In some cases, the accountant must perform adjustments to reduce electronic invoice for the bill was founded. However, to make the right business is not easy thing if you do not understand the provisions of the law. So learn the right way invoice adjustment decrease in this article of AccNet okay.

1. Cách xuất hóa đơn điện tử điều chỉnh giảm theo thông tư 78

Bill electronic tuning up under circular 78 consists of 3 steps below:

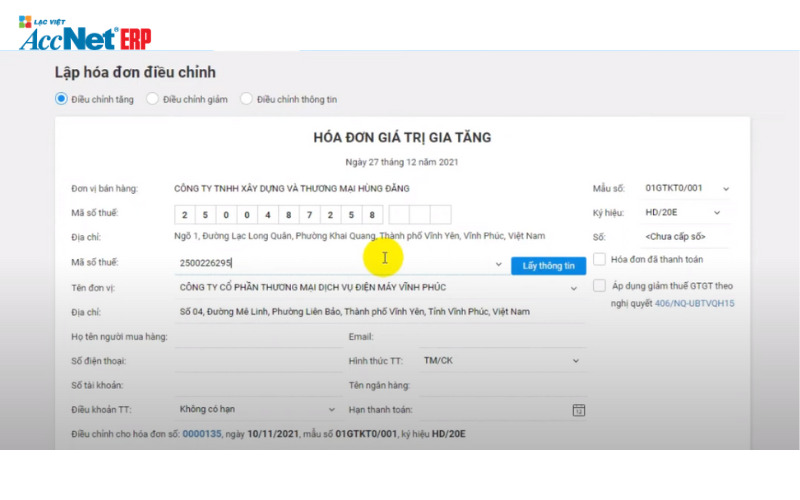

Step 1: Fill in the information reasons adjust up

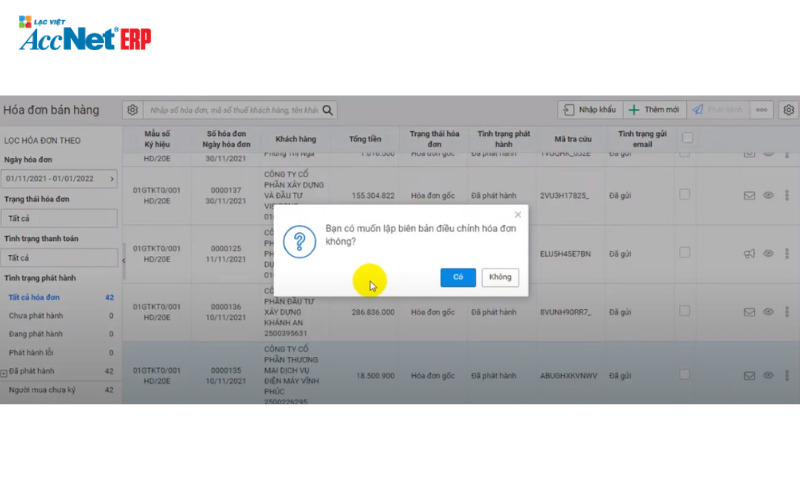

- On the “billing” as normal and select the item “invoice adjustment”

- Select the original invoice errors, the data on the invoice adjustment has inherited the data on the original invoice.

- Record reasons adjust the bill

- Reasons adjustable clearly stated in the following form: “adjustable ...... from ...... the ......”.

- For example: adjusted discount sale products X from 500,000 of 450,000 đ

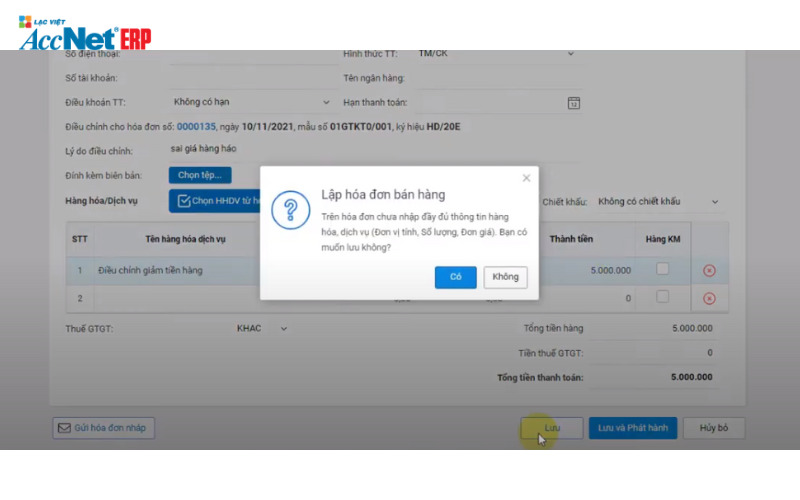

Step 2: Fill in the information content bill adjustment

Content of the invoice adjustment is adjusted according to the principle of “Wrong where correction in it.” Special note not recording the right information on the invoice adjustment that only record the corrected information.

Read more:

Step 3: Register number and send buyers

Done bill electronic tuning upsigned invoice number and send it to the seller. If the electronic invoice of you have the code of the tax authority, you perform the export, signed the invoice number and send to the tax office to be issued a new code, then send to buyers.

Việc xuất HĐ điều chỉnh giảm theo Thông tư 78 là một quy trình phức tạp mà nhiều doanh nghiệp gặp khó khăn trong việc thực hiện. Nếu không nắm rõ quy định, thực hiện sai bước, doanh nghiệp có thể mắc phải các sai sót về số liệu, thông tin hóa đơn, dẫn đến hệ lụy pháp lý, ảnh hưởng tiêu cực đến quá trình kê khai thuế. Khó khăn lớn nhất là phải đảm bảo việc điều chỉnh đúng cách, vừa tuân thủ quy định vừa không gây rối cho sổ sách kế toán.

Đây chính là lúc AccNet eInvoice trở thành công cụ hữu hiệu. Phần mềm này giúp doanh nghiệp tự động hóa quy trình xuất hóa đơn điều chỉnh giảm, hướng dẫn chi tiết từng bước theo đúng quy định của Thông tư 78. Nhờ khả năng theo dõi, cập nhật chính xác thông tin, AccNet eInvoice giúp giảm thiểu rủi ro sai sót, tiết kiệm thời gian đáng kể, đảm bảo doanh nghiệp của bạn luôn tuân thủ pháp luật. Hãy khám phá AccNet eInvoice để đơn giản hóa quy trình xuất hóa đơn điều chỉnh ngay hôm nay!

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

2. The case need adjustment invoice

Business need the invoice electronically adjustable up in the specific case after:

- Bill writes wrong: The bill was drawn up and delivered to the buyer or the seller, that the buyer has to pay the tax and then detect the bill has flaws: the Number of goods sold, selling price,...higher than reality and need to adjust.

- Discount trade: Account trade discount is set at the end of or after the end of the program, discount, then adjustment invoice will be accompanied by tables, statistics, invoice number, amount, tax amount adjustment.

- Discount wholesale: adjustment Invoice is set up business case detection of defective product, poor-quality goods after invoicing and accounting of revenue, decided to reduce the price for customers

- Business detect the defective goods of inferior quality when did invoicing and accounting of revenue, business decision to reduce prices for customers. At this time need to set up adjustment invoice for the initial invoice.

- Adjustable reduction of revenue: Settlement after construction work, installation of lower value temporary initially.

3. Legal provisions for the adjustment invoice

3.1. Quy định xuất hóa đơn điều chỉnh giảmThe legal grounds for the bill electronic tuning up at Paragraph 3 of Article 20 circular no. 39/2014/TT-BTC rules are as follows:

- Case bill was drawn up and delivered to the buyer or the seller, the goods got delivered, the service has been provided, the tax due to the seller and the buyer declaration. Then discovered there are errors, then the seller and the buyer agreement and the text specifies flaws, besides the seller need to invoice adjustment specifies the content adjust (increase or decrease) the quantity of goods, sale price, VAT..., the VAT for the invoice number... sign,...

- Based on the bill was adjusted, the seller and the buyer made the declaration business of buying, selling, output tax, input tax. Note: the adjustment is not recorded, a negative number (-).

Read more:3.2. Quy định kê khai hóa đơn điều chỉnh giảm

According to the office 3430/TCT-KK of the General department of taxation issued regulations on the declaration and bill of sale. As prescribed in the office, on the declaration adjustment invoice sales tax rate is done as follows:

- The seller made the declaration adjustment invoice to the list template 01-1/VAT and recorded a negative value.

- The buyer shall declare goods into the model 01 to 2/VAT and recorded a negative value.

At present, the General department of taxation has support for entering negative value in the list 01-1/VAT, 01 TO 2/VAT on app HTKK, iHTKK.

4. Các yếu tố ảnh hưởng trực tiếp đến việc xuất HĐ điều chỉnh giảm

Bill electronic adjustment reduced turnover depends on the factors such as reduced tax rates, discounts, sales, reducing the number of goods or trade discount. So, let's learn how to export bill electronic tuning up for the above factors.

Adjustable reduced due to factors tax rate- Sellers and buyers establish agreement specifies flaws

- The seller invoicing adjust and send the invoice adjusted for buyers. The seller and the buyer according to the adjustment made to adjust the output tax and input tax.

- Content bill adjustments need to specify: “adjust The reduced VAT of the invoice number...sign...days...months...years...from...the...”

Learn more:Bill electronic adjust discount based on the price of sale

- Buy-side and sell-side deal and make a record discount sale.

- The seller invoicing adjust and send to buyers. Content stating: “Invoice discount adjustment seller of a bill of...sign...days...months...years...from...the...”

If the wrong number of goods on the bill, then the bill electronic tuning up as follows:

- Conduct of the program, the bill was set wrong, which must clearly wrong about the number on the bill was set wrong.

- Adjustments to reduce the electronic invoice with the goods name, service record: “adjustment Invoice number of the invoice, VAT symbols..., model number... of...days...months...years...”.

As prescribed in circular no. 39/2014/TT-BTC of the Ministry of Finance:

- For goods and services, is trade discount for the customer on the invoice, VAT can be current retail price has been discounted for customers, the VAT and the total amount to be paid was including VAT.

- For the case of trade discount based on the number and sales of goods and services, the amount of sales discount is adjusted on the bill of sale goods or services of any final purchase, or the next. Also for the case of the discount amount are accumulated at the end of the program, discount, then set the adjustment with the list of invoices, the amount of tax is adjusted. Based on the bill was adjusted, sell-side and buy-side declaration adjust the sales tax, VAT input, output.

Hopefully with the useful information that AccNet share in this article that can help businesses make way invoice adjustment decrease right according to the law. Track AccNet to update more knowledge in the field of accounting, okay.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: