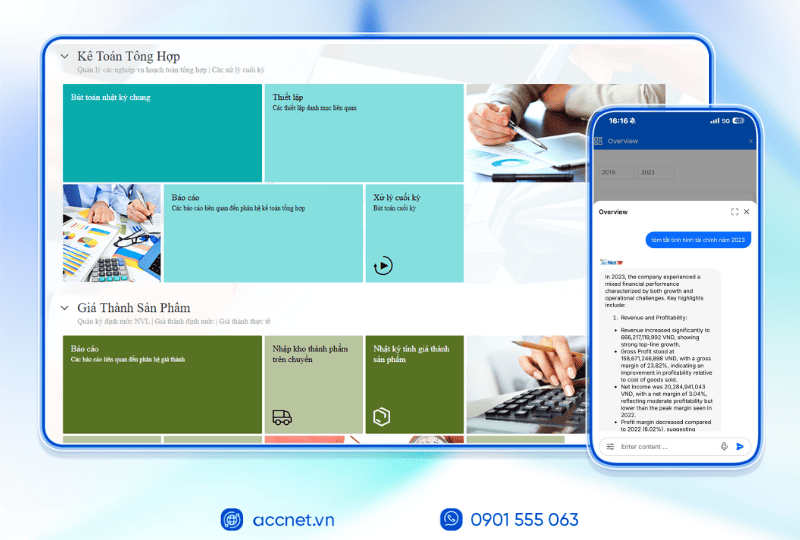

Đây chính là nơi AccNet ERP, đặc biệt module AccNet Asset, phát huy hiệu quả vượt trội:

- Tự động ghi nhận biến động tài sản: mọi tài sản mới, tăng, giảm, điều chỉnh đều được cập nhật trực tiếp, không cần nhập tay vào biểu mẫu.

- Kiểm tra dữ liệu trước khi kê khai: hệ thống sẽ cảnh báo nếu có thông tin không hợp lệ (thiếu giá trị, sai đối tượng…) để giảm sai sót khi nộp tờ khai.

- Lưu lịch sử biến động chi tiết: từ ngày mua, sửa chữa, khấu hao, đến thanh lý – mọi bước được lưu lại để dễ truy xuất và đối chiếu về sau.

- Tạo biểu mẫu kê khai tự động: khi cần gửi tờ khai tài sản bổ sung theo yêu cầu pháp lý, bạn có thể xuất mẫu đúng chuẩn – đầy đủ – sẵn sàng nộp.

- Đồng bộ với module kế toán – tài chính: các phát sinh tài sản sẽ được phản ánh tự động vào sổ sách và báo cáo tài chính chung.

With AccNet ERP, việc kê khai tài sản bổ sung không còn là công việc áp lực, mà trở thành quy trình tối ưu, liên tục và minh bạch — giúp doanh nghiệp tuân thủ pháp luật và quản lý tài sản hiệu quả hơn.

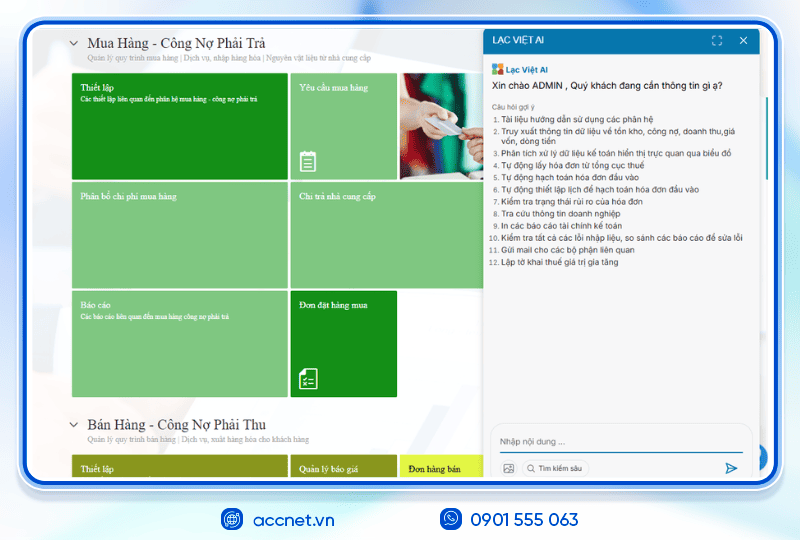

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Việc sử dụng mẫu kê khai tài sản bổ sung mới nhất không chỉ là yêu cầu pháp lý bắt buộc mà còn là yếu tố quan trọng để quản lý tài sản hiệu quả. Doanh nghiệp/cá nhân cần sử dụng mẫu trên đúng mục đích để tránh rủi ro pháp lý. Phần mềm AccNet ERP là một lựa chọn phù hợp, hỗ trợ doanh nghiệp không chỉ quản lý tài sản hiệu quả mà còn đáp ứng tốt các yêu cầu kê khai bổ sung.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: