Chief accountant role is extremely important in business operations, development of any business. However, there are a lot of businesses do not really understand the powers, the duties of the chief accountant to be able to take advantage of the capacity of their inherent. Let's Accnet find out now in this article, okay.

1. Task/job/function of chief accountant

The chief accountant is senior leadership, undertook the important work in the department. So chief accountant do? Cthe evil work of the chief accountant, what is? Let's AccNet listed a number of functions the duties of the chief accountant right after this, okay.

1.1. The main task of the chief accountant

Management executive/accounting department

- Chief accountant need to plan work, division work, reasonable progress monitoring made.

- Ensure each staff accountant to understand their tasks, finish work on time.

- Support, answer questions, guide staff when necessary.

Establish/maintain accounting system

- Chief accountant to set up an accounting system efficiency, meet the requirements of financial management of business, to comply with the provisions of current legislation.

- The financial statements must be set up correctly, properly reflect the financial situation of the business.

1.2. Function/duties of the chief accountant of the financial statement

Establishment/presentation of financial statements

- Establishment of financial reports periodically (monthly, quarterly, and annually) to provide financial information timely for leaders/stakeholders.

- Clearly presented, easy to understand about the financial situation of the business, explaining the figures, pointing out the point to note.

Analysis/financial evaluation

- Analysis of indicators such as profit, cost, cash flow, to evaluate the effectiveness of business operations.

- Based on financial analysis, given the proposals to help businesses improve business performance, strengthen financial capacity.

1.3. The work of the chief accountant about tax/legal

Management/control tax

- Work/duties of the chief accountant is to ensure that the business is in full compliance with the legal provisions of the tax, set up the report the correct tax, pay the tax due date.

- Handle the problems that arise related to tax, prepare documents, explanations when you check from the tax authority.

Check/ensure compliance with legal

- Track/ensure the accounting operations of the business are to comply with the provisions of law.

- Prepare documents, reports, work with the auditors, authorities in the inspection.

Read more:

1.4. Functions of the chief accountant of budgets/financial forecast

Budgeting

- Duties/functions of the chief accountant is planning your budget for the entire business, allocate financial resources, reasonable for the department to ensure the operation smoothly.

- Monitor the use of the budget, ensuring departments implement the right plan, solve problems that arise related to spending.

Financial forecast

- Forecast financial indicators such as revenue, profit, cash flow based on data, current market trends.

- Given the scenario of financial solutions to help businesses deal with the financial fluctuations can occur.

1.5. Function/duties of the chief accountant management financial risk

- Identification/evaluation of financial risks, such as risk, liquidity risk, exchange rate risk on interest rates.

- Construction measures to prevent/manage risk, ensure business can respond in time when the problem occurred.

1.6. The work of the chief accountant of training/employee development

- Training accounting staff: Organize training courses, advanced skills/knowledge for accounting staff to meet work requirements.

- Growing accounting team: Job/function of chief accountant is building a team of accounting that capacity, ensure the inheritance/sustainable development for business.

2. The concept of the chief accountant

Chief accountant (Chief Accountant) is the leader of the accounting department in the company, business or business unit. They are responsible for the entire operation of the financial system of the business.

Responsibilities/duties of the chief accountant the most basic is the management, direction, supervision, and consult with senior leaders, operational, financial of the business, support given financial strategy aimed at the development of business activity of the business.

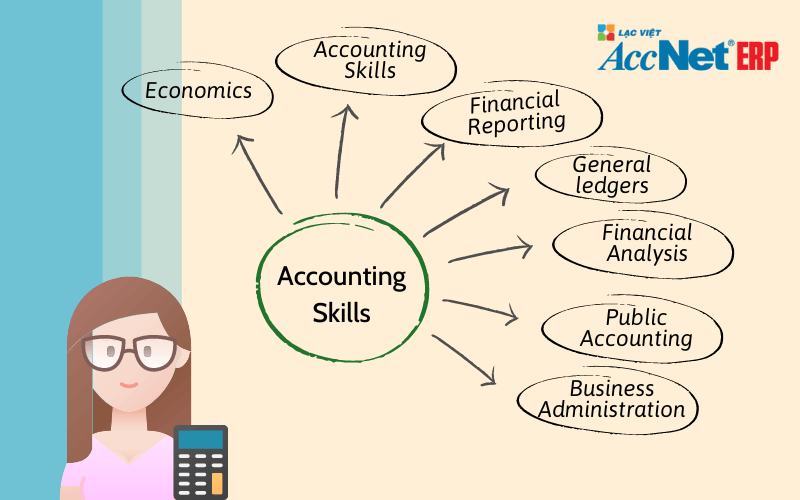

3. Mandatory skills required of the chief accountant

Surely you know about the role, function the duties of the chief accountant in business mentioned in the above sections. With the role, mission-critical will go with the workload incredibly large. So to assume the position of chief accountant requires soft skills, professional skills, as well as to understand the technology, advanced software to serve the work.

3.1. Soft skills of management

Here are the soft skills important of the chief accountant:

- Skills communication, behavior: This is a skill that anyone or any field should also equipped with communication skills, conduct. For chief accountant typically reports, working with senior leadership, authority, therefore communication skills extremely important.

- Skills time management: Because of the volume of work big should the chief accountant to hone your skills and time management. Arrange, plan for the logical work, ensuring work completed on schedule.

- Careful, meticulous: the peculiarities of this profession is to work with the numbers in the table statistics, financial statements, tax returns or settlement, so ask the chief accountant must be carefully and meticulously. Remember, whether it is small flaws but can be damaging for business.

Learn more:

3.2. Skills professional experience

To complete work/duties of the chief accountant in business requires knowledge, skills, expertise of the accounting profession, the ability to grasp the whole situation, field of activity of the company, knowledgeable, quickly grasp the terms of law provisions.

In addition, this position should proficient in office computer to a good use of task on the computer service work.

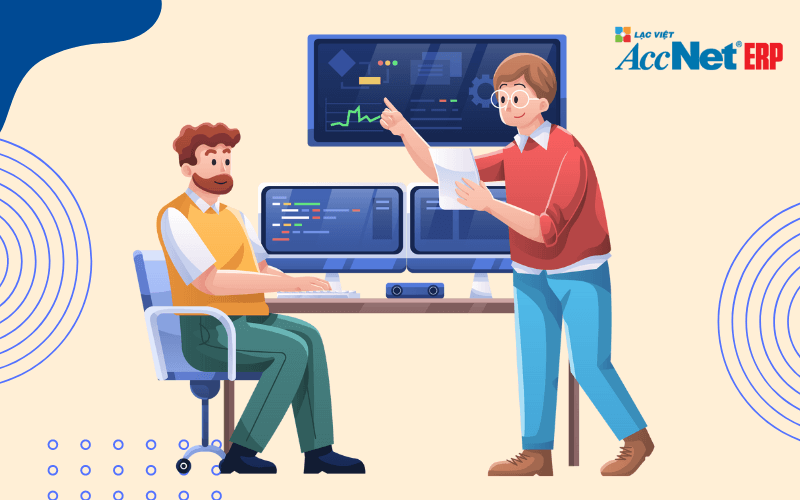

3.3. Understand the accounting software today

The era of technology 4.0 with the inventors have created the technology, advanced software serve many industry sectors, bringing more benefits for your business. In the field of accounting, many software is built to serve the activities related to accounting in order to save time, optimize work efficiency. Each software will have features, pros, cons separately, chief accountant must understand the accounting software now commonly used to be able to manage work easily, efficiently, as well as completion of the function the duties of the chief accountant in business.

With accounting software AccNet:

- Fully responsive accounting profession according to the circular, the latest decision of the Ministry of Finance and the tax authority.

- Automation in the synthesis of the data, transfer the revenue, established a tax return, financial statement with just 1 click.

- Technology applications, cloud computing, users easy to use anytime, anywhere.

- Fully meet all the accounting profession in accordance with the accounting standards.

4. Laws for chief accountant

4.1. The general rules for chief accountant

Những quy định chung đối với kế toán trưởng quy định tại Điều 20 Nghị định 174/2016/NĐ-CP ban hành bởi Chính phủ:

In case the unit has not appointed chief accountant, layout person in charge of the accounting, or can hire the services of chief accountant prescribed. The maximum duration layout person in charge of accounting is 12 months, after this time the unit must layout the chief accountant.

Rules of accounting:

- The unit of accounting in the field of state include: units only have one person to do accounting or bookkeeping tasks, units of accounting, budget, financial, social, towns, then no need to make appointment of the chief accountant, which just appointed in charge of accounting.

- The organizations and enterprises super small according to legal regulations should be arranged in charge of the accounting that are not required layout of the chief accountant.

Change deadline, appointment of the chief accountant:

- Term of appointment of the chief accountant, accounting charge of the unit is 5 years, then must perform the process of re-appointment of the chief accountant, accounting charge.

- When there is a change of the chief accountant, in charge of accounting, the legal representative or the executive manager of the accounting unit to organize the implementation of handover of work, the material between the chief accountant, in charge of the ex-accountant, chief accountant, in charge of new accounting. At the same time to inform the relevant units, the agency where the unit of account opening transaction on the name and specimen signature of the chief accountant, in charge of new accounting. However, the chief accountant, accounting charge old still responsible for the accounting job in his time in charge.

Read more:

4.2. Conditions and standards of chief accountant

Tại Điều 54 của Luật kế toán số 88/2015/QH13 quy định điều kiện, tiêu chuẩn làm kế toán trưởng như sau:

- Quality professional ethics, integrity, honesty, consciously abide by the law.

- Qualified, professional accounting from intermediate upwards

- Certified chief of accountant.

- Have the time actually worked in the accounting field for at least 2 years for people with professional qualifications, professional accounting from the university of upward, at least 3 years for qualified, professional accounting intermediate or college.

In addition, the government has specified standard conditions of growth accounting in accordance with each type of unit.

4.3. People are not becoming chief accountant

People are not becoming chief accountant specified in Article 52 of the Law on accounting of 88/2015/QH13 dated as follows:

- Minors; who have limited or loss of capacity for civil acts; who are applying the measures put in an institution or facility compulsory detoxification.

- People are forbidden to practice accounting as a decision of the Court; people are being prosecuted for criminal responsibility; who is serving a prison sentence, or was convicted of a criminal assault order management, economic crimes of the ministry related to accounting that hasn't been deleted in project work.

- Who are her birth parents, adoptive parents, spouse, child, adopted child, brother, sister, brother of the legal representative, head, director, general director, deputy director, deputy general director in charge of finance - accountant, chief accountant, the same unit of accounting, except for business private company limited by an individual as the owner, other cases prescribed by The government.

- People are manager, operator, storekeeper cashier, buying or selling property in the same unit except business private company limited by an individual owner, in other cases stipulated by The government.

5. Rights and responsibilities of the chief accountant

In Article 55 of the Law on accounting of 88/2015/QH13 have regulations on the powers and responsibilities of the chief accountant.

Responsibility:

- Done in accordance with the law on accounting and finance.

- Organization operating the accounting system in accordance with the law.

- Perform financial reporting should comply with accounting policies, accounting standards.

Rights: Chief accountant have the right to independent professional accounting.

In particular, the chief accountant of the state agency, organization, unit, using the state budget, or enterprise by the state holds over 50% of charter capital have the following rights:

- There are comments in writing with the legal representative of the unit of accounting on issues such as hiring, transfer, salary increase, bonus, discipline accounting.

- Requirements related parts in the unit provides full timely of accounting documents related to accounting jobs, financial monitoring.

- Reserves the professional opinion in writing when there is another opinion with the opinion of the decision.

- A written report with legal representative of the unit when the detection unit has Law violations, financial accounting; if you still have to accept the decision shall be reported to the immediate superior of the decision or state agency having jurisdiction, is not responsible for the consequences of the enforcement of that decision.

Refer to: Cách xác định số dư cuối kỳ của các tài khoản tài chính trong doanh nghiệp

Chief accountant played a key role in managing the financial business, but many businesses have yet to actually leverage the entire capacity and powers of this position. With the volume of work is large, complex nature, such as management, accounting system, financial reporting, tax monitoring, compliance with the law, the chief accountant are often faced with high pressure, prone to errors if there is no timely support from professional tools.

Accnet ERP mang đến giải pháp toàn diện cho kế toán trưởng, giúp tự động hóa quy trình, tăng cường tính chính xác/minh bạch trong công tác quản lý tài chính. Hệ thống hỗ trợ kế toán trưởng trong việc lập kế hoạch ngân sách, báo cáo tài chính, dự báo tài chính, giúp họ tối ưu hóa thời gian, nâng cao hiệu quả công việc. Hãy để Accnet ERP trở thành trợ thủ đắc lực, giúp bạn quản lý tài chính doanh nghiệp hiệu quả!

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

So, AccNet helped you solve question the duties of the chief accountant in what is the business? Responsibilities and powers of the chief accountant. Hopefully with the knowledge in the article help you better understand the position of chief accountant to be able to search be suitable candidates, leveraging effective capacity.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: