Invoice under the contract is the process of establishment/release of bill through the agreement in the contract between the seller, buyer. Today, some businesses still not understand the importance of the released single under the contract. This article will help you to make properly issued invoice according to the economic contract. Let's AccNet subscribe now!

1. Bill has been under contract no?

The answer is Yesbill , usually according to contract. When the business signed a contract for the sale of goods/provision of services, the invoice is an important part of the process perform the contract. The bill is based on the terms and conditions have been agreed in the contract.

2. How to export bills under contract basic economics today

Here is a guide specific fact about how to export bills under economic contracts through 6 steps:

- Step 1: Check the contract

- Step 2: Preparation information

- Step 3: invoice

- Step 4: Send invoices

- Step 5: Recorded in the books

- Step 6: Save the invoice

Step 1: Check the contract to determine the time of invoice

Before the invoice, you need to check carefully the terms of payment in the contract was signed. Usually, invoices are when:

- Delivery is completed.

- The service has been provided in full.

- Get money advance or in installments payment specified in the contract.

Ensure invoice the right time as agreed in the contract to avoid violation of the legal provisions of the bill.

Step 2: Prepare the required information before the invoice under the contract

- Company name, address, tax code of the enterprise you (the seller)

- Customer name, address, tax code buy-side

- Contract number, contract date, the payment terms.

- Describe in detail your product or service, quantity, unit price, total value.

- Determine the exact tax rates apply (usually 10%).

Read more:

- How to export electronic invoice đúng mẫu theo quy định Thông tư 78 mới nhất

- Xuất hóa đơn khách lẻ đúng quy định giúp tránh rủi ro bị xử phạt thuế

- Hướng dẫn giảm trừ giá trị trên hóa đơn theo đúng quy định thuế

Step 3: invoice under the contract

If the business you use electronic billing, log in to the system, creating new invoice. Complete, accurate information has prepared. The longer you use paper invoices, please complete the information form invoice has been issued, there should be no errors.

Necessary information is available on the invoice before under a contract:

- Detailed description name of goods/services

- Specifies the number of goods/services provided.

- Selling price not include VAT.

- The total value of goods or services.

- Calculate VAT (according to the tax rate applicable).

- Total amount to be paid, including VAT.

- Record contract number and the date of signing the contract.

Step 4: Send the invoice to the customer after the invoice under the contract

- Electronic invoicing: Send invoices to clients via email/invoice system electronic. Need confirmed after customer get bill

- Paper invoices: Send paper invoices by post/deliver directly to the customers according to the method agreed in the contract.

Step 5: Record the bill was under contract to bookkeeping

- Recognition of revenue from the sale of goods/provision of services according to the value indicated on the invoice.

- Recorded VAT payable on account 3331 (VAT payable).

- If you have not received immediate payment, record the amount receivable from a customer on account 131 (receivable of clients).

Step 6: Save the invoice has under contract

- Electronic invoices must be securely stored in the system under Article 6 of Decree 119/2018/ND-CP and Article 11 of circular 68/2019/TT-BTC about storage time.

- Store copy paper invoice along with a contract under Article 3 of circular no. 39/2014/TT-BTC and Accounting law 2015 (revised) in Article 41 the law, save the invoice.

Note: Before invoice under the contractplease check all information. If errors are detected after the invoice, you need to invoice adjustment or cancellation invoice in accordance with the regulations.

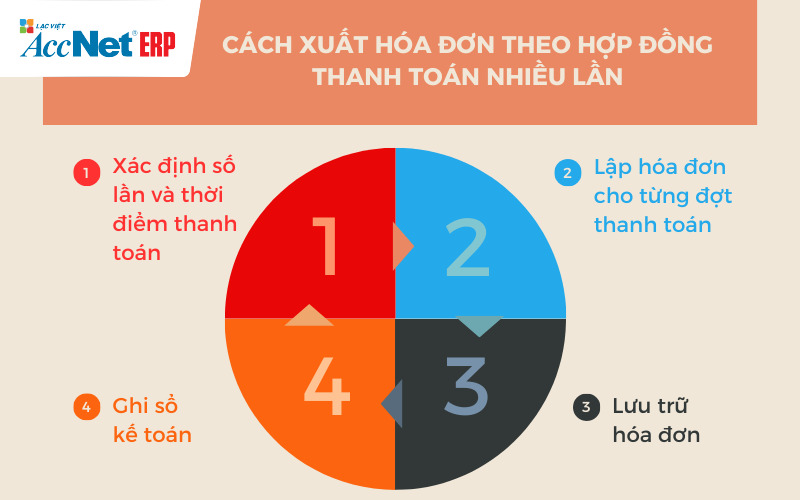

3. How to export bill under the contract payment many times

Step 1: Determine the number of times and the time of payment

First, need to check carefully the terms in the contract about the number of times the payment, the specific time when each payment takes place. For example, the contract may stipulate payment in 3 tranches: tranche 1 is advance, tranche 2 after completing 50%, phase 3 is complete contract.

Each tranche payment usually has a specific value has been clearly stated in the contract, you need to recognize the correct this value on the invoice.

Step 2: Setup an invoice for each payment before the invoice under the contract

With respect to bills advance:

- When receiving the advance payment from customers, businesses must set the invoice for the amount of the advance it.

- Invoice advance must clearly is bill advance, detailing the amount of the advance received, accompanied by information about the contract number, contract date.

- For example: Bills advance of 20% of the contract value can write "advance tranche 1 under contract no. 01/HDJ-KT day 01/01/2024 value advance: 200 million".

For invoice under the contract for the batch next payment:

- Billed for the amount of payment of that stage. Specifies the amount of work/goods has been made, the payment amount for this batch, contract number, contract date.

- For example: Bill series 2 can record "payment tranche 2 contract no. 01/HDJ-KT day 01/01/2024 value payment: 300 million".

For invoice settlement under the contract:

- After the completion of the entire contract, invoice settlement for the rest of the contract.

- Specifies the total value of the contract, the account was previously paid, the remaining amount need to pay.

- For example: Bill tranche 3 (settlement) can record "Settlement contract no. 01/HDJ-KT day 01/01/2024, settlement value: 500 million."

Read more:

- Cá nhân lập hóa đơn cung cấp dịch vụ cho doanh nghiệp

- Những lưu ý khi hộ kinh doanh xuất hóa đơn cho khách hàng và doanh nghiệp

- Doanh nghiệp cần lưu ý gì khi xuất hóa đơn VAT cho khách cá nhân

Step 3/Step 4: bookkeeping/storage bill

For 2-step this end, the implementation process will be similar to the way invoice under the contract basic at part 2

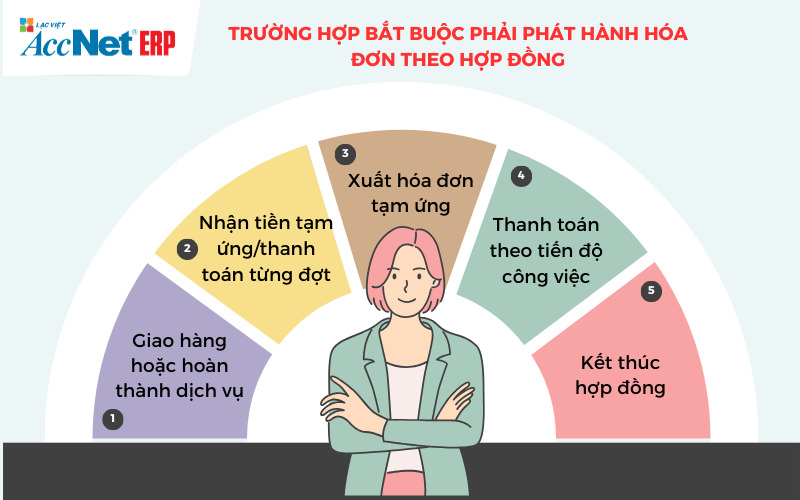

4. The case required to issue an invoice under the contract

- When delivery of goods/services completion: If the contract stipulates that bills must be after delivery or completion of services, the business required to issue invoice in accordance to that.

- When receiving the advance payment: If the contract requires payment in advance, or advance, the business must produce the invoice advance payment under the contract upon receipt of money from customers.

- Invoice-in-progress contract: In the contract are the terms of payment according to the schedule, the business must invoice for each payment after the completion of the work respectively.

Learn more:

- Doanh nghiệp cần làm gì khi invoice gifts for employees

- Doanh nghiệp cần lưu ý gì khi tạm ứng có phải xuất hóa đơn không

- Doanh nghiệp cần biết quy định xuất hóa đơn đỏ tối thiểu bao nhiêu tiền

5. The consequences of not invoiced under the contract

No invoice under the contract can lead to the following penalty:

- Penalty from 10 to 20 million if no invoice when sales/service provider. Free kick from 20 to 50 million if they continue to violate (Article 24 of Decree 125/2020/ND-CP)

- Punishment from 3 to 5 million if the bill is late from 1-10 days. Penalty from 10 to 20 million if late on the 21st day (Article 24 of Decree 125/2020/ND-CP)

- Arrears of taxes, VAT, CIT. Interest on late payment of tax 0,03%/day on the amount of tax paid (Article 142, the Law on tax Administration, 2019)

- In severe cases, can be fined up to 4 billion, or imprisonment from 3 months to 7 years (Article 200 of the penal code, the 2015 - amendment 2017)

6. Giải pháp toàn diện để xuất hóa đơn theo hợp đồng với phần mềm AccNet eInvoice

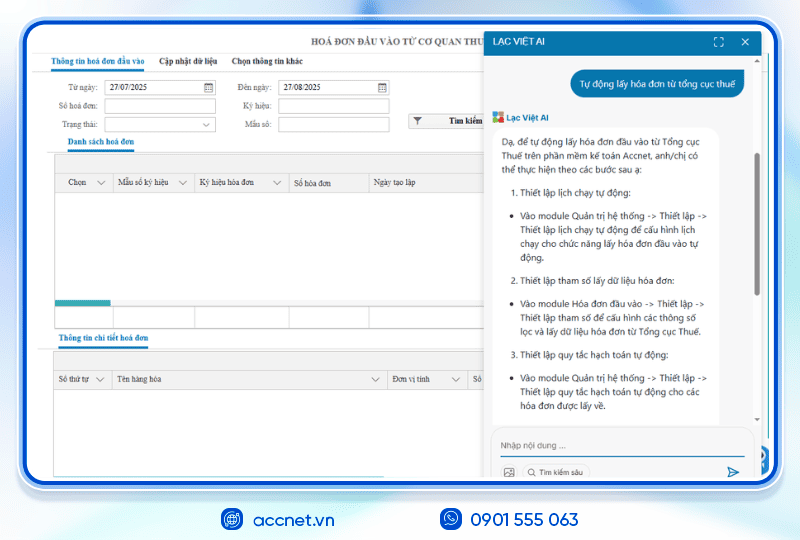

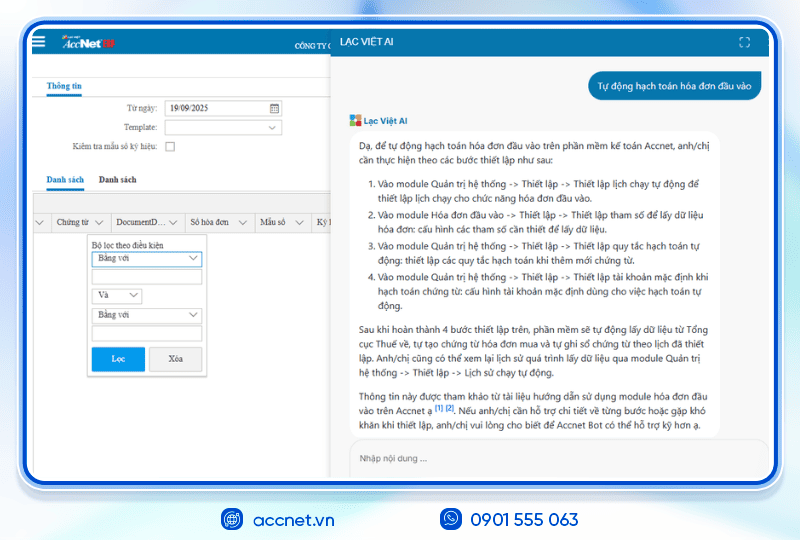

Đối với các doanh nghiệp hoạt động theo mô hình ký kết hợp đồng – từ thương mại, dịch vụ, xây lắp cho đến dự án – việc xuất hóa đơn theo hợp đồng luôn đòi hỏi độ chính xác cao, khả năng kiểm soát chặt chẽ giữa các bộ phận. Khi hợp đồng có nhiều điều khoản thanh toán, thay đổi giá trị, phụ lục điều chỉnh, nghiệm thu từng phần… thì quy trình phát hành hóa đơn bằng cách nhập tay không chỉ tốn thời gian mà còn tiềm ẩn rủi ro sai lệch số liệu, lệch tiến độ, hoặc phát hành sai thời điểm dẫn đến vi phạm quy định thuế.

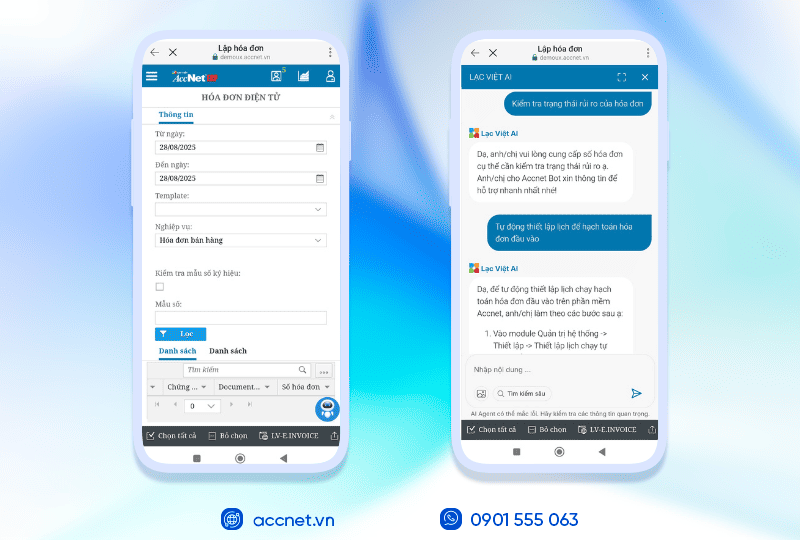

Chính vì vậy, doanh nghiệp đang có xu hướng chuyển sang sử dụng giải pháp hóa đơn điện tử chuyên nghiệp để đảm bảo mọi hóa đơn được lập đúng hợp đồng – đúng giá trị – đúng thời điểm. Trong số các giải pháp hiện nay, AccNet eInvoice nổi bật nhờ khả năng kết nối trực tiếp với dữ liệu hợp đồng, tự động lấy thông tin khách hàng, hạng mục, giá trị đã nghiệm thu, số tiền còn lại… từ hệ thống nội bộ. Điều này giúp bộ phận kế toán giảm 80–90% thao tác nhập liệu, hoàn toàn tránh được lỗi sai số.

Không chỉ vậy, AccNet eInvoice còn hỗ trợ doanh nghiệp thiết lập quy trình kiểm duyệt hóa đơn trước khi xuất, đảm bảo mỗi hóa đơn liên quan đến hợp đồng đều được kiểm tra đồng bộ giữa kế toán – kinh doanh – pháp lý. Dữ liệu hóa đơn sau khi phát hành được lưu trữ tập trung, dễ tra cứu, dễ đối soát, có thể kết nối với AccNet ERP hoặc các hệ thống quản trị khác để theo dõi doanh thu theo từng hợp đồng. Đây là nền tảng quan trọng giúp doanh nghiệp tối ưu vận hành, nâng cao minh bạch, hạn chế tối đa tranh chấp về sau.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

The invoice under the contract is an important factor that can not be ignored in any business transaction. Hope that through this article, you've mastered the steps necessary to invoice standard, ensuring all transactions are done in a legal way.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: