One of the financial indicators is important, demonstrating the ability to use short-term assets effectively, the key is to spin short-term assets (TSNH). So spin TSNH what is the meaning of it for business out why, how to improve this indicator? Let's AccNet explore through the article below!

1. The concept of rotation property what is short term?

Asset turnover short-term (Short-term asset turnover) is a financial index expresses the number of times that short-term assets of the business are converted into revenue in a given time period (usually a year).

2. Formula for calculating rotation short-term assets and applying practices

2.1. Formula for calculating rotation short-term assets

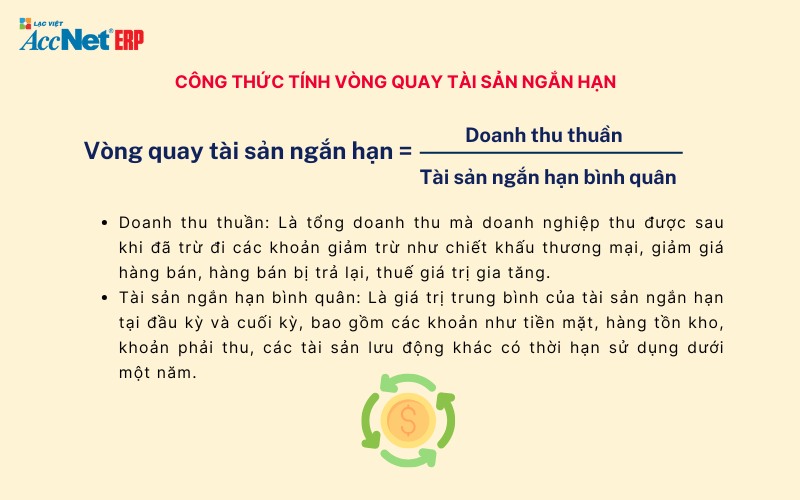

Spin short-term assets = net Sales / Assets short-term average

- Net revenue: total revenue that the business obtained after deducting deductions such as trade discounts, discounts, sales, sales returns, value-added tax.

- Assets short-term average: The average value of short-term assets at the beginning and end of the period, including the account as cash, inventory, accounts receivable, other current assets other term use under a year.

2.2. Applying the formula in financial analysis

Comparing only the number of revolutions short-term assets over the accounting period to help businesses assess trends in use of assets. If this indicator decreased, businesses need to check the cause:

- Inventory increased by no control.

- Duration debt collection spans.

- Policy, asset management, yet effective.

Spin TSNH is also a measure to compare business with competitors in the same field.

Read more:

2.3. Illustrative examples practical

Case 1: A manufacturing enterprise has net sales in the year 2023 is 500 billion in short-term assets the beginning of the period is 200 billion, and the end is 220 billion. Distance calculator:

- Assets short-term average = (200 + 220) / 2 = 210 billion

- Spin short-term assets = 500 / 210 = 2,38 times

This means that in years, business has transformed short-term assets of revenue to 2.38 times. This indicator the higher the effective use of short-term assets as possible.

3. Sense of rotation TSNH in business

3.1. Efficiency measurement using short-term assets

Only the number of revolutions TSNH provide an accurate measure of how businesses are leveraging the assets such as cash, accounts receivable, inventory to generate revenue.

3.2. Affect the liquidity, efficiency of operations of the business

- Asset turnover short-term low might indicate that the troubled business in the conversion of short-term assets into cash. This can weaken the ability to pay its short term debts.

- If the business is improved spin TSNH, they can reduce the costs of storage, speed up recovery of debts and maintain steady cash flow.

3.3. Contact with the index and other financial

Spin short-term assets do not operate independently but closely related to financial indicators such as:

- ROA (Return on Assets): this indicator increased when the business using assets efficiently to generate profits.

- ROE (Return on Equity): Business has rotation TSNH high often have the ability to increase return on equity.

- Working capital: spin TSNH directly affect the speed of rotation of working capital, the impact to the overall effect.

4. The factors affecting the rotation short-term assets

4.1. Scale business, industry business

Small businesses often have rotation TSNH higher due to their focus on the products/services quickly generate revenue. Industry business, also strongly influenced:

- Retail industry: There are rotation short-term assets because the sales cycle fast.

- Manufacturing industry: Often have rotation lower depending on the production cycle is longer.

Read more: Bảng kê khấu hao tài sản cố định hàng tháng đầy đủ cho từng đối tượng tài sản

4.2. Policy, asset management, short term

- Inventory management is not effective, leading to excess reduces the rotation property. For example: Apply the method of JIT (Just In Time) can reduce the amount of inventory, increasing the efficient use of assets.

- Duration debt collection long will negatively affect the rotation property. Businesses need to apply the credit policy reasonable, to strengthen the debt.

4.3. Strategic business cycles, production activities

- Business strategies focus on product/service short-life will speed up revolving assets.

- Long production cycle slows down the conversion of assets into revenue. For example, In the construction industry, property is often locked so long ago in the long-term project, leading to spin short-term assets low.

5. Cải thiện chỉ số vòng quay TSNH trong doanh nghiệp với AccNet ERP

Chỉ số vòng quay TSNH phản ánh mức độ hiệu quả trong việc sử dụng tài sản ngắn hạn để tạo ra doanh thu. Để cải thiện chỉ số này, doanh nghiệp cần đồng thời kiểm soát dòng tiền, tối ưu công nợ, quản lý chặt chẽ các loại tài sản. Một số giải pháp thực tiễn bao gồm:

-

Rút ngắn thời hạn thanh toán của khách hàng: Doanh nghiệp có thể thiết kế chính sách thanh toán linh hoạt hơn, ví dụ: khuyến khích khách hàng thanh toán sớm bằng cách giảm giá trực tiếp hoặc cộng thêm điểm thưởng cho lần mua tiếp theo. Điều này vừa giúp tăng tốc độ thu hồi công nợ, vừa duy trì mối quan hệ hợp tác bền vững với khách hàng.

-

Ứng dụng công nghệ trong quản lý tài sản ngắn hạn: Một trong những nguyên nhân khiến vòng quay TSNH chưa đạt hiệu quả là do doanh nghiệp chưa có cái nhìn tổng thể, cập nhật kịp thời về tình hình tài sản. Với AccNet ERP – giải pháp quản trị doanh nghiệp tích hợp phân hệ quản lý tài sản, doanh nghiệp có thể:

-

Theo dõi chi tiết từng loại tài sản ngắn hạn, từ hàng tồn kho, tiền mặt, công nợ phải thu cho đến tài sản lưu động khác.

-

Tự động hóa quá trình phân tích, lập báo cáo, giúp nhà quản trị dễ dàng đánh giá hiệu quả sử dụng tài sản.

-

Phát hiện sớm tình trạng tồn kho dư thừa, công nợ quá hạn hoặc dòng tiền bị ứ đọng để kịp thời điều chỉnh.

-

Cung cấp số liệu chính xác, hỗ trợ ra quyết định nhanh chóng nhằm tối ưu dòng tiền, nâng cao khả năng sinh lời.

-

Việc kết hợp chính sách tài chính hợp lý với giải pháp công nghệ toàn diện từ AccNet ERP sẽ giúp doanh nghiệp nâng cao chỉ số vòng quay TSNH, tăng hiệu quả sử dụng vốn, tạo lợi thế cạnh tranh bền vững.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Vòng quay tài sản ngắn hạn là một chỉ số tài chính quan trọng, phản ánh khả năng sử dụng tài sản ngắn hạn để tạo ra doanh thu mà còn đóng vai trò quyết định. Hãy bắt đầu hành trình cải thiện vòng quay TSNH cho doanh nghiệp của bạn ngay hôm nay bằng cách trải nghiệm giải pháp phần mềm AccNet ERP!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: