As a professional accountant, whether you know that in accounting, there is an important principle called the "principle of materiality" no? If the financial statements do not comply with the principle of materiality, it can lead to the wrong decision of users. So, principle of materiality in accounting what is? The effect of it how? The same Accnet find out the details in the article below.

1. Principle of materiality in accounting what is it?

Principle of materiality is one of the basic principles in accounting. This principle stipulates that only those information can significantly influence the decisions of users of financial statements must be presented in that report.

Accordingly, the principle of materiality is defined in Clause 1, Article 22 of accounting Standards generic number 01 for that: "Information is considered critical when the missing or wrong of information that can impact on the economic decisions of users information".

Read more:

2. Content of the principle of materiality in accounting

Principles important in the field of accounting (also called the principle Materility) put out that accountants should focus on collecting, processing, and provides information that matter. This is the information which if missing or incorrect can create significant deviations in the financial statements, directly influence the economic decisions of the users information.

The information is not important, are less affected or not significant for users can be ignored or synthetic on the item with the same quality or function.

For example: In the financial statements of A hotel, there are a number of items had content similarities were pooled on an item to create convenience and clarity.

- Such as, the account such as cash, bank deposits, money transfer, etc., may be combined into one item only is Cash and cash equivalents.

- Similarly, the account as raw materials, tools, merchandise, goods sent for sale,... can be combined into one item is inventory.

3. The impact of the principle of materiality in accounting to financial statements

- According to the principle of materiality, the important information will be given and presented in a way independent on the financial statements. For example, information related to money are considered as critical as it affects the solvency of the business. Therefore, the only goal "Cash and cash equivalents" usually reported separately to ensure the clarity and importance of this information.

- The information has properties similar will be pooled when presented on the financial statements. For example, items such as raw materials, tools, finished products, goods,... are all assets related to the operation, production and business. Therefore, they are usually integrated into one's "inventory" to make the report becomes easy to follow and effective.

From the angle of business apply principle of materiality in accounting help business save time and effort when preparing financial statements, especially when there is the ability to simplify recorded events and transactions is not important.

4. The importance of the principle of materiality in business

- Compliance with principle of materiality will help to ensure that financial statements provide useful information, a full and honest, help users take the correct decision.

- Principle of materiality in accounting help prevent the presentation of the information is not significant in the financial statements, this may reduce the reliability of financial reporting.

- Principle of materiality allows business can be recorded simplified for the event, the transaction is not critical, this can help businesses reduce the cost of financial reporting.

5. The relationship between the principle of materiality and matching principle

Appropriate principles focus on ensuring that the revenue recognition and expense to go together. What this means is: When reporting a revenue accounts, the need to record an expense, respectively, related to the process of generating that revenue. This cost includes not only the cost incurred in generating revenue, which also includes costs from the previous period or the costs related to the sales of that.

However, when the appearance of conflict between the principle of materiality in accountingbusinesses can handle the following:

- Comply with the accounting standards or the relevant regulations.

- Weigh the benefits of the stakeholders and assess the degree of influence of the event.

- Refer to the opinion of experienced people in the field of accounting.

In this way, the business can ensure compliance and uniformity in the process of information processing, at the same time face and quickly resolved the conflict situation.

6. Quản lý nguyên tắc trọng yếu hiệu quả với phần mềm AccNet ERP

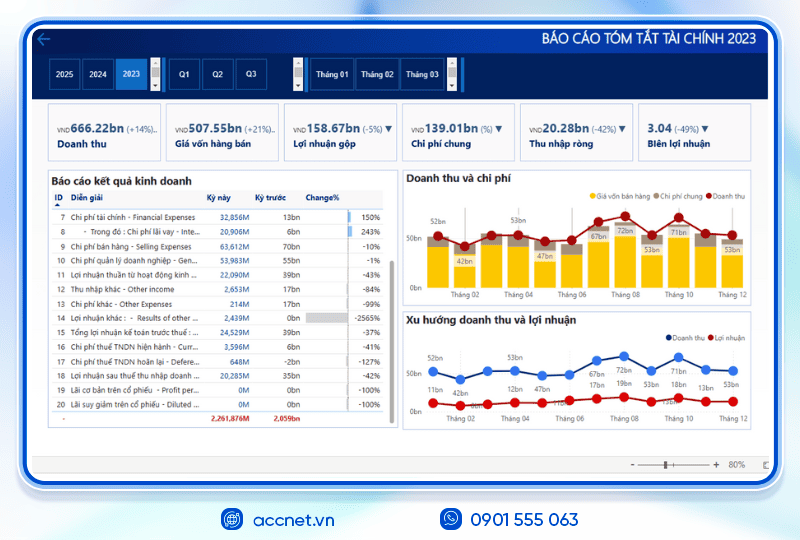

Nguyên tắc trọng yếu trong kế toán quy định rằng chỉ những thông tin có ảnh hưởng đáng kể đến quyết định của người sử dụng báo cáo tài chính mới cần được trình bày rõ ràng. Điều này đảm bảo số liệu vừa trung thực vừa hữu ích cho quản trị.

Tuy nhiên, nếu quản lý bằng Excel hoặc ghi chép thủ công, việc xác định và phản ánh đúng những khoản mục trọng yếu thường mất nhiều thời gian, dễ bỏ sót hoặc nhầm lẫn. Đây chính là lúc AccNet ERP phát huy thế mạnh.

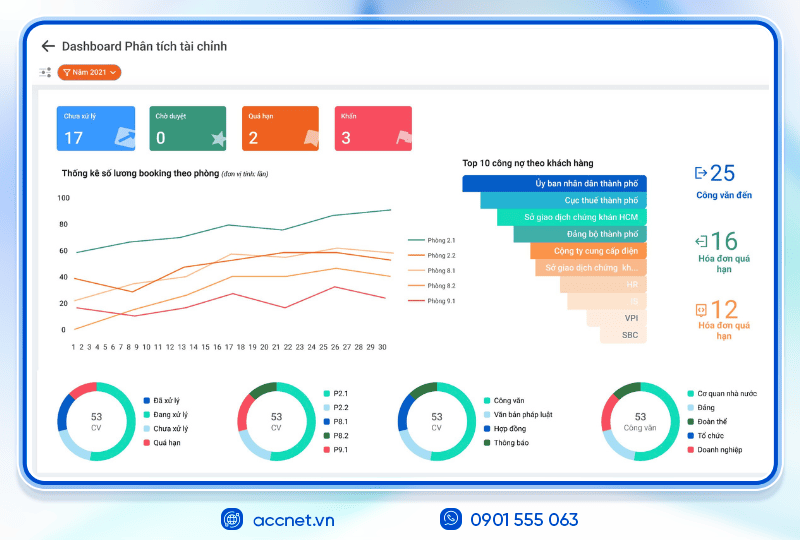

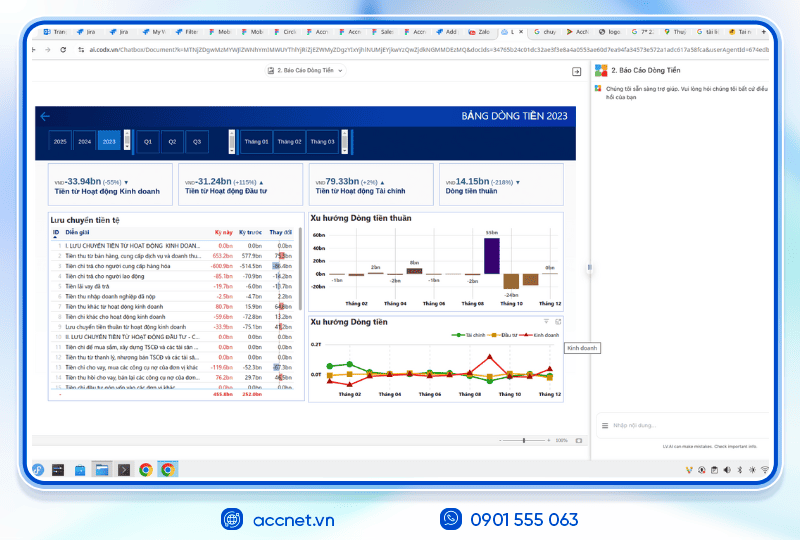

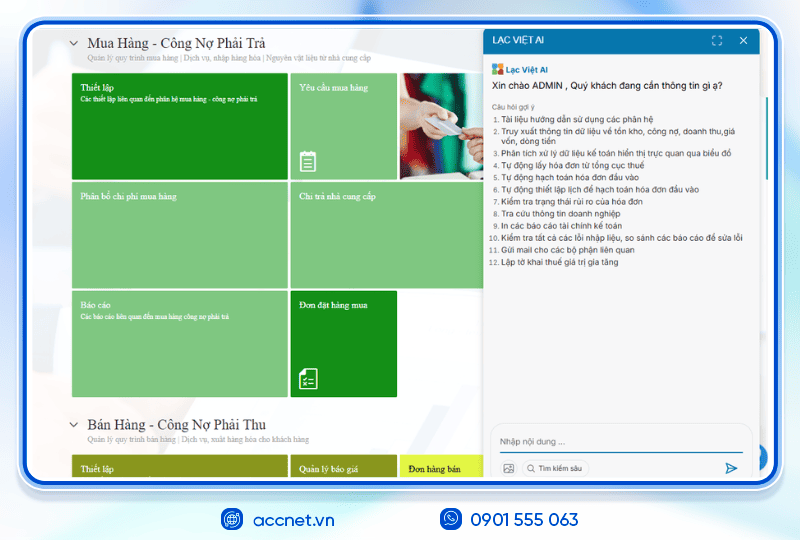

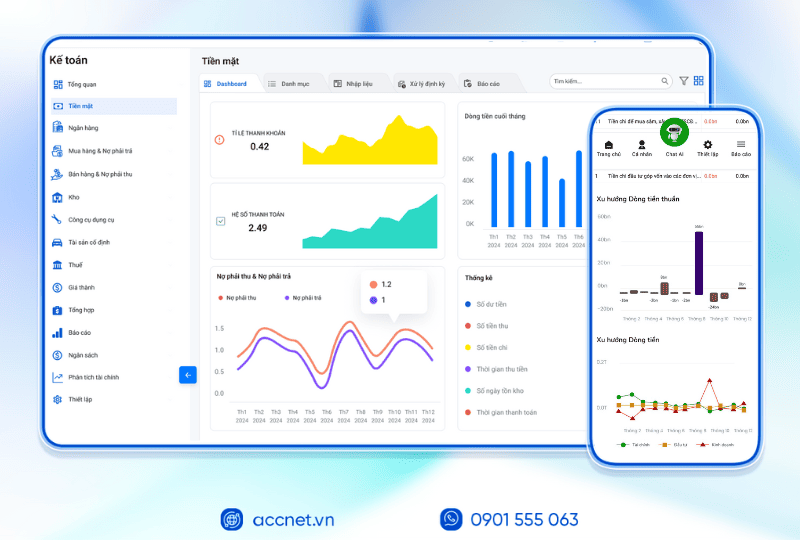

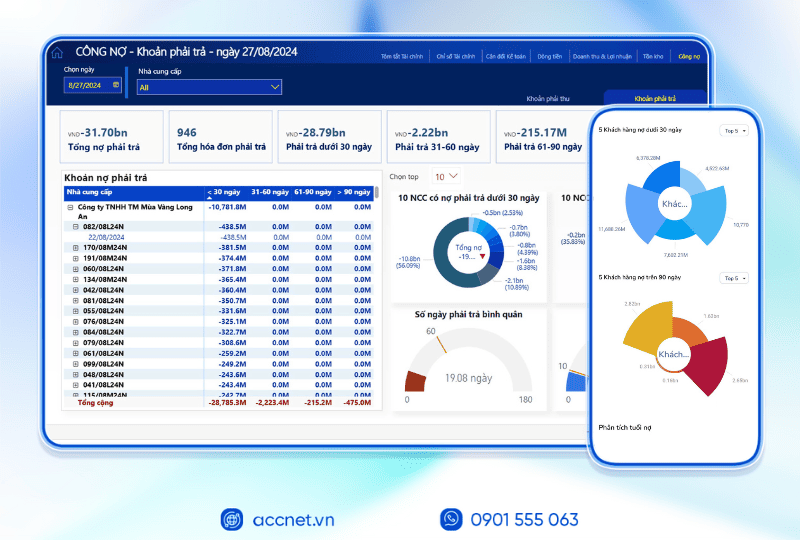

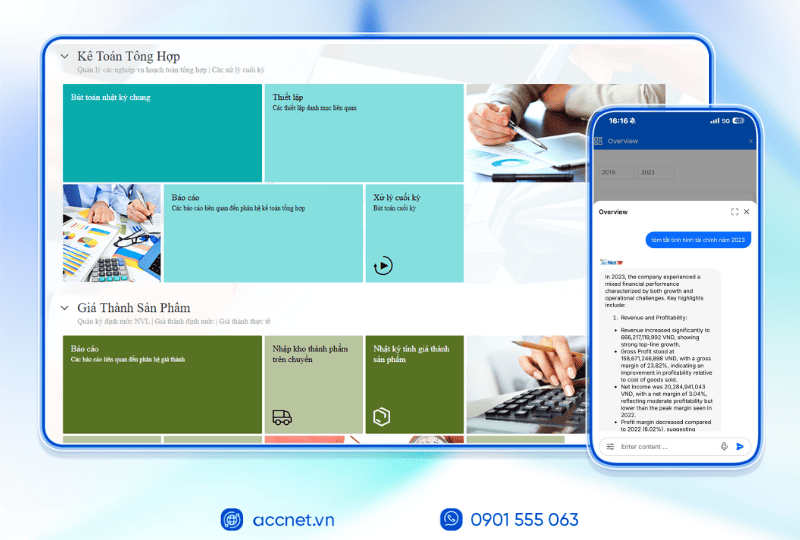

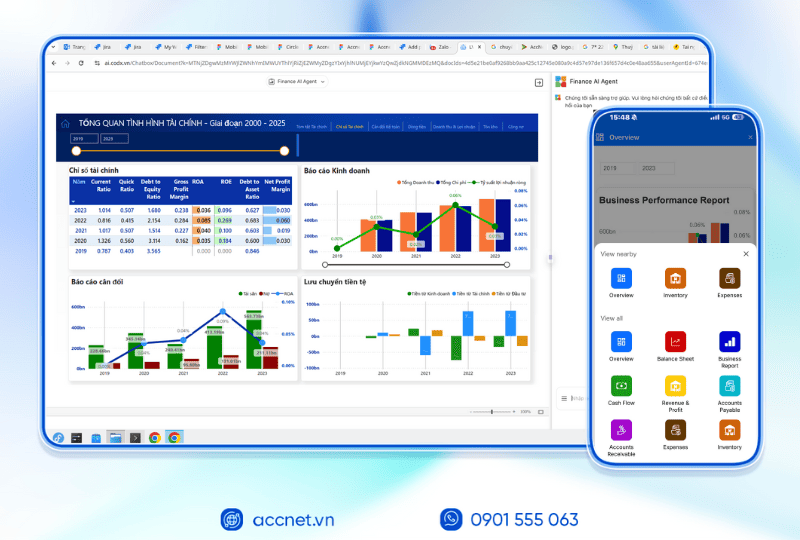

Phần mềm giúp doanh nghiệp:

- Tự động phát hiện và hạch toán thông tin trọng yếu, loại bỏ rủi ro sai sót thủ công.

- Đồng bộ dữ liệu giữa các module (mua hàng, bán hàng, kho, công nợ, tài sản…), đảm bảo tính nhất quán.

- Cung cấp báo cáo tài chính trực quan, làm nổi bật các khoản mục quan trọng để nhà quản lý dễ dàng ra quyết định.

- Tích hợp AI phân tích, gợi ý các khoản phát sinh bất thường cần lưu ý.

Với AccNet ERP, doanh nghiệp không chỉ tuân thủ nguyên tắc trọng yếu mà còn nâng cao hiệu quả quản lý, giảm thiểu rủi ro và tiết kiệm đáng kể nguồn lực kế toán.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

In general, principle of materiality in accounting is an important part to contribute to ensuring the truthfulness and completeness of financial statements. The updates principle of materiality in the year 2024 will help for this principle becomes clear and more understandable, consistent with business practice today.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: