Việc triển khai hệ thống kế toán không chỉ là nhập liệu hay cài phần mềm, mà còn phụ thuộc vào cách hiểu, áp dụng những nguyên tắc kế toán cơ bản — những quy ước, chuẩn mực quyết định tính chính xác, đáng tin cậy, khả năng so sánh của báo cáo tài chính. Bài viết này được viết từ góc nhìn chuyên gia quản trị vận hành số, nhằm giúp lãnh đạo, đội ngũ tài chính doanh nghiệp nắm rõ khái niệm, vai trò, ứng dụng thực tế của các nguyên tắc đó khi thiết kế, lựa chọn, triển khai giải pháp kế toán cho doanh nghiệp.

1. Khái niệm Nguyên tắc Kế toán

Nguyên tắc kế toán là tập hợp các quy tắc, chuẩn mực, quy ước bắt buộc hoặc khuyến nghị mà nhân sự kế toán, quản trị tài chính, các bên liên quan áp dụng khi ghi chép, tổng hợp, lập báo cáo tài chính. Những nguyên tắc này tạo nền tảng để chuyển các giao dịch kinh tế thành số liệu tài chính có thể kiểm chứng, so sánh, sử dụng cho quyết định quản trị, đầu tư hay nghĩa vụ pháp lý.

Tại sao doanh nghiệp cần hiểu rõ các nguyên tắc này?

- Đảm bảo báo cáo phản ánh đúng bản chất kinh tế của các nghiệp vụ, tránh sai lệch do cách xử lý sổ sách.

- Tạo cơ sở pháp lý, kỹ thuật để tích hợp dữ liệu vào phần mềm, tự động hóa báo cáo thuế, BCTC, phân tích quản trị.

- Hỗ trợ hội nhập giữa hệ thống kế toán nội bộ, tiêu chuẩn chuẩn mực (VAS/IFRS) khi doanh nghiệp mở rộng quy mô hoặc tiếp nhận đầu tư.

Read more:

2. Vai trò, ý nghĩa khi áp dụng nguyên tắc kế toán cơ bản

Áp dụng nghiêm túc, đồng bộ các nguyên tắc kế toán cơ bản đem lại lợi ích thiết thực cho cả hoạt động vận hành, chiến lược phát triển doanh nghiệp.

- Đảm bảo minh bạch, giảm rủi ro pháp lý: Khi các nguyên tắc được tuân thủ, báo cáo tài chính phản ánh trung thực kết quả hoạt động, giúp giảm rủi ro tranh chấp với cơ quan thuế, đối tác, nhà đầu tư, kiểm toán độc lập.

- Hỗ trợ ra quyết định quản trị, đầu tư: Số liệu đáng tin cậy tạo nền tảng để ban lãnh đạo phân tích hiệu suất, phương án tối ưu chi phí, hoạch định dòng tiền, đánh giá cơ hội đầu tư. Điều này đặc biệt quan trọng khi doanh nghiệp chuyển từ quản trị thủ công sang hệ thống ERP hoặc phần mềm kế toán tích hợp.

- Nâng cao quản trị nội bộ, uy tín thị trường: Báo cáo chính xác, kịp thời giúp cải thiện quản trị rủi ro tài chính, nguồn vốn lưu động, cải thiện mối quan hệ với ngân hàng, nhà cung cấp, khách hàng. Đồng thời tăng độ tin cậy trước nhà đầu tư, đối tác chiến lược.

- Căn cứ pháp lý, tiêu chuẩn kế toán: Ở Việt Nam, khung pháp lý (Luật Kế toán, VAS) xác định các nguyên tắc cơ bản làm cơ sở cho chuẩn mực kế toán chi tiết. Việc nắm vững các nguyên tắc này giúp doanh nghiệp dễ dàng áp dụng chuẩn mực, tuân thủ nghĩa vụ báo cáo thuế, áp dụng tốt các cập nhật quy định.

- Tối ưu hóa quy trình ghi nhận, đối chiếu: Khi nguyên tắc được chuẩn hóa trong quy trình nội bộ, hệ thống, việc ghi nhận nghiệp vụ, khớp lệnh, đối chiếu liên phòng ban (kế toán — kho — bán hàng) được tự động hóa, giảm sai sót, tiết kiệm thời gian kiểm soát.

- Hỗ trợ tự động hóa báo cáo quản trị, tuân thủ: Các nguyên tắc như cơ sở dồn tích, phù hợp, thận trọng là đầu vào cho thiết kế các rules tự động trong phần mềm (ví dụ: khi ghi nhận doanh thu theo hợp đồng, tự động phân bổ chi phí theo nguyên tắc phù hợp). Điều này cho phép hệ thống sinh báo cáo quản trị, báo cáo pháp lý đồng thời, nhất quán.

- Nâng cao năng lực phân tích, dự báo: Dữ liệu chuẩn (theo nguyên tắc lịch sử, phù hợp) giúp nhà quản trị tin tưởng vào các mô hình phân tích, dự báo tài chính, từ đó hoạch định ngân sách, chiến lược tăng trưởng hiệu quả hơn.

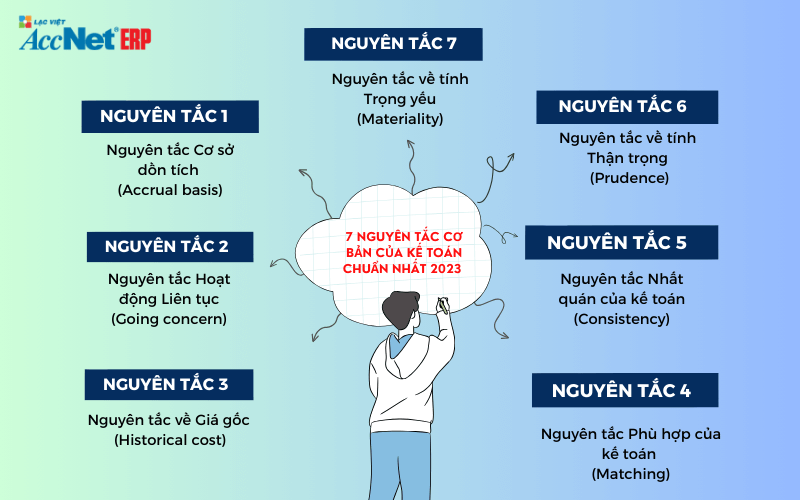

3. 7 Nguyên tắc Kế toán Cơ bản

Trong hệ thống kế toán Việt Nam, 7 nguyên tắc kế toán cơ bản được quy định trong Chuẩn mực kế toán Việt Nam (VAS) số 01 – Chuẩn mực chung. Đây là “xương sống” của toàn bộ hệ thống kế toán, chi phối cách doanh nghiệp ghi nhận, trình bày, phân tích dữ liệu tài chính. Việc hiểu, vận dụng đúng từng nguyên tắc là nền tảng quan trọng để doanh nghiệp xây dựng quy trình kế toán hiệu quả, minh bạch, nhất quán.

Nguyên tắc cơ sở dồn tích (Accrual Basis)

Nội dung: Mọi nghiệp vụ kinh tế, tài chính phải được ghi nhận tại thời điểm phát sinh, không căn cứ vào thời điểm thực tế thu hoặc chi tiền.

Ý nghĩa thực tế: Nguyên tắc này giúp báo cáo tài chính phản ánh đúng bản chất của các hoạt động kinh doanh, chứ không chỉ là dòng tiền ra vào. Đối với các doanh nghiệp đang chuyển đổi số, việc tích hợp nguyên tắc dồn tích trong phần mềm kế toán giúp hệ thống tự động nhận biết doanh thu, chi phí phát sinh, ngay cả khi chưa có dòng tiền thực tế.

Ví dụ: Doanh nghiệp A giao hàng, xuất hóa đơn trong tháng 9, nhưng đến tháng 10 mới nhận được tiền thanh toán. Theo nguyên tắc dồn tích, doanh thu vẫn được ghi nhận trong tháng 9 – thời điểm phát sinh nghĩa vụ, quyền lợi.

Nguyên tắc hoạt động liên tục (Going Concern)

Nội dung: Khi lập báo cáo tài chính, doanh nghiệp phải được giả định là đang hoạt động liên tục, không có ý định hoặc bị buộc phải ngừng hoạt động trong tương lai gần.

Ứng dụng trong doanh nghiệp: Nguyên tắc này là cơ sở để tính toán các khoản dự phòng, khấu hao hay đánh giá giá trị tài sản dài hạn. Trong các hệ thống kế toán số, nguyên tắc này thể hiện qua việc duy trì các dữ liệu liên kỳ, đảm bảo tính liên tục của thông tin quản trị.

Ví dụ: Nếu doanh nghiệp có kế hoạch giải thể trong năm tới, báo cáo tài chính cần được lập theo cơ sở khác (ví dụ: giá trị thanh lý), đồng thời ghi rõ trong phần thuyết minh.

Nguyên tắc giá gốc (Historical Cost)

Nội dung: Tài sản phải được ghi nhận theo giá trị thực tế ban đầu tại thời điểm ghi nhận – bao gồm giá mua, chi phí trực tiếp đưa tài sản vào sử dụng.

Ý nghĩa: Nguyên tắc giá gốc giúp đảm bảo tính khách quan, ổn định của báo cáo tài chính, tránh việc điều chỉnh giá trị tài sản theo biến động thị trường.

Ví dụ: Một máy móc có giá mua 4,8 tỷ đồng, chi phí lắp đặt 300 triệu đồng sẽ được ghi nhận giá gốc 5,1 tỷ đồng. Dù sau đó giá thị trường tăng lên 6 tỷ, kế toán vẫn phải giữ nguyên giá trị 5,1 tỷ trên sổ sách.

Read more:

Nguyên tắc phù hợp (Matching Concept)

Nội dung: Doanh thu, chi phí phải được ghi nhận trong cùng kỳ kế toán – tức là chi phí phải được ghi nhận trong kỳ tạo ra doanh thu đó.

Tác động trong thực tế: Đây là nguyên tắc cốt lõi khi doanh nghiệp áp dụng phần mềm kế toán quản trị hoặc ERP. Khi quy trình được số hóa, hệ thống có thể tự động liên kết doanh thu – chi phí để phản ánh chính xác lợi nhuận gộp, lợi nhuận thuần theo từng kỳ.

Ví dụ: Nếu doanh nghiệp bán hàng vào tháng 3, dù hàng hóa được nhập từ tháng 12 năm trước, thì giá vốn của lô hàng đó vẫn phải được ghi nhận trong tháng 3 – thời điểm ghi nhận doanh thu.

Nguyên tắc nhất quán (Consistency)

Nội dung: Các phương pháp, chính sách kế toán đã chọn phải được áp dụng thống nhất ít nhất trong một kỳ kế toán năm.

Lợi ích: Sự nhất quán giúp so sánh kết quả tài chính giữa các kỳ trở nên chính xác, minh bạch hơn. Trong hệ thống kế toán số, việc thay đổi phương pháp (ví dụ: cách tính giá xuất kho) đều được ghi nhận trong log hệ thống, phục vụ kiểm toán, quản trị.

Ví dụ: Doanh nghiệp sử dụng phương pháp FIFO để tính giá xuất kho trong năm 2024, sang năm 2025 muốn chuyển sang bình quân gia quyền thì phải công bố lý do, đồng thời nêu rõ tác động đến BCTC trong phần thuyết minh.

Nguyên tắc thận trọng (Prudence Concept)

Nội dung: Kế toán phải cân nhắc kỹ lưỡng, không ghi nhận cao hơn giá trị tài sản/thu nhập, không thấp hơn nợ phải trả/chi phí.

Ứng dụng: Trong thực tế, nguyên tắc thận trọng được thể hiện qua việc lập dự phòng giảm giá hàng tồn kho, dự phòng công nợ khó đòi hoặc chi phí phải trả. Trong các phần mềm kế toán hiện đại, quy tắc này được thiết lập sẵn để tự động tính toán dự phòng theo tỷ lệ định sẵn, giúp doanh nghiệp tránh tình trạng “phù phép” lợi nhuận.

Ví dụ: Nếu một khoản nợ 200 triệu đồng quá hạn 6 tháng, hệ thống kế toán có thể tự động nhắc kế toán viên trích lập dự phòng theo tỷ lệ 50% hoặc 100%, tùy quy định nội bộ.

Nguyên tắc trọng yếu (Materiality Concept)

Nội dung: Thông tin được coi là trọng yếu nếu việc thiếu hoặc sai lệch có thể ảnh hưởng đáng kể đến quyết định của người sử dụng báo cáo tài chính.

Ý nghĩa thực tiễn: Nguyên tắc này cho phép doanh nghiệp đơn giản hóa các khoản mục không đáng kể mà vẫn đảm bảo tính trung thực của báo cáo. Trong các hệ thống ERP, doanh nghiệp có thể cài ngưỡng trọng yếu (ví dụ: giá trị giao dịch nhỏ hơn 1 triệu đồng được gộp nhóm) để giảm tải khối lượng ghi chép thủ công.

Ví dụ: Chi phí điện, nước, văn phòng phẩm của bộ phận bán hàng có thể được gộp chung vào một tài khoản chi phí thay vì tách riêng từng khoản nhỏ lẻ.

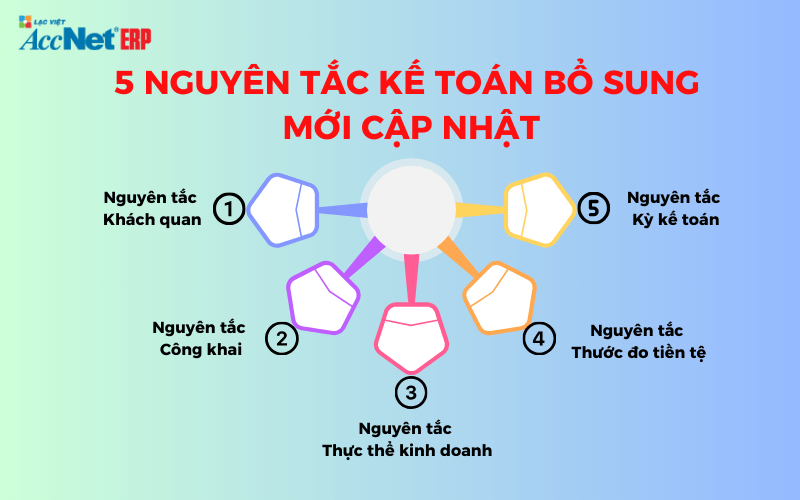

4. 5 Nguyên tắc Kế toán Bổ sung

Bên cạnh 7 nguyên tắc kế toán cơ bản, nhiều tổ chức đào tạo, chuyên gia kế toán còn đề cập thêm 5 nguyên tắc bổ sung — được xem là khung nền hỗ trợ việc vận hành, tự động hóa hệ thống kế toán trong doanh nghiệp. Các nguyên tắc này đặc biệt quan trọng khi doanh nghiệp bước vào giai đoạn chuyển đổi số, cần tích hợp dữ liệu tài chính, kế toán, quản trị trên cùng một nền tảng.

Nguyên tắc Khách quan

Nội dung: Mọi thông tin kế toán phải dựa trên chứng từ hợp lệ, bằng chứng xác thực, phản ánh trung thực bản chất giao dịch.

Ứng dụng trong doanh nghiệp: Nguyên tắc này giúp đảm bảo tính minh bạch, độc lập của bộ phận kế toán, đồng thời là cơ sở để hệ thống ERP tự động kiểm tra tính hợp lệ của chứng từ (hóa đơn, phiếu thu, hợp đồng điện tử...).

Ví dụ: Một nghiệp vụ mua hàng chỉ được ghi nhận khi có đủ hóa đơn VAT, biên bản nghiệm thu. Trong phần mềm kế toán số, hệ thống có thể cảnh báo nếu chứng từ bị thiếu hoặc trùng lặp.

Learn more:

Nguyên tắc Công khai

Nội dung: Báo cáo tài chính phải được trình bày rõ ràng, dễ hiểu, đầy đủ thông tin, công bố đúng thời hạn.

Ý nghĩa thực tiễn: Công khai là yếu tố then chốt để xây dựng niềm tin với nhà đầu tư, ngân hàng, cổ đông. Khi ứng dụng phần mềm kế toán hiện đại, doanh nghiệp có thể chia quyền truy cập cho từng bộ phận, giúp ban giám đốc, kiểm toán nội bộ hay cơ quan thuế truy cập thông tin tức thời, minh bạch, an toàn.

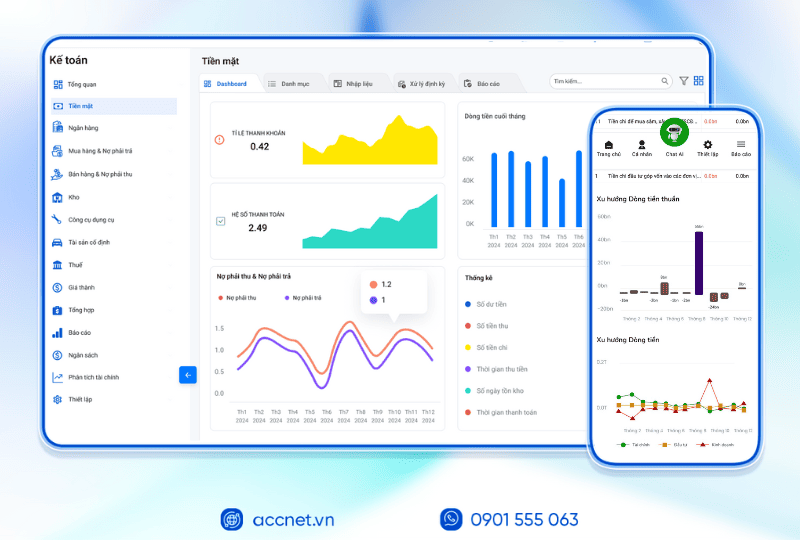

Ví dụ: Phần mềm có tính năng dashboard trực quan cho phép giám đốc xem ngay tình hình doanh thu, chi phí, công nợ theo thời gian thực — thay vì chờ cuối kỳ tổng hợp thủ công.

Nguyên tắc Thực thể kinh doanh

Nội dung: Doanh nghiệp được xem là một thực thể độc lập, tách biệt hoàn toàn với cá nhân chủ sở hữu.

Ứng dụng: Nguyên tắc này đặc biệt quan trọng trong quản lý dòng tiền. Khi hệ thống kế toán được vận hành đúng chuẩn, chi tiêu cá nhân sẽ không được ghi nhận vào chi phí của doanh nghiệp.

Ví dụ: Nếu chủ doanh nghiệp sử dụng tài khoản công ty để chi tiêu cá nhân, phần mềm kế toán có thể tự động phát hiện, phân loại khoản này là khoản phải thu nội bộ, đảm bảo minh bạch dòng tiền.

Nguyên tắc Thước đo tiền tệ

Nội dung: Chỉ những giao dịch có thể đo lường bằng tiền tệ mới được ghi nhận vào sổ kế toán.

Ý nghĩa: Tiền tệ là thước đo chung giúp báo cáo tài chính dễ hiểu, dễ so sánh, có thể tổng hợp trên quy mô toàn doanh nghiệp.

Ứng dụng trong chuyển đổi số: Các phần mềm kế toán hiện nay hỗ trợ đa tiền tệ (VNĐ, USD, EUR...), giúp doanh nghiệp có thể giao dịch quốc tế mà vẫn bảo toàn tính nhất quán khi lập báo cáo hợp nhất.

Ví dụ: Khi một chi nhánh giao dịch bằng USD, công ty mẹ lập báo cáo bằng VNĐ, hệ thống tự động quy đổi theo tỷ giá cập nhật thời gian thực, đảm bảo tính chính xác, thống nhất.

Nguyên tắc Kỳ kế toán

Nội dung: Mọi báo cáo tài chính phải được lập trong kỳ kế toán xác định (tháng, quý, năm), duy trì ổn định giữa các kỳ để đảm bảo khả năng so sánh.

Ý nghĩa: Kỳ kế toán giúp doanh nghiệp đánh giá hiệu quả hoạt động theo chu kỳ. Khi hệ thống kế toán được số hóa, việc chốt sổ từng kỳ trở nên tự động, giúp giảm tải công việc cho kế toán viên.

Ví dụ: Phần mềm kế toán có thể tự động khóa dữ liệu sau khi kết thúc kỳ kế toán, đảm bảo không ai có thể sửa sổ hoặc thêm nghiệp vụ ngoài kỳ mà không được cấp quyền.

5. Xử lý xung đột, thách thức khi áp dụng nguyên tắc kế toán cơ bản

Khi các nguyên tắc kế toán cơ bản xung đột

Trong thực tế, doanh nghiệp có thể gặp trường hợp xung đột giữa các nguyên tắc, như giữa phù hợp, trọng yếu (chi phí nhỏ nhưng phát sinh nhiều kỳ). Khi đó, kế toán cần:

- Xác định mức độ ảnh hưởng của mỗi nguyên tắc đối với báo cáo.

- Ưu tiên nguyên tắc đảm bảo tính trung thực, hợp lý cao nhất.

- Ghi rõ cơ sở lựa chọn trong phần thuyết minh báo cáo tài chính.

Refer to: Những yếu tố ảnh hưởng đến số dư tài khoản và báo cáo tài chính

Thách thức trong áp dụng tại doanh nghiệp Việt Nam

- Trình độ nhân sự: Cần đội ngũ kế toán hiểu sâu về chuẩn mực, tránh ghi nhận sai lệch giữa thực tế, pháp lý.

- Cập nhật pháp luật: Các quy định kế toán thường xuyên thay đổi, đòi hỏi doanh nghiệp phải có hệ thống theo dõi tự động.

- Hệ thống thông tin chưa đồng bộ: Khi nhiều chi nhánh hoặc bộ phận sử dụng các phần mềm khác nhau, dữ liệu có thể bị sai lệch hoặc trùng lặp.

- Khả năng diễn giải: Một số nghiệp vụ phức tạp (hợp đồng dài hạn, thuê tài chính, doanh thu dồn tích) cần kỹ năng phân tích để áp dụng đúng nguyên tắc.

6. Lợi ích của việc áp dụng đồng bộ các nguyên tắc trong môi trường số

Khi các nguyên tắc kế toán (cả cơ bản, bổ sung) được tích hợp trực tiếp vào quy trình vận hành số, doanh nghiệp sẽ đạt được 4 giá trị nổi bật:

- Tự động hóa, chuẩn hóa quy trình: Giúp loại bỏ lỗi ghi nhận, giảm khối lượng công việc thủ công, tối ưu thời gian chốt sổ.

- Minh bạch tài chính, tuân thủ pháp luật: Mọi dữ liệu đều có chứng từ điện tử đi kèm, truy xuất dễ dàng khi kiểm toán hoặc thanh tra thuế.

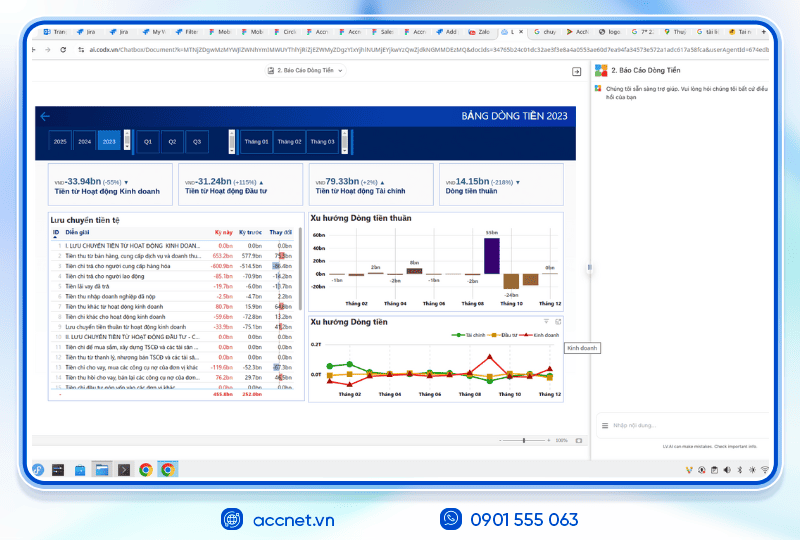

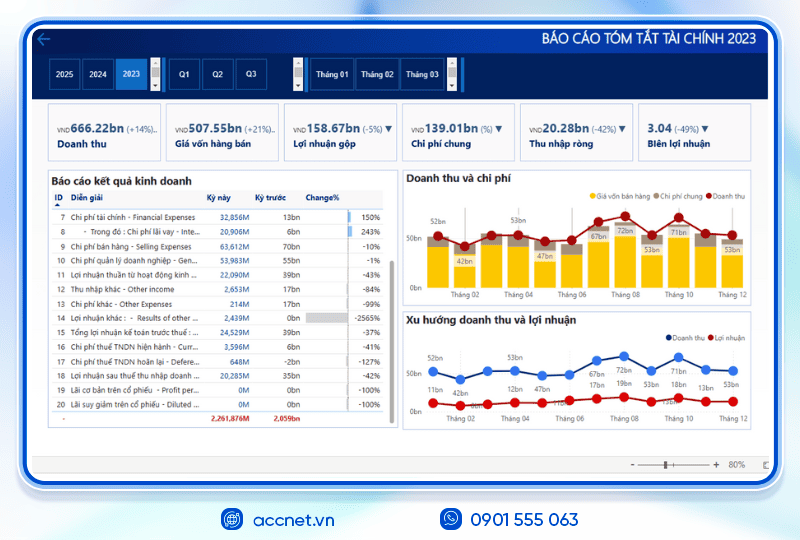

- Hỗ trợ ra quyết định nhanh chóng: Ban lãnh đạo có thể nắm tình hình dòng tiền, chi phí, lợi nhuận theo thời gian thực, từ đó đưa ra quyết định chiến lược kịp thời.

- Dễ dàng mở rộng, kết nối hệ thống: Các nguyên tắc kế toán được số hóa giúp doanh nghiệp dễ dàng tích hợp với phần mềm ERP, CRM hay hóa đơn điện tử, tạo nên hệ sinh thái tài chính thống nhất.

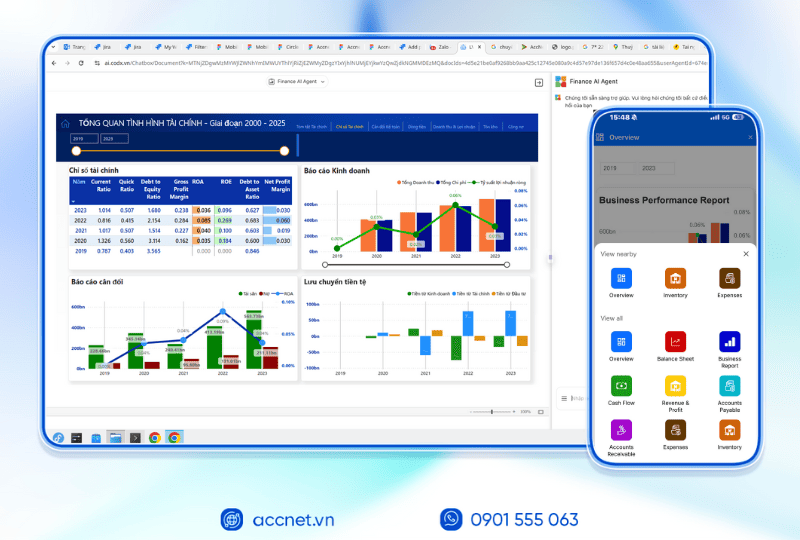

7. Giải pháp AccNet ERP – Tự động hóa áp dụng các Nguyên tắc Kế toán Cơ bản trong DN

Khi doanh nghiệp đã hiểu rõ về khung nguyên tắc kế toán, bước tiếp theo là lựa chọn nền tảng quản trị phù hợp để chuyển hóa các nguyên tắc này thành hành động thực tế.

AccNet ERP – giải pháp phần mềm kế toán doanh nghiệp do Lạc Việt phát triển – là lựa chọn tối ưu cho doanh nghiệp đang tìm kiếm một hệ thống vừa tuân thủ chuẩn kế toán Việt Nam, vừa hỗ trợ chuyển đổi số toàn diện.

Những ưu điểm nổi bật của AccNet ERP:

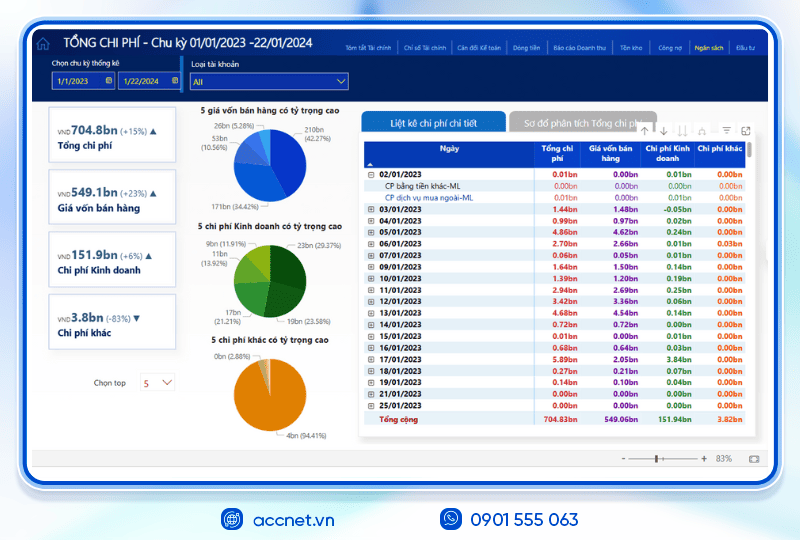

- Tự động hóa theo nguyên tắc dồn tích, phù hợp: Tự động ghi nhận doanh thu – chi phí theo kỳ, phân bổ chi phí trả trước, kết chuyển cuối kỳ chính xác.

- Kiểm soát theo nguyên tắc thận trọng, nhất quán: Hệ thống nhắc nhở khi vượt ngưỡng chi phí hoặc sai lệch chính sách kế toán, đồng thời lưu log thay đổi.

- Minh bạch theo nguyên tắc khách quan – công khai: Dữ liệu được lưu trữ an toàn trên nền tảng điện toán đám mây, hỗ trợ truy xuất chứng từ điện tử mọi lúc, mọi nơi.

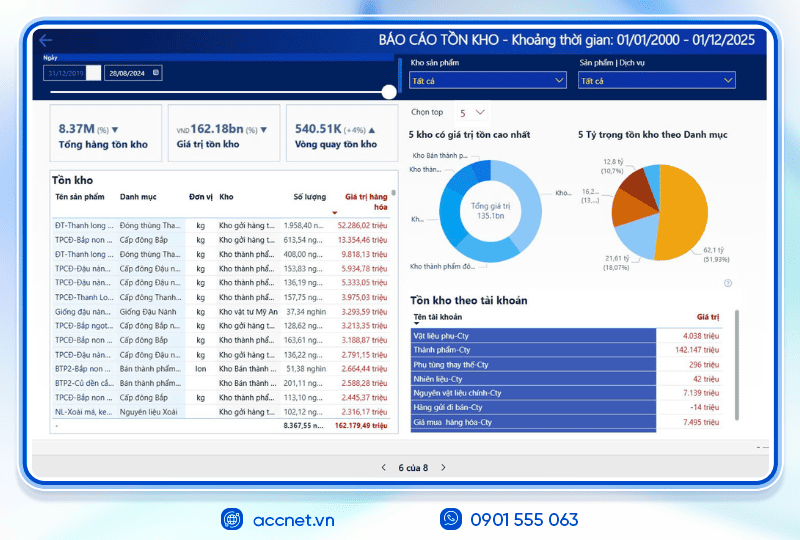

- Hỗ trợ đa tiền tệ – đa kỳ kế toán: Dễ dàng thiết lập báo cáo hợp nhất, theo dõi tình hình tài chính toàn hệ thống mà vẫn tuân thủ chuẩn mực kế toán Việt Nam.

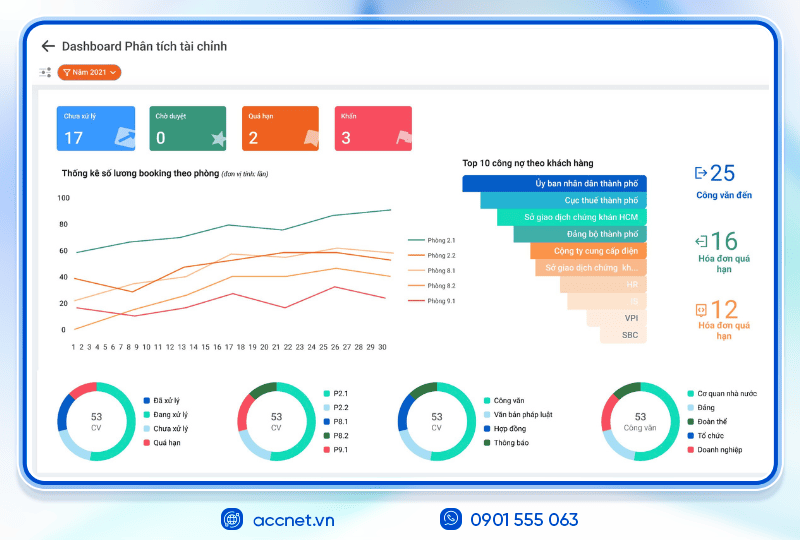

- Phân tích thông minh: Tích hợp AI, dashboard tài chính, giúp ban lãnh đạo nắm bắt hiệu quả vận hành theo thời gian thực, từ đó ra quyết định dựa trên dữ liệu chuẩn xác.

Với AccNet ERP, doanh nghiệp không chỉ đảm bảo tuân thủ các nguyên tắc kế toán cơ bản, mà còn tối ưu hóa toàn bộ quy trình tài chính – kế toán, tạo nền tảng bền vững cho chuyển đổi số trong quản trị doanh nghiệp.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

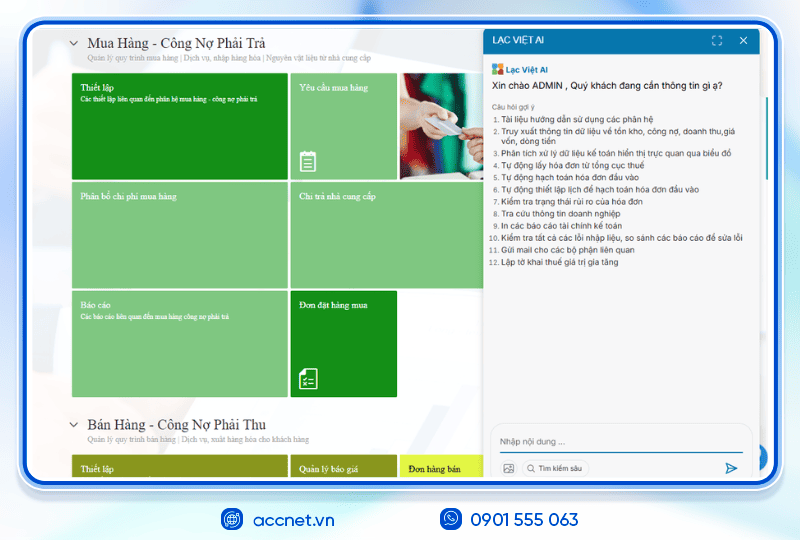

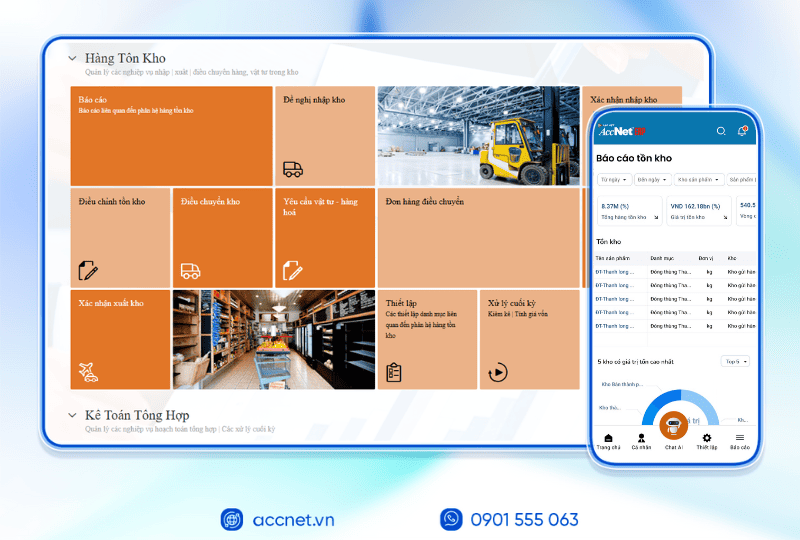

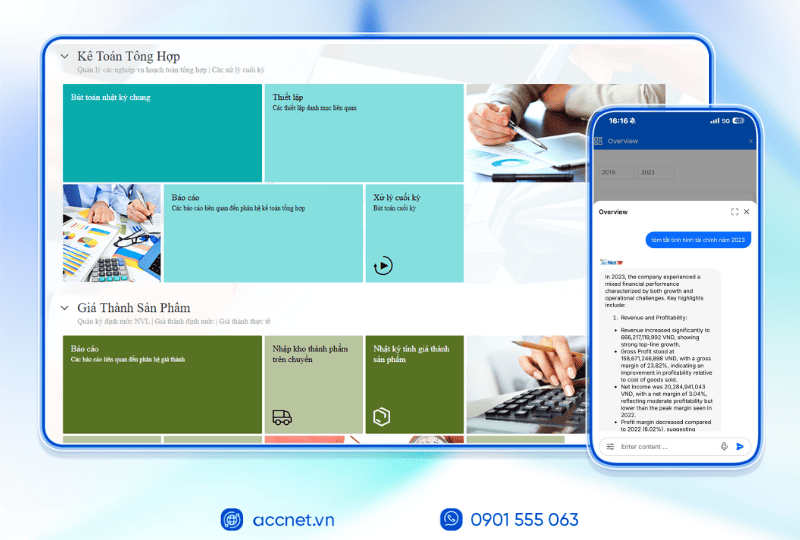

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

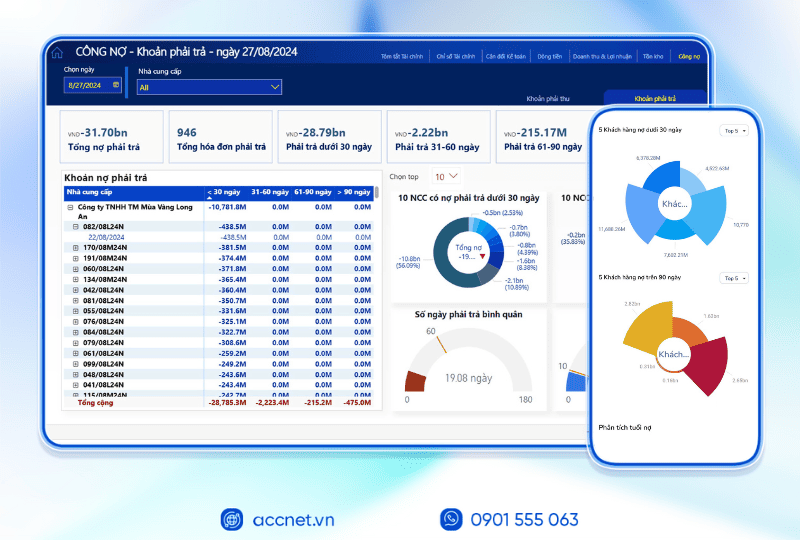

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

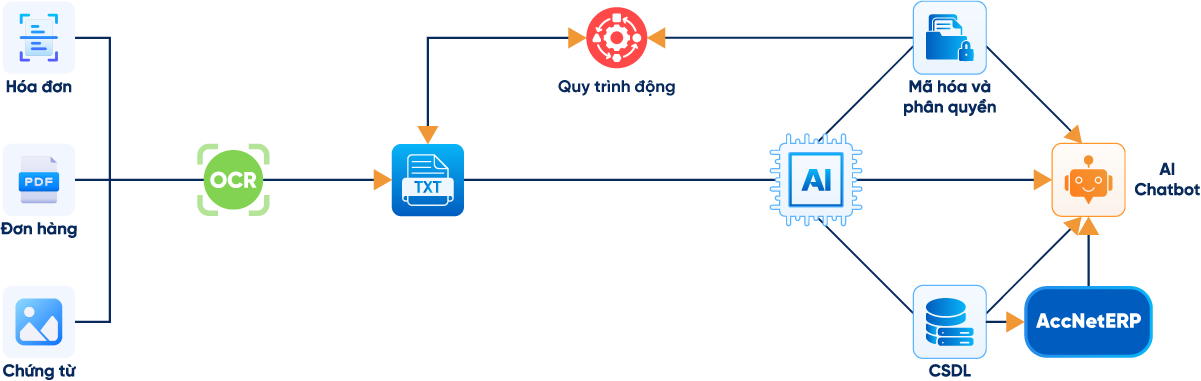

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Từ góc độ quản trị vận hành số, việc nắm vững, áp dụng đúng nguyên tắc kế toán cơ bản chính là yếu tố then chốt giúp doanh nghiệp đạt được sự minh bạch, ổn định, phát triển dài hạn. Trong kỷ nguyên chuyển đổi số, khi mọi dữ liệu kế toán – tài chính được tự động hóa, phân tích bằng công nghệ, những nguyên tắc này không chỉ còn là “chuẩn mực nghề nghiệp”, mà trở thành nền tảng cho mọi quyết định quản trị thông minh.

Giải pháp AccNet ERP chính là cầu nối giữa lý thuyết kế toán, thực tế vận hành, giúp doanh nghiệp không chỉ quản lý sổ sách mà còn kiểm soát toàn bộ hiệu quả tài chính, tối ưu chi phí, nâng cao năng lực cạnh tranh.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: