A concept indispensable when evaluating the effective use of assets is current assets average. This is not just a financial index which is also a tool to support businesses to plan, control cash flow, short-term efficacy. This article AccNet will provide comprehensive perspective on the concept of mobile assets, average calculation, the role of it in managing business finance. In particular, the content will guide detail, help businesses understand, effective application in practice.

1. Assets on average, what is?

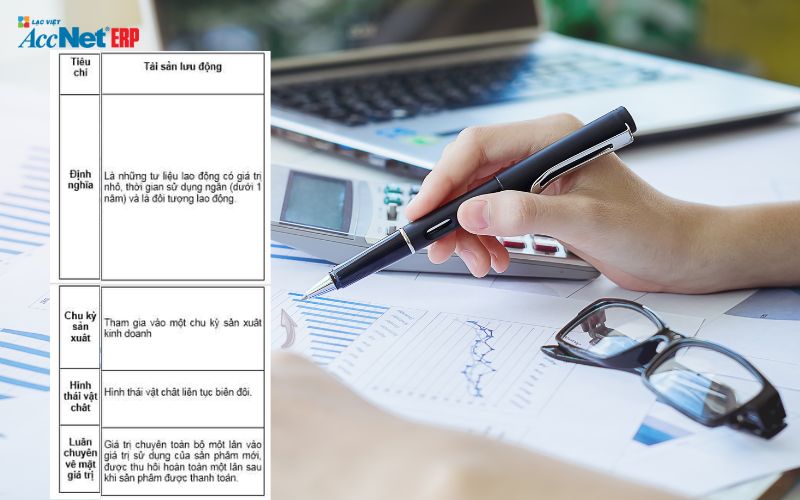

Tài sản lưu động bình quân là giá trị trung bình của tài sản lưu động mà doanh nghiệp sở hữu trong một khoảng thời gian nhất định, thường là một kỳ kế toán (tháng, quý, năm). Đây là một chỉ số quan trọng để đánh giá hiệu quả sử dụng tài sản ngắn hạn của doanh nghiệp. Tài sản lưu động trung bình phản ánh giá trị trung bình của các tài sản có tính chất ngắn hạn, dễ chuyển đổi thành tiền mặt, bao gồm tiền, hàng tồn kho, các khoản phải thu.

Assets average difference compared to fixed assets?

- Duration of use: Assets often be converted within 1 year, while the fixed assets have the time long-term use.

- Liquidity: liquid Assets are likely to convert into cash more quickly than fixed assets.

According to the financial statements in the year 2023 on assets average by industry:

- The retail sector: Assets on average, accounted for 60% of total assets.

- Manufacturing sector: current Assets average ranged from 40% to 50% of total assets, with inventory accounted for the majority.

2. Formula for calculating liquid assets average

2.1. General formula

Assets average = (current Assets beginning of period + Assets end of period) / 2

2.2. The meaning of the formula

- Reflected liquid assets average: to Help businesses understand the extent of use of mobile assets in an accounting period.

- The basis for the financial analysis: Is the indicator platform to calculate the financial indicators other as spin liquid assets, quick ratio, the ratio liquid assets/short-term debt.

- Support working capital management: Ensure business not to backlog capital too much or deficiency of short-term capital.

Read more:

- Cách phân bổ khấu hao tài sản cố định theo thời gian sử dụng thực tế

- Bảng phân bổ khấu hao tài sản cố định chi tiết theo từng tháng chính xác

- Hệ số spin short-term assets đánh giá mức độ sử dụng vốn linh hoạt

2.3. Illustrative example

Business X has data assets as follows:

- Assets beginning of period: 15 billion VND.

- Assets end of period: 20 billion VND.

Apply the formula: current Assets average = (15+20)/2 = 17.5 billion VND

2.4. Note when calculating the

- Data start and end should be checked for accuracy from financial statements.

- In case there are large fluctuations in the period, to consider assets in timelines different to the average data more accurate.

3. The role of mobile assets average in business management

3.1. Optimize working capital

Assets average is a tool to help businesses allocate capital efficiently:

- Avoid excess working capital: Decrease the opportunity cost when the capital equipment backlog in inventory or accounts receivable.

- Avoid capital deficiency: Ensure liquid assets sufficient to maintain active short-term trading.

For example: A business know that the property hosted average of yourself is 10 billion VND and the cycle of debt payments is 30 days. If working capital is not reached this level, the business may have difficulty in payment of debt.

3.2. Health assessment short-term financial

Assets average suggests the possibility of liquidity, asset management, and short-term. Relevant indicators:

- The ratio of assets = liquid Assets/short-term debt. If this ratio is

- Quick ratio = current Assets (excluding inventory)/current liabilities

For example:

- Current assets: 15 billion VND.

- Short-term debt: 10 billion VND.

Ratio liquid assets/short-term debt = 15/10=1.5, meaning that businesses have the ability to pay its short-term good.

3.3. Application in financial planning

Based on assets, on average, businesses can:

- Planning cash flows: Determine the capital necessary to ensure liquidity.

- Planning, order entry, production: Based on inventory levels, on average.

- Give credit policy match: control receivables from customers.

Practical examples: A business production forecast assets average of states to be 20 billion VND. With the ratio of liquid assets/short-term debt target is 2:1, business plan in order to maintain short-term debt at the level of maximum 10 billion VND, ensure liquidity and financial health.

4. The factors that affect the assets average

4.1. Fluctuations of inventory

Inventory accounts for a large proportion of liquid assets. Therefore, any fluctuations about inventory are directly affecting assets, on average.

- Inventory management poor: Causes backlog capital, reducing the effective use of assets.

- Revenue growth: the need for reserve larger inventory.

Solution: application method, inventory management optimization as EOQ (Economic Order Quantity) or ABC analysis for inventory reduction is not necessary.

4.2. Receivables

Receivables from customers are important factors in assets. If the business is not managed well, debt stretching will increase the assets average that does not bring realistic cash-flow.

- Status: Customers delayed payments made business difficult to turn round capital.

- Solution: Apply the policy to reasonable credit (credit limits, billing period). Monitored accounts receivable, apply reminder tool automatically.

4.3. Cash flow management

Strong cash flow help businesses maintain assets average at optimal levels. Deficiency of cash flows usually occur due to:

- Conversion cycle, cash length: inventory backlog, public debt is not recovered on time.

- The cost of short-term high: Pressure from interest expense or pay the short term debts.

Solution:

- Monitoring cycle cash conversion (Cash Conversion Cycle): CCC = inventory Time + Time to collect debts - Time payment of the debt

- Speed up recovery of the debt, reducing the duration of inventory to improve cash flow.

Read more: Bảng tính khấu hao tài sản cố định phục vụ báo cáo tài chính rõ ràng

5. How to optimize mobile assets average

5.1. Minimize receivables

Apply the policy to reasonable credit:

- Just give credit for customers with good payment history.

- Shortening the credit period.

Use software asset management business AccNet Asset: Tự động hóa quy trình theo dõi, nhắc nhở thanh toán.

SOFTWARE ACCNET ASSET – STOP WASTING ASSETS

- Cut reduction by 15-20% repair costs each year thanks to proper maintenance term

- 50% discount time inventory, and reporting of property

- Avoid losses hundreds of millions of since the property is "missing the mark", using the wrong purpose

- Increase asset life cycle up minimum 25% thanks to the tracking and timely warning

- Reduce errors depreciation – is not tax arrears

A business average savings from 300 to 500 million/year after deployment AccNet Asset

SIGN UP CONSULTATION AND DEMO TODAY

5.2. Optimal assets average by managing inventory effectively

- ABC analysis: a Focus group manager of importance.

- Application EOQ: Calculate the number of order optimal to reduce the cost of storage.

- Integrated warehouse management system (WMS): track, optimize inventory in real time.

5.3. Accelerate cash flow

- Increase speed to collect the debt: Take out the policy discounts to customers early payment.

- Optimize costs short-term: to Cut the expenses do not need to improve cash flow.

- Search for funding short-term: Apply the credit package deals for business.

Tài sản lưu động bình quân không chỉ là một chỉ số tài chính mà còn là công cụ chiến lược giúp doanh nghiệp quản lý vốn hiệu quả, duy trì thanh khoản. Thông qua việc hiểu rõ công thức tính, vai trò, các yếu tố ảnh hưởng, doanh nghiệp có thể xây dựng giải pháp kế toán phù hợp để tối ưu hóa tài sản lưu động. Hãy liên hệ tư vấn ngay hôm nay cho giải pháp quản lý tài sản lưu động AccNet Asset!

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: