Any business will also come the time to consider the liquidation of assets no longer fit or are no longer worth using. However, not every enterprise is to understand how to set report liquidate business assets – a report type has an important role in ensuring transparency, legal, financial control, internal.

If your business is in the review phase, streamlined system property, prepare for the paradigm shift business or simply want to make assets accounting in a professional way, then the understanding of liquidation report is a prerequisite. This article is designed to help you understand the nature, structure, how to properly perform standard reports liquidation of assets, at the same time indicate the regulatory method of accounting most businesses need to adhere to.

1. Reports asset liquidation business is what?

The concept according to accounting - legal

Liquidation report business property is an important document is created when the business conducting the liquidation of fixed assets or other property no longer used, no longer in use value, economic or damaged completely. As prescribed in circular no. 200/2014/TT-BTC, liquidation report is part of the accounting records reflect professional reduced fixed assets, noted the cost, revenue, respectively.

The purpose of the report

- To ensure the validity and transparency in the recording lowers the property.

- Is legal grounds to accounting, tax settlement.

- To help businesses better control assets, remove assets not effective.

- Audit support in the collation and verification of property value actual rest.

Liquidation report property business has what role in the accounting system business?

- Recorded decrease in fixed assets in the correct accounting standards (VAS).

- Express earnings from the liquidator (if any), the costs related to the liquidation process (such as transport, dismantling...).

- Help optimize the structure property business, avoid the status of "virtual assets" lead to misleading financial statements.

Read more:

- Software asset management support track the entire life cycle of assets

- How to calculate depreciation of fixed assets under the new rules today

- Stock inventory and fixed assets and tools

Differentiate report asset liquidation business with other report types

| Report type | The main purpose | Time of establishment | Content |

| Liquidation report property | Reduced assets no longer in use | After the decision to liquidate | Information about the price, residual value, form liquidation |

| Report wear and tear | Reflects the value of depreciation of assets | Periodically (monthly, quarterly) | Calculate the wear and tear accumulated |

| Report inventory of assets | Reconciliations between books and reality | The end of the financial year or unscheduled | The difference between assets and books and reality |

Where does the business need to report the liquidation of assets?

Not every property exists permanently the same business. Below is the common case that the business required to report the liquidation of assets in accordance with the process regulations:

Property is no longer worth using

- Machinery, equipment, old-fashioned, backward, performance, use low.

- Means of transport no longer guarantee the safety or exceeding the period of economic use.

The property is damaged, can't fix

- In case of property damage due to natural disasters, fires, accidents.

- Repair cost exceeds the value remaining, do not bring economic efficiency.

Lost property, fire, destruction

- Due to operator error, accident or objective factors.

- Need to establish a liquidation report to reflect the volatility of the property, specifying responsibilities related (if available).

Business change, strategy development

- Switch model production business, resulting in the need to use the property to change.

- Merger, consolidation, split business that asset structure should be streamlined.

Note practices: According to the survey year 2024 by Vietnam CFO Association, more than 65% of small and medium business, no standard procedure when liquidation of assets, easily lead to errors in the accounting violations when tax settlement.

Analysis of data: According to a survey by KPMG in Vietnam 2023, more than 40% of FDI enterprises in Vietnam to implement reviewing and liquidation of assets every 2 years to ensure the asset structure streamlined, reducing the depreciation in vain, optimal operating costs.

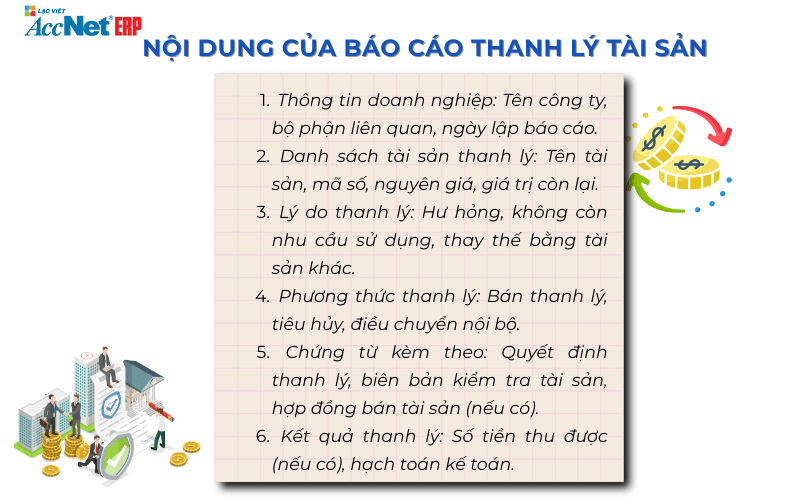

The details section of the report liquidate business assets

To report liquidate valuable property in legal, accounting, audit, business need to fully ensure the following components:

Information that the property need to liquidate

- Code fixed assets, property name, property type.

- Date purchased, original cost, depreciation accumulated value remaining.

- Current status: active/inactive, damage, loss.

Record inventory and assessment of the status property

- Council internal inventory confirm the current status of the property.

- Photos, documents proving the status damage, loss.

- Comments proposed disposal of the property.

The decision to liquidate assets

- Leadership business (or Board) issued a written decision.

- Approved liquidation, specify the method of liquidation: sale, destruction, transfer internal.

Report results liquidation

- Specify:

- Method of disposal (sale, auction, destruction...).

- Value recovered (if any).

- Costs related to the liquidation (transportation, dismantling, waste disposal...).

- The difference between the residual value, the recoverable value (profit/loss).

Signature confirmation of stakeholders

- Head of the department use the property.

- Accounting department.

- Board member, liquidator.

- Representatives and business leaders.

Practical hint: Businesses should build the form standardized to ensure consistency for the reported asset liquidation business, and easily extract serving the audit, tax inspectors. The use of accounting software assets such as AccNet Asset can help businesses automate this process, reduce errors and save time.

SOFTWARE ACCNET ASSET – STOP WASTING ASSETS A business average savings from 300 to 500 million/year after deployment AccNet Asset

SIGN UP CONSULTATION AND DEMO TODAY

2. Report template asset liquidation business in accordance

To meet the requirements of audit, tax audit, business should use the sample standard reports according to circular 200 or circular 133:

The main contents of the report template

- Business information, the number of the report.

- The property name, code number, date purchased, original cost, residual value.

- The condition of the property before liquidation.

- Method of disposal (sale, destruction...).

- The value obtained, the costs incurred.

- The conclusion of the board of liquidation, the confirmation of chief accountant.

Download the sample report asset liquidation business standard

3. The process of reporting and liquidation of assets in the enterprise

A liquidation report professional property not only ensures legal requirements, but also helps business transparency finance, optimal operation. Below is the process in full:

Step 1: inventory and assess the condition of assets

- Business establishment written inventory of the property with the participation of the used parts, accounting, property management.

- Reviews the actual state: active or damaged? Fix to be or not? There is also effective use of economics?

Step 2: proposed, approved liquidation

- Department in charge of the proposed liquidation.

- The leader board or board decision in writing.

- Decisions need to specify any property is liquidated, the method of execution, duration liquidation.

Step 3: establishment Of the council, liquidation of assets

- Include representatives: leadership, accounting, engineering (if any), used parts.

- The council has the task:

- Organization done liquidation (auctions, destroy, sell).

- Record the costs incurred.

- Record the liquidation of assets with photo, signature in full.

Step 4: Record the results liquidation on bookkeeping

- Record the decrease in value of fixed assets.

- Recorded income (if any) from the liquidation or cost related.

- Complete report asset disposal, storage, full service record settlement tax audit.

Tip practices: Business should build process, internal clear, detailed instructions for each department in order to avoid conflicts liability upon the occurrence of loss of property.

4. How accounting profession liquidation of fixed assets when reporting

Properly account for business, liquidation is the vital factor in liquidation report enterprise asset accounting. Here are specific instructions:

Accounts accounting related

- Accounts 211 – fixed Assets tangible.

- Account 214 – Depreciation of fixed assets.

- Account 811 – other Expenses.

- Account 711 – other income.

- Account 131, 111, 112 – Recorded proceeds from liquidation.

Illustrative examples accounting liquidation

Situation: Business liquidation of a printer is the cost 20,000,000, was depreciation 18.000.000 copper. Sold 3,000,000, the cost of dismantling 200,000.

Reduced to the original price fixed assets:

- Debt 214: 18.000.000

- Debt 811: 2.000.000

- There are 211: 20.000.000

Recorded income from disposal:

- Debt 111: 3.000.000

- There are 711: 3.000.000

Record the cost of liquidation:

- Debt 811: 200.000

- There are 111: 200.000

The end result: Anal, liquidation of assets = value remaining + the cost – income = 2.000.000 + 200.000 – 3.000.000 = Rate of 800,000 (recorded in other income)

Read more: How to record depreciation expense on bookkeeping transparent, accurate

5. Common mistakes when drawing up the report liquidate business assets

Business predisposed the error below when reporting, liquidation, caused great impact to financial results, legal:

- Not recorded the full remaining value or depreciation wrong.

- No records inventory, the board of liquidation valid.

- Reporting but not accounted for in the accounting books.

- Do not store documents relating to liquidation or make it difficult to audit or tax inspection.

- Irrespective of liquidator to sell the property, leading to the wrong account accounting.

Warning: According to the General department of Taxation, in the year 2023 there are more than 1,200 business is arrears of taxes due to errors in the recorded liquidation of assets, costs related.

6. Trend analysis, management, liquidation of assets by accounting software modern

In the digital era, the management and liquidation of assets by software no longer is choice – that is indispensable requirement:

Benefits of accounting software assets

- Automatically updates the value of depreciation to the time of liquidation.

- Integrated process, browse reports, decisions, minutes of liquidation.

- Sync data accounting with the accounting system synthesis.

- Stored electronic record – ready to serve audits and inspections.

Some software highlights support manager liquidation

- AccNet Asset – lifecycle management of assets from procurement to disposal.

- FAST Asset – tracking support, property alerts expired.

- MISA AMIS property – integrated reporting, liquidation, inventory transfer.

According to the report of the Vietnam Accounting Summit 2024, the business using accounting software assets decreased by 52% error when the liquidation of assets compared to business Excel users manually.

Report liquidate business assets not only is a form of administrative – it is a management tool important, to help businesses reduce costs, control risk, improve efficient use of assets.

Don't let the liquidation becomes weakness of the audit! Let's active construction process of liquidation clear, applicable accounting software assets dedicated, timely updates the provisions of the law to ensure all assets are managed closely from the beginning to the end lifecycle.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

Headquarters: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

Hotline: 0901 555 063

Email: accnet@lacviet.com.vn

Website: https://accnet.vn/

Theme: