Recorded cost is an important aspect in business accounting, apply the right principles recorded to help the business better understand the expenses incurred during business operations. Let's Accnet learn in detail about the principles recorded cost basically in this article.

1. The principles recorded in cost of basic

Below are the principles that businesses need to understand:

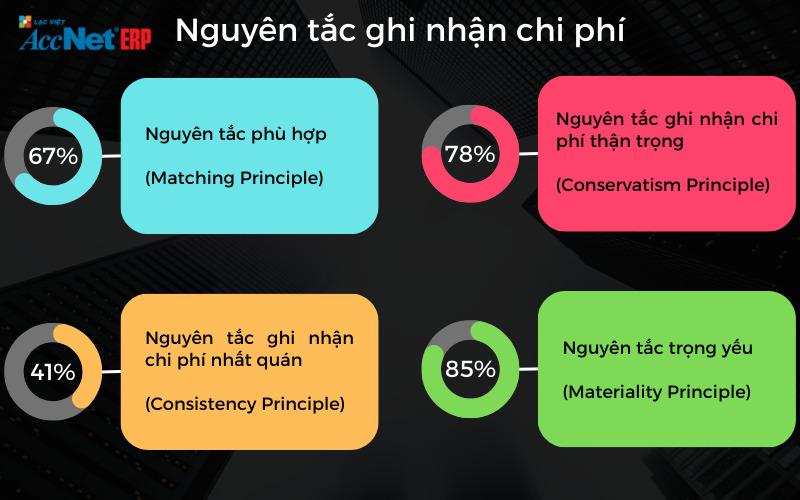

1.1. Matching principle (Matching Principle)

The matching principle requires expenses to be recorded in the same period with the revenues generated, to ensure that financial statements accurately reflect the profitability of the business during an accounting period certain.

Help provide an accurate picture of the financial situation of the business, helping managers/investors understand the relationship between revenue and cost.

Businesses produce goods, sell them in December 12, the cost related to the production of such goods (such as raw materials, labor, cost of production) must be credited in 12 months, even if the fee has been previously paid or will be paid then.

1.2. Principles recorded cost of consistency (Consistency Principle)

Consistent principle required the accounting method, the way in recorded costs must be consistently applied through the accounting period to compare financial statements across the different periods.

Helps investors, stakeholders easily compare the financial performance of the business over the accounting period, thereby making the logical decision.

Businesses are choose the method of asset depreciation according to straight line method, you should continue to use this method in the accounting period next, unless there is good reason to change, the change must be clearly stated.

1.3. Principles recorded cost prudence (Conservatism Principle)

Principle prudence requires business recorded cost, liabilities, even when there is evidence of the possibility arises, which helps to avoid the overestimation profit/assets.

Protect your business from financial risks, unwanted, financial statements, not inflated.

Businesses are faced with a legal action, has the ability to compensate, remember to acknowledge the potential cost of this immediately, even if the lawsuit has not yet been solved. On the contrary, if the business is expected to receive a share of the revenue from a contract, just recorded this revenue when sure that it will happen.

1.4. Principle of materiality (Materiality Principle)

Principles recorded cost materiality refers to the recorded cost, the financial transaction is not ignored if they affect the economic decisions of users of financial information.

Help accountants to focus on the expenses, important transactions to financial statements accurately reflect the financial situation of the business that are not disturbed by the little details.

A business can ignore the record of the small expenses such as stationery daily, but to recognition of expenses related to the procurement of office equipment because they can significantly affect the financial situation of the business.

2. Method recorded cost is based on the principle of mandatory

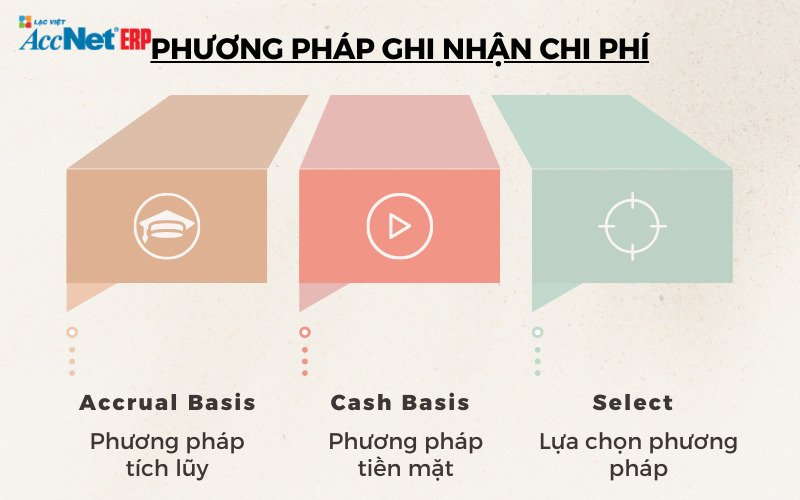

2.1. Method accumulate (Accrual Basis) on the principle of recognition of expenses

Methods cumulative record expenses when incurred, regardless of the time of payment. That is, costs are recorded in the financial statements when goods/services are used, does not depend on the expenses were paid or not.

| Benefits | Restrictions |

| Recorded all the costs related to revenue in the same period. Take out business plan, financial forecast accuracy. | System requirements accounting complex, requiring a lot of effort in keeping track of accounts payable/receivable. Recorded cost before paying, leading to a shortage of cash. |

2.2. Methods cash (Cash Basis) on the principle of recognition of expenses

Methods cash recorded the cost when the actual payment occurs. This means that expenses are recorded only when cash is actually paid, does not depend on the time goods or services are used.

| Benefits | Restrictions |

| Easy to apply, does not require accounting system complex. Accurately reflect the cash flow of the business, easily keep track of cash flow in/out. | Not accurately reflect the financial situation do not recognize the cost/revenue in the same accounting period. Not suitable for businesses that have complex transaction must comply with the accounting standards strictly. |

2.3. Choose the method of recognition of expenses

The choice of method recorded on the principles recorded cost depends on the type of business, scale of operations, legal requirements, in particular:

- Small and medium enterprises (SMEs): in accordance with the method of cash due to simple, easy to manage.

- Big business/listing: Usually apply the method to accumulate in order to ensure accuracy and compliance with accounting standards, international as IFRS (International Financial Reporting Standards) or GAAP (Generally Accepted Accounting Principles).

3. The factors that affect the recognition of expenses on the principles

The main factors that affect the recorded based on the principles recorded cost in part 1 include:

- Legal regulations and accounting standards: The legal requirements prescribed manner recorded cost standard. IFRS and GAAP provides detailed instructions on recorded cost, ensure transparency/legal.

- Industry/type of business: Peculiarities manufacturing industry, services, trade or business, small, medium, large corporations will have the method recorded different due to the scale, complexity.

- Accounting period/fiscal policy: Determine the accounting period match (month, quarter, year). Need to have policies to manage cash flow, risk reserve.

- Technology/accounting system on the principle of recognition of expenses: Accounting software is the automation process, recorded costs, reduce errors. Accounting system effectively helps to manage/record the cost better.

- Human factors: Accountant qualified/experience high recorded cost more accurately. Honest in recorded cost, ensure credibility.

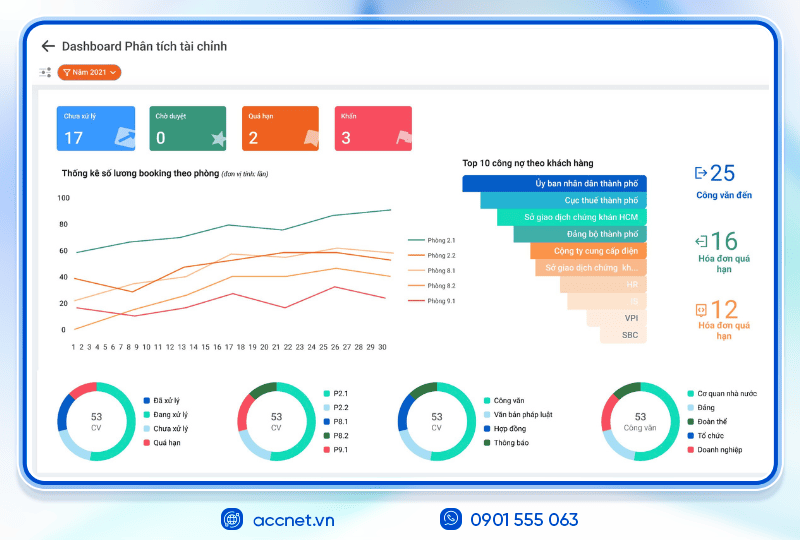

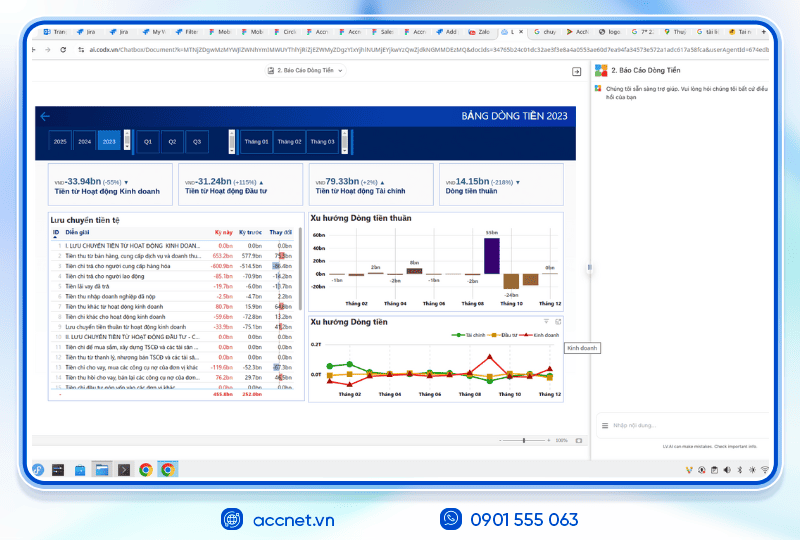

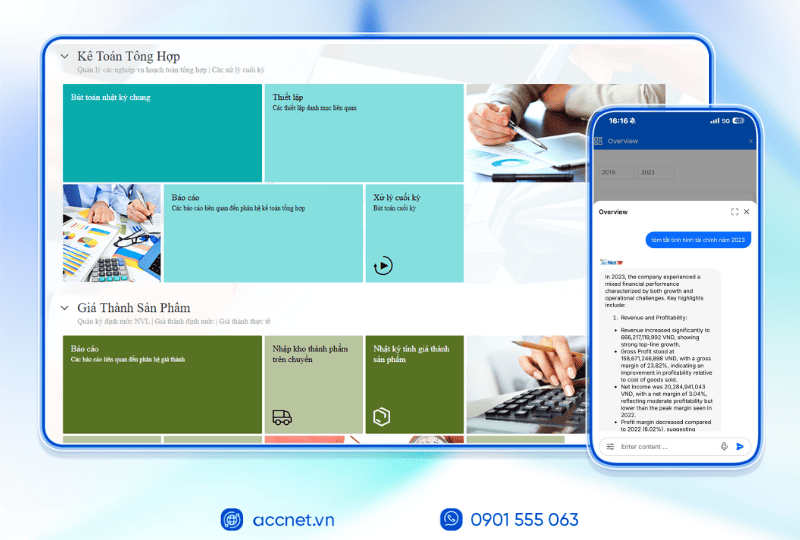

4. Ghi nhận chi phí chính xác hơn với AccNet ERP

Bài viết “Nguyên tắc ghi nhận chi phí” đã nhấn mạnh những nguyên tắc quan trọng như nguyên tắc phù hợp, nhất quán, thận trọng và trọng yếu để chi phí được ghi nhận đúng kỳ kế toán, không bị bỏ sót hoặc ghi sai.

Tuy nhiên, thực tế với cách làm thủ công—ghi sổ bằng Excel hoặc nhập liệu rời rạc—việc tuân thủ đầy đủ các nguyên tắc đó sẽ rất khó khăn, dễ phát sinh sai sót hoặc thiếu đồng bộ giữa các nghiệp vụ chi phí và báo cáo tài chính.

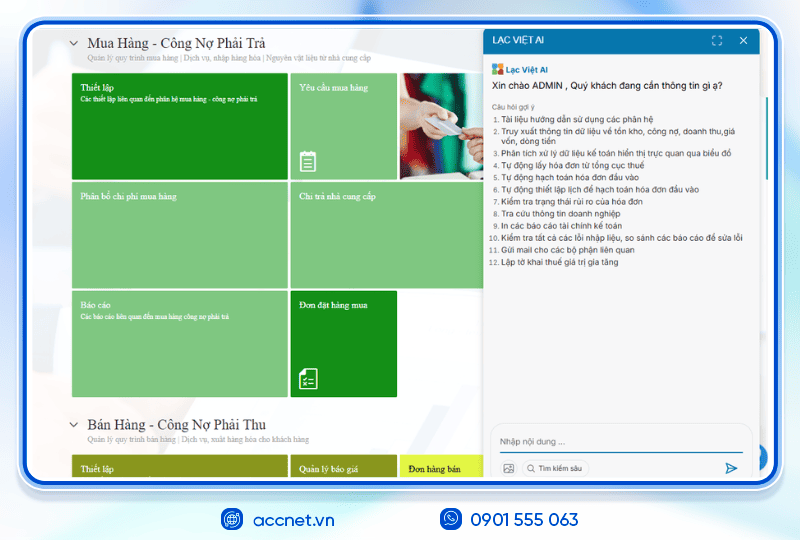

Đó chính là điểm AccNet ERP phát huy giá trị:

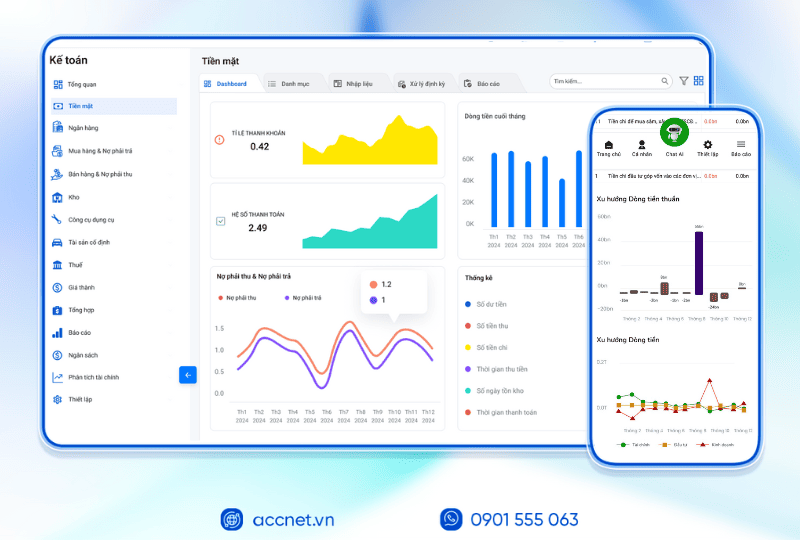

- Tự động ghi nhận chi phí đúng kỳ: các khoản chi phí phát sinh sẽ được hệ thống “hiểu” và ghi vào kỳ liên quan (không tùy tiện theo lúc thanh toán).

- Áp dụng chính sách chi phí đồng nhất: hệ thống giúp duy trì cách xử lý chi phí ổn định qua các kỳ, tránh thay đổi tùy tiện làm lệch dữ liệu.

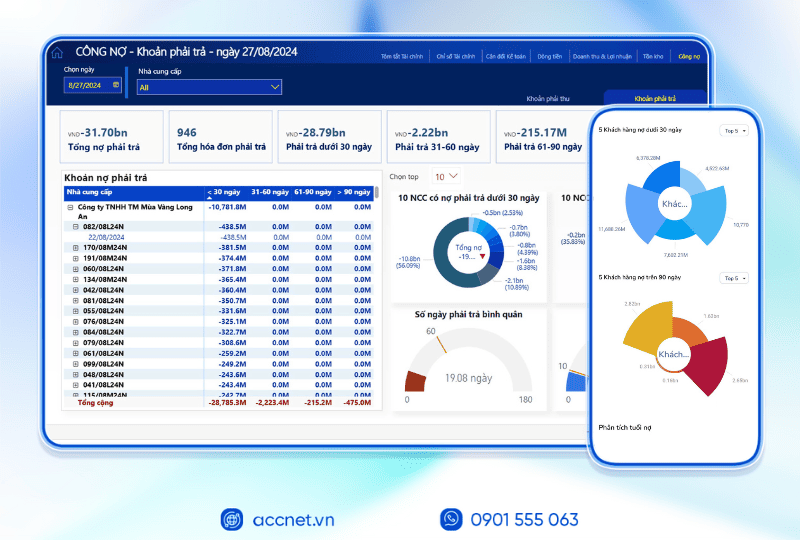

- Cảnh báo chi phí trọng yếu & rủi ro: chi phí vượt ngưỡng hoặc bất thường sẽ được đánh dấu để kiểm tra, không để sót chi phí lớn ảnh hưởng đến kết quả.

- Liên kết module chi phí – tài chính – ngân sách: chi phí phát sinh từ mua hàng, sản xuất, bảo trì… sẽ tự động cập nhật vào module tài chính mà không cần nhập tay.

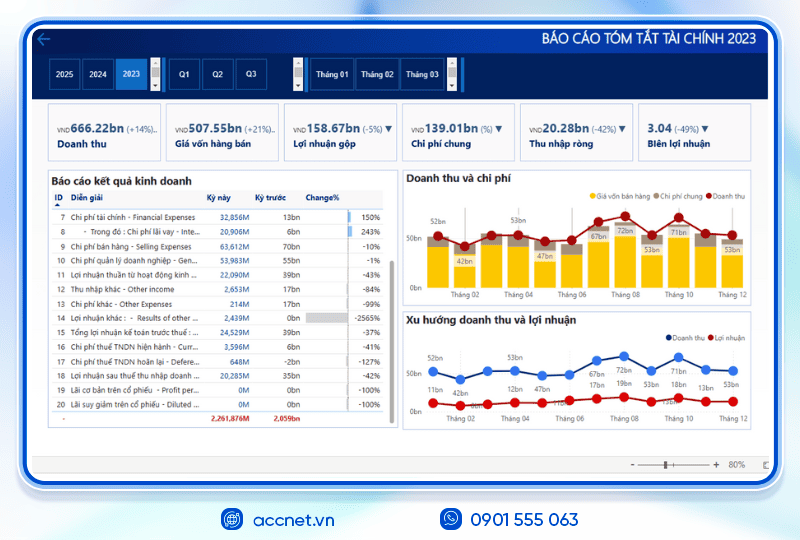

- Báo cáo chi phí phân tích sâu: người quản lý có thể xem chi tiết chi phí theo dự án, phòng ban, loại chi và so sánh giữa các kỳ để ra quyết định tối ưu.

Với AccNet ERP, việc ghi nhận chi phí không còn là gánh nặng về thủ tục hay rủi ro sai sót — mà là quy trình minh bạch, chính xác và kiểm soát hiệu quả, giúp doanh nghiệp quản lý chi phí tối ưu và củng cố tính tin cậy dữ liệu tài chính.

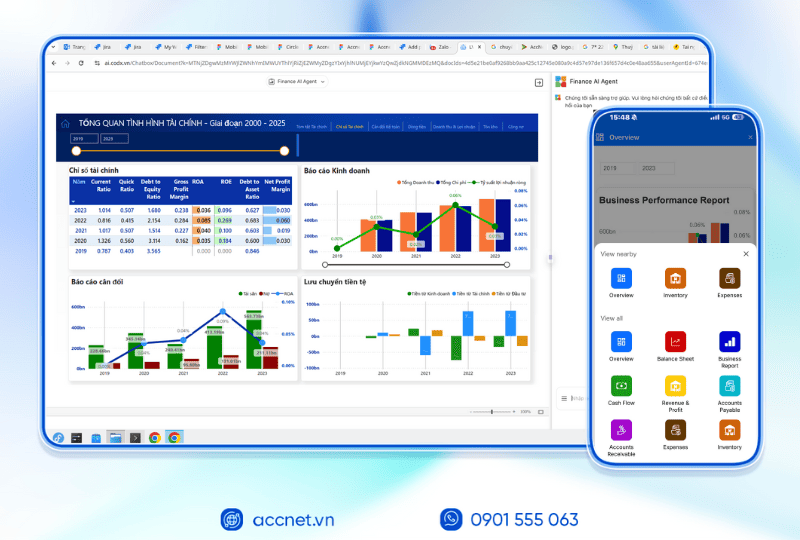

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

The properly understood principles recorded cost help business management and effective financial decisions reasonable business sustainable development. Adhere to the principles of this not only ensures transparency in financial reporting but also enhance credibility, the credibility of the business in the eyes of investors, partners and customers.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: