Tax building how much 1m2? And how to calculate the taxes construction is a problem that many special attention before make construction of houses or buildings. The same AccNet learn now about how to calculate tax on housing construction okay.

1. Tax building what is?

Tax building is a sum of money payable to the state when the individual or organization wishing related to build houses, buildings.

Tax building is one of the taxes required to submit under provisions of the tax collector current. Not paying tax is review on tax evasion and subjected to legal liability.

2. Tax building how much 1m2 depends on the type of free how?

To improve the legal, tax and building owners, public works, housing not only filed a

taxes fixed for the calculation tax building how much 1m2 for housing depends on many factors other costs. Learn the types of costs below.

2.1 Tax

Excise tax is direct taxation of individuals and organizations when building houses or construction works are obliged to submit annually to the tax authorities, directly. The excise tax is based on the type of building materials due to the owner of the declaration or construction contractor declaration.

Case you rent units and construction contract agreement clear, the construction unit will be the taxpayers, if no contract agreement, then the owner must pay this tax.

Read more:

2.2 value added Tax and personal income tax

Value added tax (VAT) is an indirect tax revenues required to submit to the state. Object declaration and payment of tax can be due to unit construction, contractor, contractors or the owners pay according to the agreement of the construction contract.

In case you hire workers to construction, accommodation, then the workers are still taxed on personal income under the provisions of state. But this tax was often the owner works declare and pay the tax.

Also for case you hire contractors and construction contract agreement, then the tax on personal income is due to the builder filed.

2.3 Free construction license

A building permit is proof for the legality of the construction, repair, renovation,...This is one of the elements to answer how tax building how much 1m2 for housing. Therefore, free building permit is account payable to be licensed construction according to the rule of law. Fee building permit, including:

- License fee construction other and renew the building permit.

- Fees for building permits accommodation of the people.

2.4 registration Fee

Similar to the concept of the cost of other fee is the fee owner must pay when building or construction work.

In the Law on charges and fees 2015 has specified the fee is determined by the percentage of the total value of the property.

3. Such tax how many building 1m2? How to calculate?

To determine the level of taxes tax building how much 1m2 for housingwe need to learn how to calculate the cost type, located in the tax built as: Tax, VAT, personal income tax...

3.1 calculation of tax

Follow the circular 302/2016/TT-BTC of the Ministry of Finance of the excise tax with respect to construction activities accommodation is calculated based on the hire workers in a construction contract:

- Income under vnd 100,000,000/year tax-free license.

- Income from vnd 100,000,000/year - 300.000.000 vnd/year tax is 300,000 vnd/year.

- Income from 300.000.000 vnd/year - 500.000.000 vnd/year tax 500,000/year.

- Income 500.000.000 vnd excise 1,000,000/year

3.2 value added Tax

VAT is one of the factors that determine the tax building how much 1m2 for housing.Formula for calculating the hue VAT when formulated as follows:

| The VAT | = | Sales tax calculator | × | Rate % tax on VAT |

In which:

- Sales tax is charged according to unit price 1m2 with a total construction area or with the cost of construction of the entire work.

- Rate % tax on VAT split into 2 cases: 3% while providing the entire building materials, and 5% when not including the supply of building materials in the construction contract.

3.3 personal income Tax

Personal income tax when the construction of private housing is calculated according to the following formula:

| PIT | = | Sales tax calculator | × | The rate of PIT on revenue | × | Tax rate personal income tax (10%) |

In which:

- Income x Rate of personal income tax is calculated on the total amount used for the construction.

- The rate of personal income tax is applied is 10% for housing construction in accordance with the law.

On this is the recipe expense categories to determine distance calculator tax building how much 1m2.

Currently, the average 1m2 house level 4 in rural areas suffer the taxpayer constructed from 70,000 - 80,000 vnd. Tax code of this construction depends on the cost of hire workers building calculated according to the m2 and depends on the price of hire workers high or low.

4. Those who have to pay tax according to construction regulations?

The objects have to pay tax on construction is the individual, organization activities, construction of houses, construction (individuals, organizations and the contractor in construction). Contractors must register, declare and pay tax, personal income tax, VAT to the tax authority at the local place of execution of construction works and housing.

5. Taxpayer build now?

After you have learn how to calculate tax building how much 1m2 as well as insulating properties. So, the individuals, organizations will have to pay taxes now? Circular 156/2013/TT-BTC provisions about the payment of taxes into the state budget at the places below:

- State treasury: In each of the provinces and cities throughout the country have when the state treasury in each ward district. At which you claim to be and taxpayer built to be solved.

- Agency management tax: You are able to declare and pay tax on construction in the tax department of the commune where you are resident.

- The organization commissioned: This is the commercial banks, credit institutions, service organizations to collect taxes under the provisions of the law. These organizations are state authorized the collection of taxes for state agencies.

6. Ward people's COMMITTEE, there are tax collector construction?

Theo Điều 10 Thông tư 92/2015/TT-BTC quy định về ủy nhiệm thu thuế như sau:

At the local unrealized taxes electronically, tax authorities, commissioned for the organization to collect taxes for individuals and organizations. The authorized to collect the tax must be made through a contract between the heads of tax administration agencies with the organization is authorized to collect the tax.

Thus, the case, the revenue agency has a contract authorized in writing to ward people's COMMITTEE in the locality where you live or the place of execution, building construction, house in the ward COMMITTEE is authorized to collect taxes.

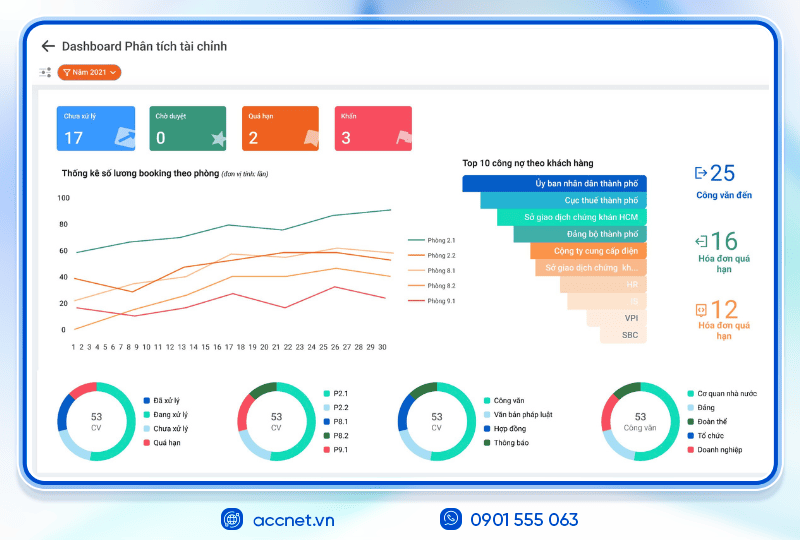

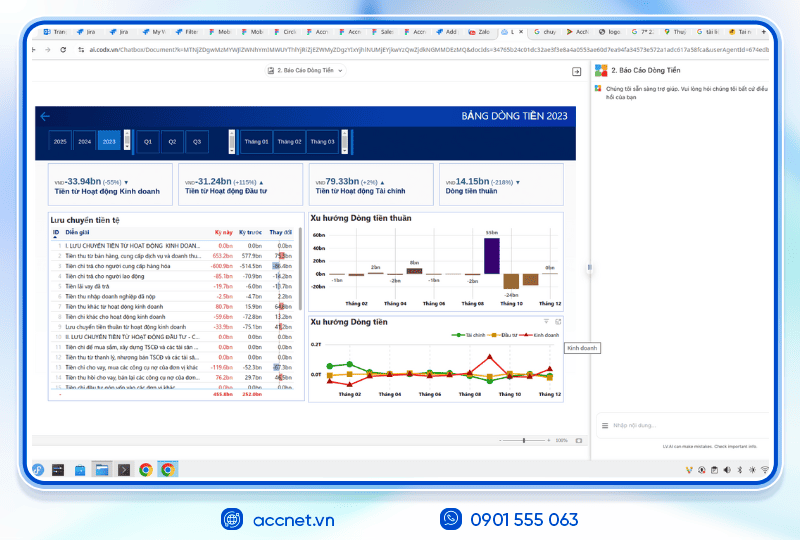

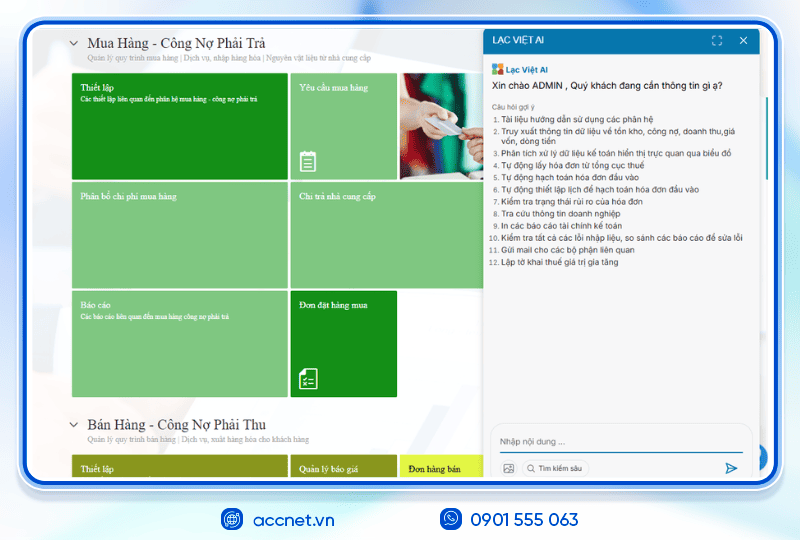

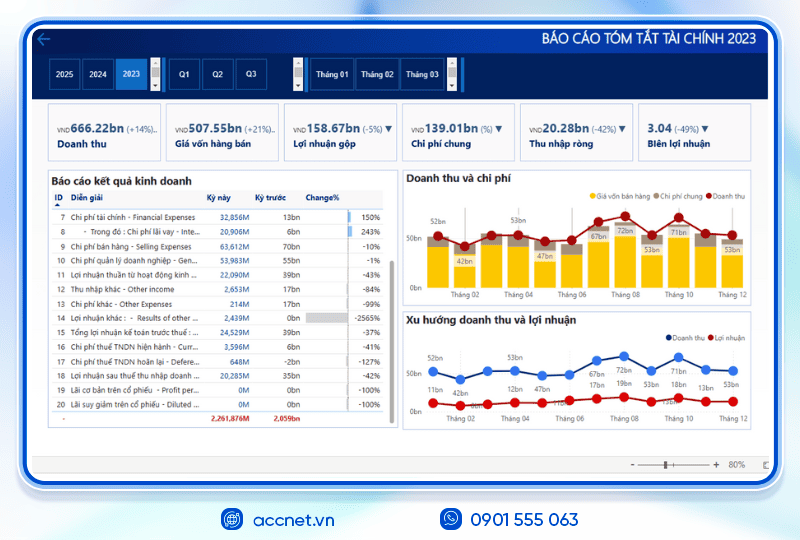

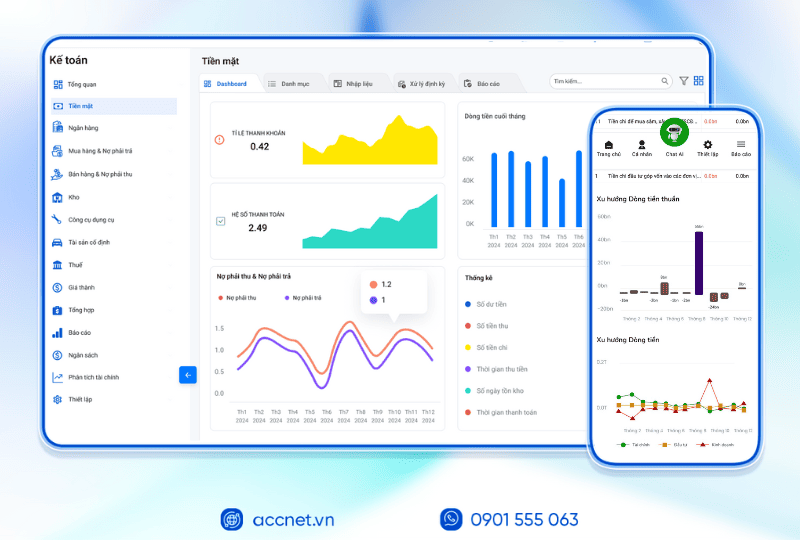

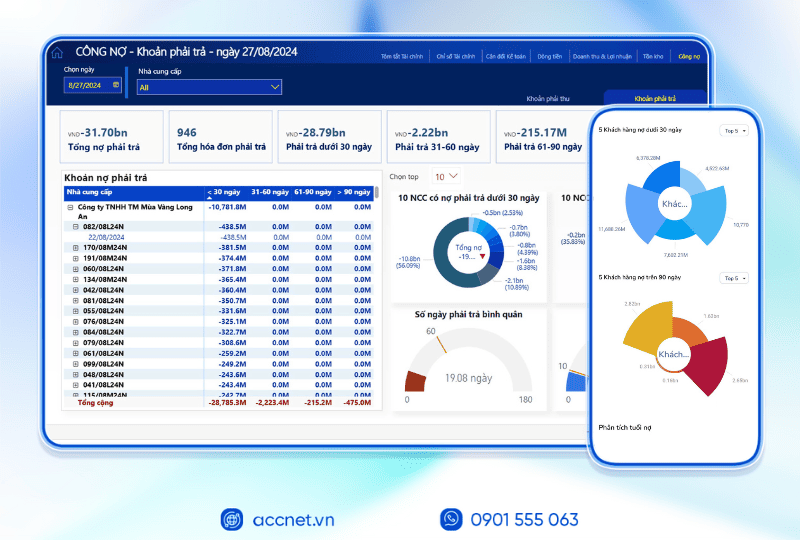

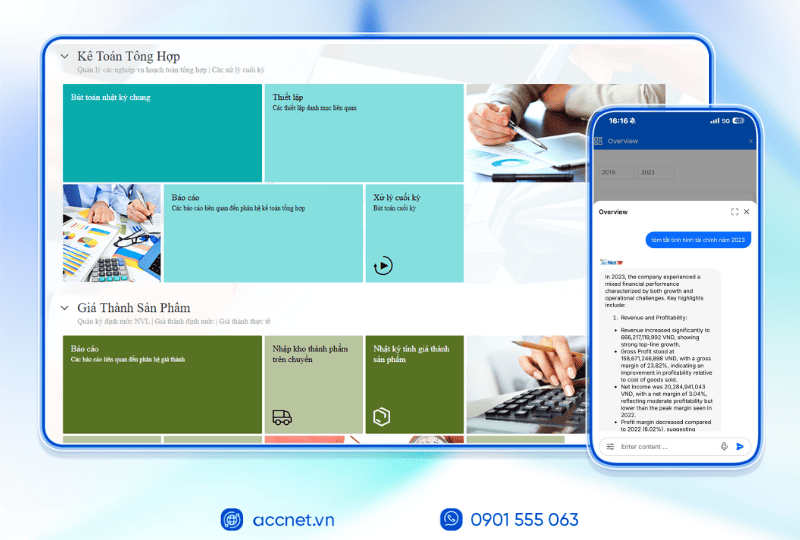

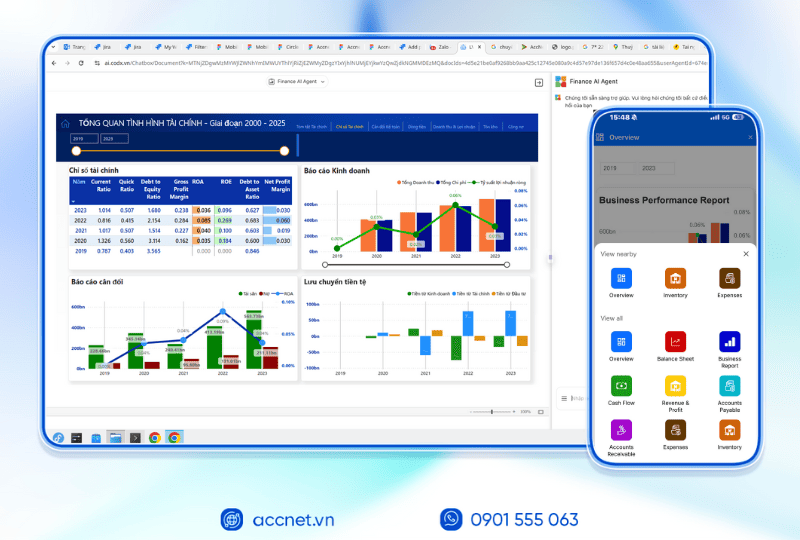

7. Quản lý thuế và chi phí xây dựng hiệu quả cùng AccNet ERP

Khi đọc đến đây, bạn đã nắm được cách xác định các loại thuế, phí và chi phí liên quan nhằm tính chính xác mức thuế cho mỗi mét vuông công trình. Đây là một minh chứng rõ ràng cho việc chi phí, thuế và các biến động tài chính không thể tách rời trong quản lý doanh nghiệp.

Và đây cũng là lúc phần mềm AccNet ERP trở thành cầu nối lý tưởng giữa kiến thức thuế & chi phí và thực tế quản lý doanh nghiệp:

- Tự động tính chi phí & thuế xây dựng: dựa trên đơn giá, diện tích, loại hợp đồng (có bao gồm vật liệu hay không), hệ thống sẽ hỗ trợ tính các loại thuế GTGT, thuế TNCN, thuế môn bài sao cho hợp lý.

- Liên kết dữ liệu qua các module: chi phí phát sinh từ xây dựng sẽ được cập nhật đồng thời vào module mua hàng, kho, tài chính – đảm bảo tổng thể số liệu không bị phân mảnh.

- Báo cáo chi phí & phân tích hiệu quả: bạn có thể xem báo cáo chi phí xây dựng theo công trình, theo giai đoạn, theo loại thuế để đánh giá xem công trình có đang phát sinh chi phí “ẩn” hay lệch theo kế hoạch.

- Cảnh báo chi phí bất thường: nếu đơn giá hoặc chi phí phát sinh vượt ngưỡng so với định mức đã thiết lập, hệ thống sẽ cảnh báo để bạn kiểm tra ngay.

- Tuân thủ quy định thuế & kế toán Việt Nam: AccNet ERP hỗ trợ áp dụng đúng các thông tư, nghị định liên quan đến thuế và chi phí xây dựng, giúp giảm rủi ro sai sót khi quyết toán.

Nhờ AccNet ERP, việc quản lý chi phí xây dựng — từ tính thuế trên từng mét vuông đến kiểm soát biến động, báo cáo – không còn là bài toán thủ công khó nhằn, mà trở thành quy trình thông minh, chính xác và minh bạch hơn.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Through this article, you've probably additional more knowledge about how to calculate tax on construction as well as are tax building how much 1m2. Hope the share of AccNet help you calculate and carry out the obligations tax when building construction, house in the right of law provisions.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: