Yêu cầu lấy hóa đơn từ phía khách hàng cá nhân ngày càng phổ biến — không chỉ để bảo hành, khiếu nại mà còn vì nhu cầu chứng minh chi phí, hoàn thuế cá nhân. Đối với doanh nghiệp đang triển khai hoặc chuẩn bị chuyển sang hóa đơn điện tử, hiểu rõ VAT invoice can be issued for individual không chỉ là tuân thủ pháp luật mà còn là tối ưu vận hành, giảm sai sót, nâng trải nghiệm khách hàng. Bài viết này, AccNet sẽ đi sâu phân tích khái niệm, những hiểu lầm thường gặp, các quy định pháp lý hiện hành liên quan đến việc xuất hóa đơn VAT cho cá nhân, dưới góc nhìn chuyên gia quản trị vận hành số.

1. Xuất hóa đơn VAT cho cá nhân là gì?

Xuất hóa đơn VAT cho cá nhân hiểu nôm na là việc doanh nghiệp lập, phát hành hóa đơn giá trị gia tăng cho người mua là cá nhân (không phải tổ chức, doanh nghiệp). Về bản chất, đó vẫn là chứng từ ghi nhận giao dịch mua bán hàng hóa/dịch vụ; khác biệt chính nằm ở thông tin người mua (thường không có mã số thuế), một số hệ quả liên quan đến khấu trừ thuế, hoàn thuế.

Vì sao doanh nghiệp phải quan tâm

Nhiều doanh nghiệp xem nhẹ việc xuất hóa đơn cho cá nhân vì nghĩ “khách không yêu cầu thì thôi”, hoặc lo ngại “xuất nhiều hóa đơn cá nhân sẽ tăng nghĩa vụ thuế”. Trên thực tế, nếu hóa đơn phản ánh đúng giao dịch thực tế, việc xuất hóa đơn cho cá nhân không làm tăng nghĩa vụ thuế một cách bất hợp lý — ngược lại, nó giúp doanh nghiệp minh bạch, dễ kiểm toán, tăng độ tin cậy với khách hàng. Với sự gia tăng yêu cầu lấy hóa đơn từ người tiêu dùng, quy trình xuất hóa đơn kém chuẩn sẽ dẫn tới tỉ lệ hủy/điều chỉnh cao, tăng khối lượng công việc cho kế toán, gây trải nghiệm xấu cho khách.

Cá nhân có được khấu trừ thuế không?

Thông thường, cá nhân mua hàng cá nhân không khấu trừ VAT như doanh nghiệp có mã số thuế. Tuy nhiên, trong một số trường hợp đặc thù (ví dụ cá nhân là người lao động nhận chi trả để thực hiện công việc theo hợp đồng, hoặc cá nhân đăng ký kinh doanh), hóa đơn có thể liên quan tới chi phí hợp lệ để tính thu nhập chịu thuế hoặc hoàn thuế. Do đó, phân loại chính xác là quan trọng khi doanh nghiệp lập hóa đơn.

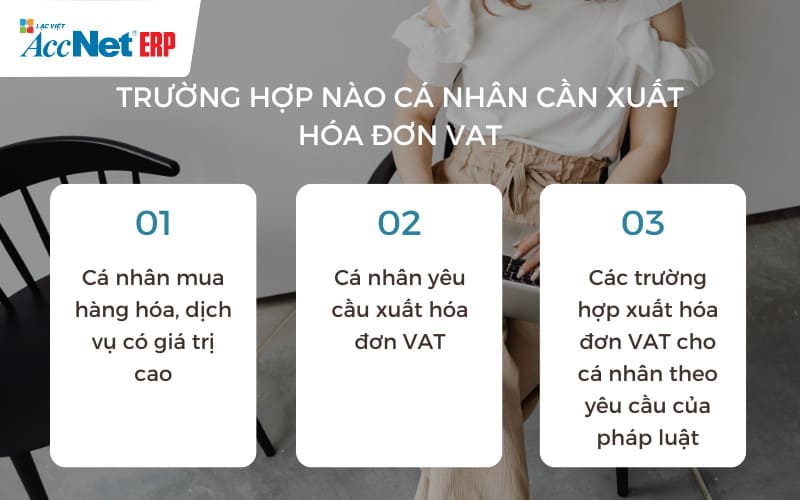

Những trường hợp cá nhân vẫn nên được xuất hóa đơn

- Mua hàng hóa có thời hạn bảo hành dài, cần hóa đơn để bảo hành.

- Dịch vụ có thể phát sinh khiếu nại, cần chứng từ làm cơ sở.

- Người mua yêu cầu hóa đơn để làm hồ sơ hoàn thuế hoặc làm chứng từ công tác.

Hiểu lầm phổ biến doanh nghiệp hay mắc phải

- “Nếu khách không có mã số thuế thì không cần xuất VAT” — sai; doanh nghiệp vẫn phải lập hóa đơn theo quy định.

- “Xuất hóa đơn cho cá nhân là trách nhiệm phụ, có thể bỏ qua” — thực tế, bỏ qua có thể dẫn tới kiểm tra, phạt hành chính hoặc mất uy tín khách hàng.

- “Xuất hóa đơn điện tử cho cá nhân phức tạp hơn hóa đơn giấy” — không nhất thiết; với phần mềm chuẩn, thủ tục, gửi hóa đơn cho khách cá nhân có thể tự động, nhanh chóng.

Read more:

2. Quy định, nguyên tắc khi xuất hóa đơn VAT cho cá nhân

Nghĩa vụ của người bán

Theo quy định về hóa đơn hiện hành, mọi tổ chức, doanh nghiệp kinh doanh đều có nghĩa vụ xuất hóa đơn VAT khi phát sinh giao dịch bán hàng hóa, cung cấp dịch vụ — bao gồm cả trường hợp người mua là cá nhân.

- Nếu cá nhân yêu cầu xuất hóa đơn, doanh nghiệp bắt buộc phải lập hóa đơn đúng thời điểm, đúng giá bán, đúng thuế suất.

- Việc xuất hóa đơn không chỉ để cung cấp chứng từ cho khách hàng mà còn nhằm ghi nhận doanh thu, thuế GTGT đầu ra, nghĩa vụ kê khai thuế của doanh nghiệp.

- Không xuất hóa đơn khi có yêu cầu của khách hàng bị xem là hành vi vi phạm, có thể bị xử phạt theo Nghị định 125/2020/NĐ-CP.

Quy định về thông tin bắt buộc trên hóa đơn (theo Điều 10 – Nghị định 123/2020/NĐ-CP)

Khi lập hóa đơn cho cá nhân, doanh nghiệp vẫn phải đảm bảo hóa đơn có đầy đủ các nội dung bắt buộc:

- Name, address and tax identification number of the seller.

- Tên hàng hóa/dịch vụ, đơn vị tính, số lượng, đơn giá, thành tiền.

- Thuế suất GTGT, tiền thuế GTGT (nếu thuộc đối tượng chịu thuế).

- Tổng giá thanh toán.

- The date of invoice.

- Chữ ký số của người bán.

Lưu ý: Quy định này áp dụng cho mọi đối tượng mua, dù là doanh nghiệp, hộ kinh doanh hay cá nhân không kinh doanh.

Hóa đơn điện tử là bắt buộc đối với doanh nghiệp

Theo Nghị định 123, Thông tư 78, doanh nghiệp phải sử dụng hóa đơn điện tử.

- Điều này nghĩa là mọi hóa đơn xuất cho cá nhân cũng đều lập bằng phần mềm hóa đơn điện tử.

- Phần mềm sẽ tự kiểm tra định dạng, chuẩn dữ liệu, gửi dữ liệu hóa đơn sang cơ quan thuế ngay khi phát hành.

- Nhờ đó, hóa đơn điện tử cho cá nhân vẫn có giá trị pháp lý đầy đủ, dễ tra cứu, dễ đối chiếu, giảm tối đa sai sót khi vận hành.

Read more:

Những lưu ý quan trọng khi xuất hóa đơn VAT cho cá nhân

Không bắt buộc ghi mã số thuế khi cá nhân không kinh doanh

- Nếu người mua là cá nhân không kinh doanh, không có mã số thuế, bạn được phép để trống mục mã số thuế người mua.

- Doanh nghiệp không được tự ý điền, vì đây là thông tin định danh thuế.

Cá nhân có quyền yêu cầu xuất hóa đơn

Nhiều cá nhân cần yêu cầu hóa đơn vì:

- Dùng làm bằng chứng thanh toán.

- Dùng để bảo hành đối với hàng hóa, thiết bị.

- Dùng để chứng minh chi phí khi làm việc với đơn vị chi trả khác (ví dụ: bảo hiểm).

Do đó, khi cá nhân yêu cầu, doanh nghiệp phải đáp ứng đúng thời điểm, đúng giá trị giao dịch.

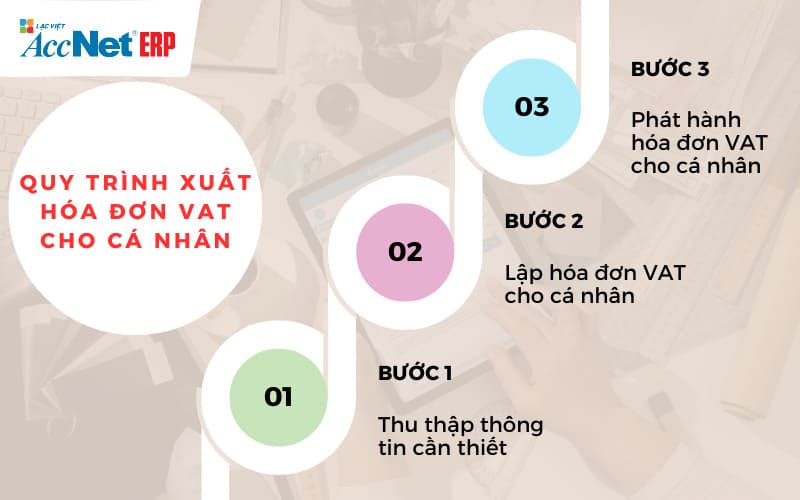

3. Các bước xuất hóa đơn VAT cho cá nhân

Khi doanh nghiệp chuyển sang sử dụng hóa đơn điện tử, việc xuất hóa đơn VAT cho cá nhân không chỉ dừng lại ở thao tác lập hóa đơn mà còn phải đảm bảo tính liên thông giữa bán hàng – vận hành – kế toán. Dưới đây là quy trình chuẩn mà doanh nghiệp nên áp dụng để hạn chế sai sót, tăng tốc độ phát hành.

Bước 1. Đăng nhập vào phần mềm hóa đơn điện tử

Trước tiên, bạn truy cập vào phần mềm hóa đơn điện tử mà doanh nghiệp đang sử dụng.

- Mở trình duyệt hoặc ứng dụng phần mềm.

- Nhập tên đăng nhập, mật khẩu do quản trị hệ thống cấp.

- Kiểm tra xem tài khoản bạn đang dùng có quyền tạo, phát hành hóa đơn hay không — vì nhiều phần mềm phân quyền theo từng vị trí trong doanh nghiệp. Khi đăng nhập thành công, bạn sẽ thấy giao diện quản lý hóa đơn.

Bước 2. Tạo hóa đơn mới

- Tại màn hình chính, bạn chọn mục “Hóa đơn”, “Lập hóa đơn” hoặc “Tạo hóa đơn mới” tùy theo tên gọi của phần mềm.

- Chọn loại hóa đơn GTGT (VAT) vì đây là loại hóa đơn bắt buộc khi xuất cho cá nhân mua hàng hóa, dịch vụ chịu thuế.

- Hệ thống sẽ hiển thị form để bạn bắt đầu nhập dữ liệu hóa đơn.

Bước 3. Điền thông tin hóa đơn

Bước 1: Khai báo thông tin người bán

Bạn rà soát, điền (hoặc kiểm tra thông tin tự động hiển thị):

- Business name

- Headquarter address

- Tax code

- Số điện thoại / email liên hệ Thông tin này phải đúng theo GPKD, đúng với hồ sơ đã đăng ký với cơ quan thuế.

Bước 2: Khai báo thông tin hàng hóa – dịch vụ

Bạn nhập chi tiết theo thực tế giao dịch:

- Tên hàng hóa/dịch vụ: ghi rõ ràng để khách dễ hiểu.

- Số lượng: nhập đúng theo thực tế.

- Đơn giá: giá chưa VAT.

- Thuế suất: 0%, 5%, 8% hoặc 10% tùy loại hàng hóa/dịch vụ.

- Thành tiền: hệ thống sẽ tự tính theo số lượng × đơn giá.

Nội dung này phải trùng khớp với hợp đồng, phiếu thu hoặc phiếu xuất tương ứng.

Bước 3: Điền thông tin người mua là cá nhân

Do người nhận hóa đơn là cá nhân, bạn thực hiện đúng như sau:

- Tên cá nhân: ghi đúng họ tên theo thông tin khách hàng cung cấp.

- Địa chỉ cá nhân: nhập đúng địa chỉ khách đưa (có thể theo CMND/CCCD hoặc địa chỉ thực tế).

- Mã số thuế cá nhân:

- Nếu người mua có MST, bạn nhập vào để cơ quan thuế ghi nhận.

- Nếu không có, bạn để trống — luật không yêu cầu bắt buộc cá nhân phải có MST khi nhận hóa đơn.

Không cần ghi thông tin CMND/CCCD trừ khi khách yêu cầu ghi chú thêm.

Learn more:

Bước 4. Kiểm tra lại thông tin

Trước khi phát hành, bạn cần rà soát toàn bộ:

- Tên + địa chỉ cá nhân có đúng chưa

- Mã số thuế cá nhân (nếu có)

- Name of goods/services

- Số lượng, đơn giá, thuế suất

- Tổng thành tiền, tiền thuế

- Date of invoice

Đây là bước quan trọng nhất, vì nếu sai thì bạn phải lập hóa đơn điều chỉnh hoặc hủy hóa đơn, vừa mất thời gian vừa ảnh hưởng đến khách hàng.

Bước 5. Phát hành hóa đơn

Khi mọi thông tin đã chính xác:

- Nhấn “Ký số”, “Phát hành” hoặc “Gửi hóa đơn đến cơ quan thuế” tùy theo giao diện phần mềm.

- Chữ ký số (USB Token hoặc ký số từ xa) sẽ xác thực hóa đơn, gửi dữ liệu sang cơ quan thuế.

- Khi hệ thống báo “Đã phát hành”, hóa đơn chính thức hợp lệ.

Bước 6. Gửi, lưu trữ hóa đơn

Cuối cùng, bạn cần:

- Gửi hóa đơn cho khách qua email, mã tra cứu hoặc file PDF.

- Lưu trữ hóa đơn trên phần mềm theo quy định.

- Có thể tải bản sao PDF để lưu trữ nội bộ, phòng trường hợp cần đối chiếu.

Hóa đơn điện tử phải được lưu tối thiểu 10 năm theo pháp luật.

4. Những lỗi thường gặp khi doanh nghiệp xuất VAT cho cá nhân

Doanh nghiệp thường gặp các lỗi dưới đây, dẫn đến phải hủy hoặc điều chỉnh hóa đơn:

Sai tên khách hàng

Vì khách hàng cá nhân không có mã số thuế, việc sai tên dễ khiến doanh nghiệp khó đối soát khi cần quản lý bảo hành hoặc lịch sử giao dịch.

Sai thuế suất hoặc sai mô tả hàng hóa

Đặc biệt phổ biến ở các ngành có nhiều phân nhóm sản phẩm. Khi xuất hóa đơn VAT cho cá nhân, nhiều nhân viên chỉ chọn sản phẩm tương tự dẫn đến sai thuế suất.

Sai ngày lập hóa đơn

Lỗi này kéo theo thủ tục điều chỉnh phức tạp, có thể bị xử phạt hành chính.

Lập hóa đơn nhưng chưa gửi khách

Không gửi hóa đơn ngay khiến khách không có chứng từ để bảo hành hoặc khiếu nại, gây mất uy tín doanh nghiệp.

5. Câu hỏi doanh nghiệp thường gặp khi xuất VAT cho cá nhân

Khách không muốn cung cấp email thì gửi hóa đơn bằng cách nào?

Doanh nghiệp có thể gửi qua SMS hoặc cung cấp link tra cứu online. Nhiều hệ thống e-invoice hiện đã hỗ trợ gửi qua Zalo để tăng tỷ lệ khách nhận được hóa đơn.

Cá nhân mua hàng rồi đổi trả, có phải hủy hoặc lập lại hóa đơn không?

Có. Doanh nghiệp phải lập hóa đơn điều chỉnh hoặc hóa đơn hủy theo đúng nghiệp vụ. Đây là lý do kiểm soát vận hành ngay từ đầu rất quan trọng.

Xuất hóa đơn VAT cho cá nhân vào cuối tháng có rủi ro gì không?

Không rủi ro nếu giao dịch ghi nhận đúng ngày, lập hóa đơn đúng thời điểm. Tuy nhiên, doanh nghiệp thường bị sai ngày lập nếu dồn hóa đơn → dễ bị cơ quan thuế kiểm tra.

Có được xuất hóa đơn gộp cho nhiều cá nhân không?

Không. Mỗi cá nhân là một đối tượng mua riêng, phải lập hóa đơn riêng.

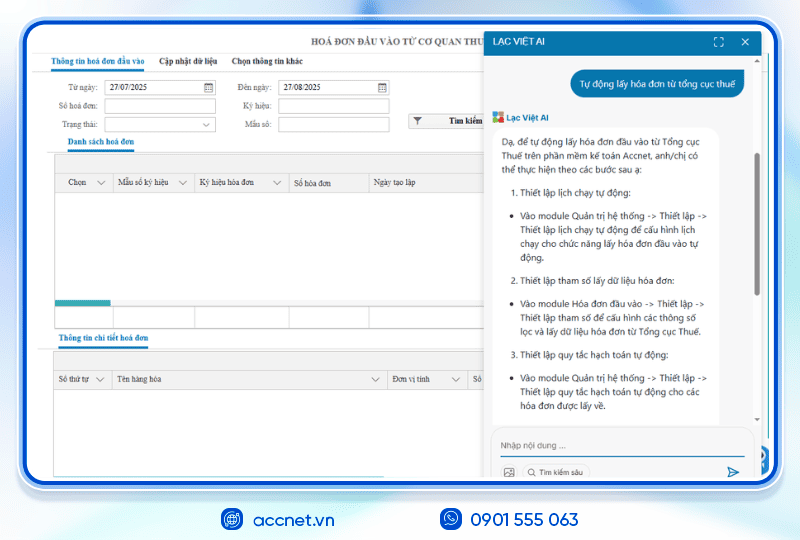

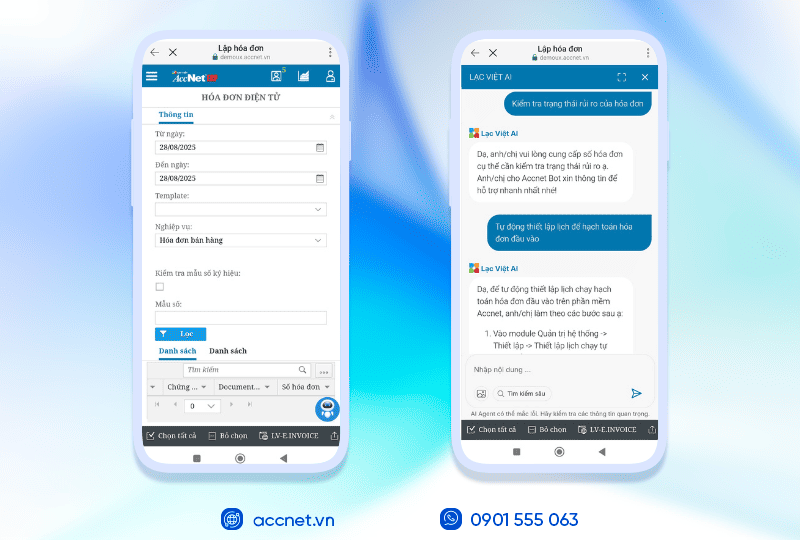

6. Tối ưu quy trình xuất hóa đơn VAT cho cá nhân với AccNet eInvoice

Khi khối lượng xuất hóa đơn VAT cho cá nhân tăng mạnh, doanh nghiệp rất dễ gặp các vấn đề như sai thông tin, gửi hóa đơn chậm, thất lạc hóa đơn hoặc trùng số liệu giữa các hệ thống. Giải pháp AccNet eInvoice được thiết kế để xử lý triệt để những vấn đề này bằng cách tự động hóa toàn bộ quy trình lập – ký – gửi – lưu trữ hóa đơn điện tử.

AccNet eInvoice mang lại cho doanh nghiệp:

- Tự động lập, ký số hóa đơn trong vài giây

- Gửi hóa đơn đa kênh: Email, SMS, Zalo, link tra cứu

- Tích hợp trực tiếp với POS, ERP, website để tránh nhập liệu trùng

- Quản lý hóa đơn theo thời gian thực, tra cứu dễ dàng theo số hóa đơn, SĐT, email

- Bộ lọc cảnh báo sai sót trước khi phát hành

- Đáp ứng đầy đủ chuẩn kết nối của Tổng cục Thuế

AccNet eInvoice đặc biệt phù hợp với doanh nghiệp bán lẻ, dịch vụ, logistics, giáo dục, y tế — những ngành phát sinh nhiều hóa đơn cá nhân mỗi ngày. Nếu bạn đang cần tối ưu quy trình xuất hóa đơn, giảm thủ công, hạn chế sai sót, chuẩn hóa vận hành, AccNet eInvoice là giải pháp mà doanh nghiệp rất nên xem xét trong giai đoạn chuyển đổi số.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT

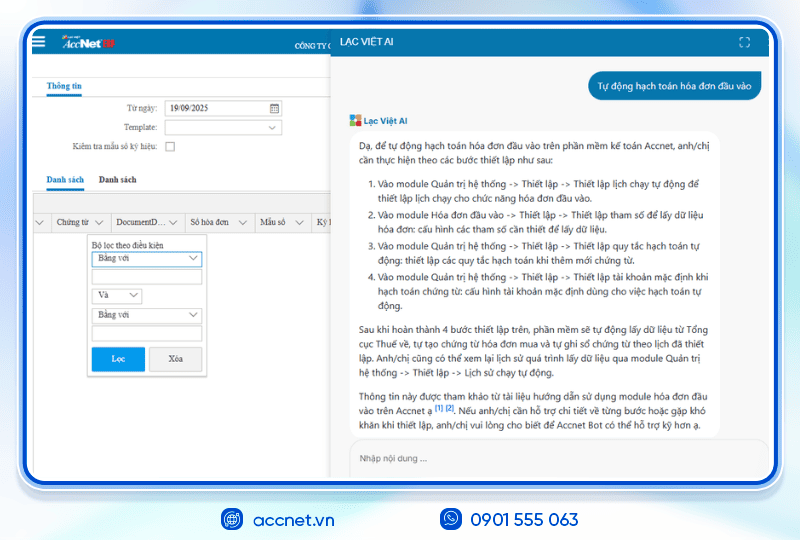

AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

- Tạo và phát hành hóa đơn chỉ trong chưa đầy 30 giây, đảm bảo tốc độ và tính chính xác cao.

- Ký số trực tiếp ngay trên phần mềm, loại bỏ nhu cầu chuyển đổi file qua các công cụ trung gian, tiết kiệm đáng kể thời gian và chi phí.

- Tự động hóa toàn bộ quy trình từ nhập liệu, gửi email cho khách hàng đến lưu trữ hóa đơn, giúp giảm thiểu thao tác thủ công và hạn chế tối đa rủi ro sai sót.

- Kết nối liền mạch với hệ thống kế toán, bán hàng và ngân hàng điện tử, tạo nên một dòng chảy dữ liệu xuyên suốt trong toàn bộ hoạt động tài chính.

- Đồng bộ dữ liệu theo thời gian thực, mang lại sự minh bạch, chính xác và hỗ trợ ban lãnh đạo đưa ra quyết định kịp thời.

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025)

Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice:

- Xuất hóa đơn trực tiếp từ máy POS: Khi khách hàng thanh toán tại điểm bán hàng, hóa đơn điện tử được sinh ra ngay lập tức trên thiết bị POS, giúp giảm thiểu tối đa thao tác thủ công cũng như thời gian trì hoãn — toàn bộ giao dịch đều được ghi nhận & xử lý nhanh chóng, chuẩn xác.

- Tích hợp với sàn thương mại điện tử: Doanh nghiệp có thể kết nối dữ liệu đơn hàng từ các sàn TMĐT phổ biến, đồng bộ thông tin bán hàng, rồi phát hành hóa đơn tự động từ hệ thống AccNet. Việc này giúp tránh sai sót, tiết kiệm thời gian so với xuất hóa đơn thủ công từ file excel hay nhập dữ liệu tay.

- Đồng bộ hóa – lưu trữ & quản lý một cách liền mạch: Các hóa đơn phát sinh từ POS hoặc các sàn TMĐT được tích hợp vào hệ thống kế toán – lưu trữ hóa đơn đầu ra đầy đủ, cho phép tra cứu nhanh chóng, hỗ trợ trình tự kê khai thuế, đối soát doanh thu theo từng kênh.

- Tối ưu quy trình, giảm sai sót: Với tự động nhập liệu, ký số trên phần mềm, gửi hóa đơn cho khách hàng qua email hoặc các kênh số, doanh nghiệp giảm thiểu hầu hết các bước thừa, tránh được lỗi nhập tay hoặc mất dữ liệu.

✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp

- Discount 80–90% chi phí in ấn, chuyển phát, lưu kho

- Rút ngắn 70% thời gian xử lý, tăng hiệu suất kế toán

- Hóa đơn phát hành – tiền về nhanh hơn, cải thiện dòng tiền

- Hạn chế tối đa sai sót nghiệp vụ, minh bạch hóa dữ liệu

- Nâng cao trải nghiệm khách hàng nhờ tra cứu & thanh toán tiện lợi

✅ Tích hợp toàn diện cùng AccNet ERP

- Tự động hạch toán doanh thu ngay khi phát hành hóa đơn

- Phiếu thu/chi lập tức khi có biến động ngân hàng

- Updated công nợ & số dư real-time

- Hóa đơn gắn kết chứng từ gốc & báo cáo tài chính – đối chiếu nhanh, báo cáo chuẩn

✅ Chi phí hợp lý – Lợi ích vượt trội

- Gói cơ bản chỉ từ vài trăm nghìn đồng

- Phù hợp cả doanh nghiệp nhỏ lẫn tập đoàn lớn

- Đầu tư một lần – tận dụng lâu dài, dễ dàng mở rộng theo nhu cầu

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Với sự siết chặt của cơ quan thuế với dữ liệu online, doanh nghiệp không chỉ cần hiểu đúng quy định về VAT invoice can be issued for individual, mà còn phải tối ưu hóa quy trình xuyên suốt: từ thu thập thông tin – lập hóa đơn – ký số – gửi khách – lưu trữ. Một hệ thống hóa đơn điện tử tốt sẽ giúp doanh nghiệp giảm lỗi, tăng tốc độ phục vụ, đảm bảo tuân thủ pháp luật tuyệt đối. Đặc biệt với doanh nghiệp có tần suất hóa đơn lớn, việc tự động hóa quy trình là điều kiện tiên quyết để vận hành hiệu quả, bền vững.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: