Gifts to employees is the interest in welfare policies, reward of the business, contribute to encourage teamwork, promote dedication of the staff. Besides choosing meaningful gifts, enterprises should also pay attention to the invoice for the gift this to manage finances effectively. So, how to invoice gifts for employees how? Let's AccNet find out right under article later!

1. Gifts for employees have to produce an invoice?

The answer is Yes!

Theo quy định của pháp luật Việt Nam, quà tặng cho nhân viên được coi là một khoản chi phí của doanh nghiệp. Khi doanh nghiệp tặng quà cho nhân viên, nếu quà tặng này có giá trị, doanh nghiệp muốn ghi nhận chi phí này vào sổ sách kế toán, thì bắt buộc phải xuất hóa đơn (According to the Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC)

So when do not need invoice? - Answer:

In some cases, if the gifts of small value or of the welfare program periodically (such as gift, new year, festival), the business can't invoice separately for each gift. However, these costs should still be recorded in the accounting records, tax returns in full.

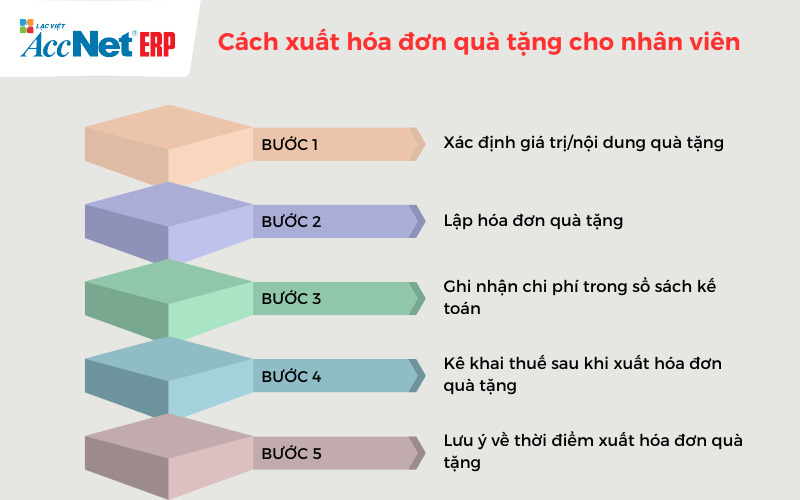

2. Guide how to export invoice gifts for employees

Step 1: Determine the value/content of gifts for the staff before the invoice

Before proceeding invoice gifts for employeesbusinesses need to clearly define the value of the gifts for employees. This includes the detailed list of factors:

- Name of goods/services

- Number

- Unit price

- Total value

Read more:

Step 2: billing gifts for employees before the invoice

Once you have identified the value/content of gifts, business conduct invoicing according to the information below:

- Specify product name, or service is donated.

- Record the specific number of each item/service.

- Record the value of each unit of goods/services pre-tax.

- Calculate the total value of the goods/services (quantity x unit price).

- Applicable VAT, according to current regulations (usually 0%, 5%, 10% depending on the type of goods/services).

- The total value after the addition of VAT.

Step 3: Record the cost in the accounting records after the invoice gifts for employees

After invoice gifts for employeesbusinesses need to recognize the cost gifts on bookkeeping. Gifts for employees is often considered as cost benefits, are recorded in cost management/cost of sales.

- Recorded value of gifts (including VAT).

- Recorded the VAT number of gifts (if any).

- If the gift is a product from the inventory of the business, need to record inventory reduction.

Step 4: tax declaration after the invoice gifts for employees

Giving gifts to employees, that may arise obligations tax, including value added tax (VAT), corporate income tax (CIT). Businesses need to pay attention declare these taxes in accordance with the regulations to avoid penalties.

- Declare the output VAT: Businesses need to recognize and declare VAT from invoices gifts in the tax declaration is in

- Declaration of corporate INCOME tax: the Cost of staff gifts can be deducted when calculating the corporate INCOME tax if they meet the conditions as prescribed by law.

Read more:

Step 5: note about the time of invoice gifts for employees

Businesses need to ensure invoice gifts right at the time giving gifts to employees. The delay in invoice can lead to fines, is considered a violation specified on the invoice.

Businesses also need to check thoroughly the information on the invoice prior to release, ensuring invoices enough information.

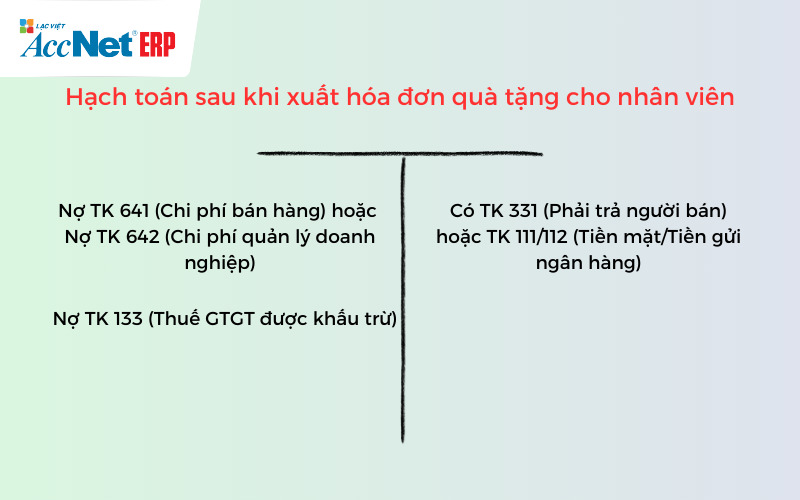

3. Accounting after the invoice gifts for employees

After invoice gifts for employeesbusinesses need to make the accounting entries accounting to record charges, gift tax, VAT related in bookkeeping. Below is the accounting details:

- Accounting cost gift - Debt TK 641 (Cost of sales) or Debt TK 642 (Cost business management): the Total value of gifts (including VAT).

- Accounting output VAT - Have TK 3331 (VAT payable): the amount Of VAT payable is recorded on the invoice gifts.

Suppose business invoice for a gift with value of 10 million, 10% VAT is 1 million, accounting would be as follows:

- Debt TK 641/Debt TK 642: 11 million

- Have TK 3331: 1 million

Learn more:

The gift will bring value to the business, pay attention to the steps guide invoice gifts for employees in accordance with the regulations in content on. Please ensure that every gift to employees are recorded, accounting processing in the right way, to bring the maximum benefit for both the business and employees.

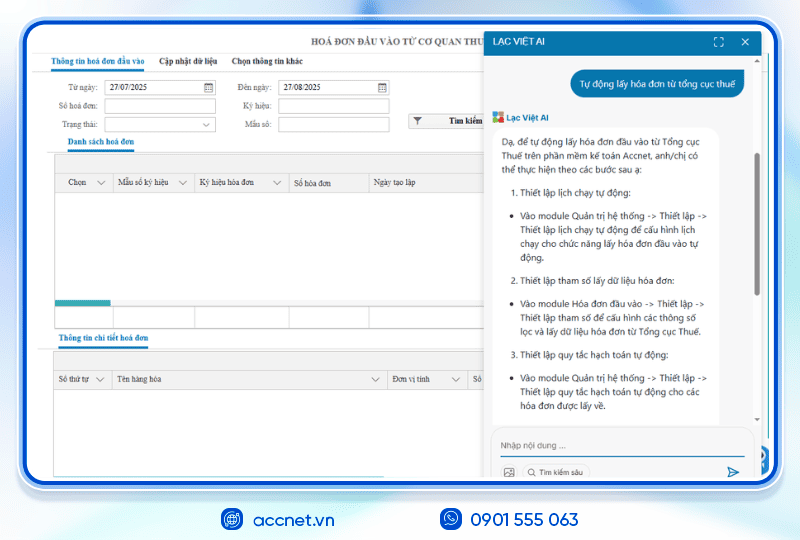

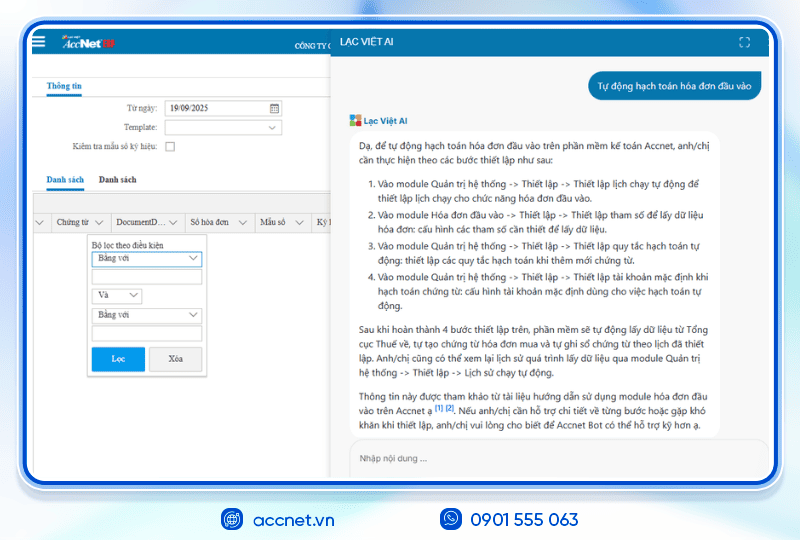

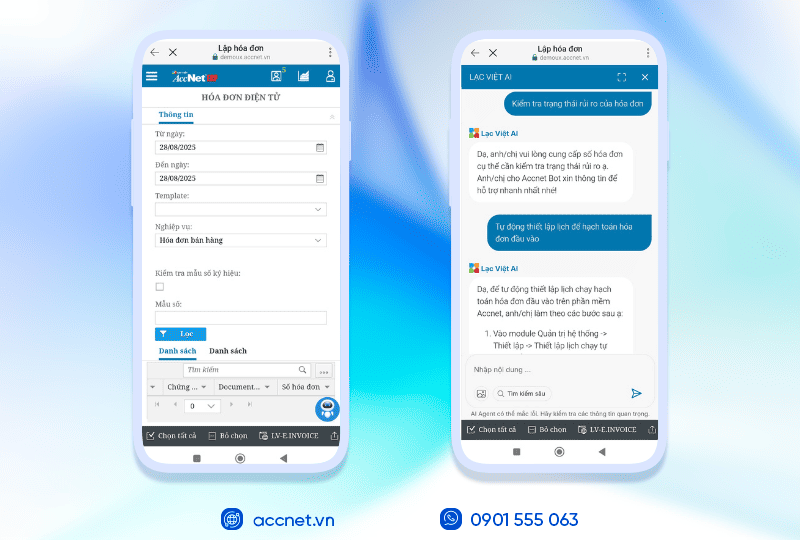

Việc xuất HĐ quà tặng cho nhân viên đòi hỏi tuân thủ đúng quy định thuế, ghi nhận chi phí rõ ràng, tránh sai sót không đáng có. Để thực hiện dễ dàng, chính xác, hãy sử dụng Management software electronic invoice AccNet eInvoice, giải pháp tối ưu cho mọi nhu cầu hóa đơn của bạn. Trải nghiệm ngay!

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT

AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

- Tạo và phát hành hóa đơn chỉ trong chưa đầy 30 giây, đảm bảo tốc độ và tính chính xác cao.

- Ký số trực tiếp ngay trên phần mềm, loại bỏ nhu cầu chuyển đổi file qua các công cụ trung gian, tiết kiệm đáng kể thời gian và chi phí.

- Tự động hóa toàn bộ quy trình từ nhập liệu, gửi email cho khách hàng đến lưu trữ hóa đơn, giúp giảm thiểu thao tác thủ công và hạn chế tối đa rủi ro sai sót.

- Kết nối liền mạch với hệ thống kế toán, bán hàng và ngân hàng điện tử, tạo nên một dòng chảy dữ liệu xuyên suốt trong toàn bộ hoạt động tài chính.

- Đồng bộ dữ liệu theo thời gian thực, mang lại sự minh bạch, chính xác và hỗ trợ ban lãnh đạo đưa ra quyết định kịp thời.

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025)

Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice:

- Xuất hóa đơn trực tiếp từ máy POS: Khi khách hàng thanh toán tại điểm bán hàng, hóa đơn điện tử được sinh ra ngay lập tức trên thiết bị POS, giúp giảm thiểu tối đa thao tác thủ công cũng như thời gian trì hoãn — toàn bộ giao dịch đều được ghi nhận & xử lý nhanh chóng, chuẩn xác.

- Tích hợp với sàn thương mại điện tử: Doanh nghiệp có thể kết nối dữ liệu đơn hàng từ các sàn TMĐT phổ biến, đồng bộ thông tin bán hàng, rồi phát hành hóa đơn tự động từ hệ thống AccNet. Việc này giúp tránh sai sót, tiết kiệm thời gian so với xuất hóa đơn thủ công từ file excel hay nhập dữ liệu tay.

- Đồng bộ hóa – lưu trữ & quản lý một cách liền mạch: Các hóa đơn phát sinh từ POS hoặc các sàn TMĐT được tích hợp vào hệ thống kế toán – lưu trữ hóa đơn đầu ra đầy đủ, cho phép tra cứu nhanh chóng, hỗ trợ trình tự kê khai thuế, đối soát doanh thu theo từng kênh.

- Tối ưu quy trình, giảm sai sót: Với tự động nhập liệu, ký số trên phần mềm, gửi hóa đơn cho khách hàng qua email hoặc các kênh số, doanh nghiệp giảm thiểu hầu hết các bước thừa, tránh được lỗi nhập tay hoặc mất dữ liệu.

✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp

- Discount 80–90% chi phí in ấn, chuyển phát, lưu kho

- Rút ngắn 70% thời gian xử lý, tăng hiệu suất kế toán

- Hóa đơn phát hành – tiền về nhanh hơn, cải thiện dòng tiền

- Hạn chế tối đa sai sót nghiệp vụ, minh bạch hóa dữ liệu

- Nâng cao trải nghiệm khách hàng nhờ tra cứu & thanh toán tiện lợi

✅ Tích hợp toàn diện cùng AccNet ERP

- Tự động hạch toán doanh thu ngay khi phát hành hóa đơn

- Phiếu thu/chi lập tức khi có biến động ngân hàng

- Updated công nợ & số dư real-time

- Hóa đơn gắn kết chứng từ gốc & báo cáo tài chính – đối chiếu nhanh, báo cáo chuẩn

✅ Chi phí hợp lý – Lợi ích vượt trội

- Gói cơ bản chỉ từ vài trăm nghìn đồng

- Phù hợp cả doanh nghiệp nhỏ lẫn tập đoàn lớn

- Đầu tư một lần – tận dụng lâu dài, dễ dàng mở rộng theo nhu cầu

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: