Financial reporting is not only mandatory document in the record tax settlement, but also the strategy map out the full scene the financial health of the business. For those enterprises that are implementing accounting systems – especially assets accounting – the financial reporting standards, full precision is the key element for decision-making governance, attract investment, ensure compliance with the law.

However, many small and medium enterprises or businesses are in phase shift of still having difficulty with the question: financial reporting how? So where to start? How to ensure the correct form, the right data, the right term?

This article will give you detailed instructions, step by step specific about how to create financial statements on the Excel sheet properly according to the accounting standards in Vietnam, in accordance with circular no. 200/2014/TT-BTC. At the same time, you will also find the hint tool to help businesses save time, control risks.

1. Why financial reporting is the duty survival of the business?

Financial statements (FS) is the system synthesis report reflects the entire operation business assets, liabilities, financial results of the business at a time (end of period) or in a time period (quarter, year).

Financial reporting true enough to bring 4 core values:

Assessment tools, effective internal financial:

- The administrator can determine the revenue – cost – profit practice.

- From there, decisions to allocate resources, cut costs, invest in the right moment.

Base work with tax authorities, auditing:

- Is a part of the record settlement of corporate INCOME tax, financial statements need to be submitted by the deadline, the correct form according to the regulations.

- Teen or errors in reporting can lead to penalties for late payment of tax arrears or discredit finance.

Mandatory documents when called for, capital, bank loans tenders:

- Banks, investors will be based on the financial statements to assess the financial capability, ability to repay debt.

- FINANCIAL transparency is the advantage in the bidding activities, cooperative venture.

Integrated support system assets accounting – finance – taxation: When implementing accounting software, asset data, fixed assets, amortization, liquidation,... should be integrated into the balance sheet, notes to FINANCIAL statements.

Conclusion: FS is not just “report” that is the ecosystem financial data should be designed, standardized operation closed with the entire accounting system of the business.

Read more:

- Accounting software online saves time

- Accounting software business manufacturer support quick report

- Accounting solutions for small business retail

2. Financial statements what is? Structure, current regulations

To be financial reports accurately, first of all enterprises need to understand the structure of the report as well as the legal regulations are applied.

The concept of financial reports according to standard VAS – circular 200

According to the accounting standards in Vietnam (VAS), circular no. 200/2014/TT-BTC: financial reporting is a system of the form aggregate, reflect the financial condition, results of operations, business, cash flow of the business during an accounting period.

FS is set at the end of each accounting year, or quarterly if the business is located in the group object must report periodically. Mandatory subjects of financial reporting:

- All types of businesses have legal personality (Public LIMITED company, shares,...).

- - Invested enterprises, foreign investment, business listing.

- The organization has manufacturing operations – business goods and services.

The composition of a set of financial statements in full

A set of FINANCIAL statements prepared according to circular 200, including 4 the main form:

| STT | Report name | Sign the form | Main content |

| 1 | Balance sheet | B01-DN | Assets, liabilities, equity |

| 2 | Report results of business activities | B02-DN | Revenue, cost, profit |

| 3 | Statements of cash flows | B03-DN | Cash out – on from active business, investment, finance |

| 4 | Notes to financial statements | B09-DN | Detailed explanation of the items on the form above |

Businesses use accounting software will usually automatically aggregated data fixed assets into B01-DN-overs B09-DN.

Specified time limit, the form of submission of financial statements

According to the regulations of the Ministry of Finance:

Deadline for submission:

- Annual financial report: the slowest day 31/3 years later.

- Quarterly financial statement (for DN listing): not later than 20 days after the end of the quarter.

Where to file:

- The tax management directly.

- Statistics agency (if required).

- Department of planning & investment (if required check).

Submission form:

- Submit print has a signature stamp.

- Submit electronically via software HTKK or accounting software has integrated XML form.

3. How to create financial statements according to circular 200 for each section

Below are specific instructions how to set up each form in the financial statements, based on actual experience, legal requirements of the Ministry of Finance.

DOWNLOAD FILE SAMPLE BALANCE SHEET ACCOUNTING B01-DN

DOWNLOAD FILE REPORT TEMPLATE BUSINESS RESULTS B02-DN

How to set up the balance sheet (B01-DN)

Base data to:- Final balance of the account in the accounting system synthesis.

- Data fixed assets, current assets, debt, equity.

- Includes two main parts: Assets and capital.

- Each section divided into short term and long term.

B1: Draw final balance of the account assets, liabilities, capital.

B2: Classification according to the model B01-DN:

- Property: TK 111, 112, 131, 152, 211, 213,...

- Liabilities: TK 311, 331, 333, 338,...

- Equity: TK 411, 414, 421,...

B3: Ensure the standard recipe: Total assets = Liabilities + Equity

Note: If you use software asset management data, fixed assets, depreciation will automatically be pushed into the “long-term Assets” → reduce the error recorded wrong or missing depreciation.

How to report results of business activities in the financial statements according to circular 200 (B02-DN)

Purpose: Reflects the entire revenue, expenses, results, profit/loss during the accounting period. The only main goal:- Net revenue.

- Cost of goods sold.

- Gross profit.

- Financial costs, cost management.

- Other income other expenses.

- Profit before after CIT.

- General revenue (TK 511), price of capital (TK 632) cost of sales (641) cost management (642), CIT (821).

- Ensure the data matches the pen math was the end of the period.

- Calculate gross profit net of tax to be paid.

Tip realistic: Production enterprise, need to calculate the exact cost of goods sold under each states to ensure a profit is not false.

How to report cash flows in financial reports according to circular 200 (B03-DN)

There are 2 methods of establishment:- Live: Recorded in detail cash flow in/out.

- Indirect: adjustable from accounting profit before tax → cash flow.

- Cash flow from business operations.

- Cash flow from investing activities.

- Cash flow from financing activities.

- Starting from accounting profit before tax.

- Plus/Minus the account non-cash, such as depreciation of fixed assets, exchange rate differences,...

- Adjust increase/decrease in working capital (receivables, payables, inventory).

Note: Enterprises have negative cash flows continuously in 2 states is often banking, auditing, risk assessment high → need to closely monitor this indicator.

Read more:

The way of notes to financial statements (B09-DN)

Target:- Explain the extraordinary items important on 3 reports remaining.

- Provide detailed information about:

- Accounting principles.

- Fixed assets.

- Public debt, revenue – cost.

- Capital volatility.

- Detailed list of fixed assets.

- Loan agreement, memorandum of capital contribution, legal document internal.

- Appendix proven revenue/cost/tax.

- Presented in the order form B09-DN.

- Led projector the correct code number on the balance sheet, B02, B03.

- If there is accounting software property can export the report notes fixed assets directly → reduce errors.

Suggestions: The indicator is explained as clear statements as to audit, create trust with financial partners.

4. The standard steps to financial reporting for business

How to create financial statements according to circular 200, not simply “move window to PDF” which is a process check – the – validation metrics are standardized.

Step 1. Reviewing the transfer of data end of the period

- Transfer revenue (511), price of capital (632), cost (641, 642), other income (711), profit/loss (911).

- Calculate tax estimates, recorded tax expense (821).

- The profit after tax in TK 421.

Errors frequently: Do not transfer the full guide to balance irregularities at TK 911 or TK 421.

Step 2. Collate data fixed assets – liabilities – inventory

- Fixed assets: To joints between property report, section 211, 213 in the balance sheet.

- Receivables/payables: collate details window 131, 331 with balance synthetic.

- Inventory: Make sure the joint between the window warehouse, TK 152, 156.

Tip control: In the table for lighting detail each item → reviewing or using the software supports match.

Step 3. Use software support financial reporting according to circular 200

Currently, the accounting software modern (as AccNet Cloud) enables enterprises to:

- Automatic synthesis of data end of the period according to the standard format of B01, B02, B03, B09.

- Export XML file to file tax electronic or print format A4 the sign.

- Check errors common (loss of balance, lack of the movement, deviation of the account).

Efficient recorded: Can shorten the duration of the FS from 5-7 days to 1-2 working days, with accuracy >95%.

Learn more:

5. Some flaws common to avoid when done how to set financial reports on Excel

Although the form in the financial statements have been standardized, but in fact, a lot of businesses – especially small and medium sized businesses – still have the error that caused the statements is false, which causes difficulties when tax settlement or work with the audit.

Do not update the data depreciation, revaluation of assets

- No depreciation of fixed assets often or not update after the transfer, liquidation → cause the carrying value on financial statements higher reality.

- Do not adjust the residual value after revaluation of assets lead to deviations of total assets, affects both the balance sheet reports the results of business activities.

For example: A business noted machinery worth $ 2 billion VND, but no depreciation for 3 years, prompted the balance sheet “virtualization” capacity long-term assets.

The transfer gain – not full

- Miss transfer TK 911 → TK 421 (retained earnings) → do wrong column “Equity”.

- Profit after tax is not adjusted properly to report cash flows → cause deviations realistic cash-flow.

Solution: Set the account to transfer profit/loss automatically in accounting software.

Metrics do not match between the form when done by financial reporting on Excel

- Total assets is not equal to the total capital in the balance sheet.

- Profit on B02 not match with profits used to adjust the cash flow in B03.

- The items presented on the B01 but there is no explanation in specific B09 (statement).

Real-life situations: A business fined 15 million due to submit financial reports that profits on B02 deviation of 500 million VND compared to the audit data to detect.

Teen overs clear for the special items

- Not presented in detail the reasons for increase/decrease abnormal, fixed assets, liabilities, or fluctuations in revenue mutations.

- Do not specify the accounting method applied, for example, the straight-line depreciation, reviews inventory according to FIFO or weighted average.

Recommendations: For business valuable assets or are implementing accounting system assets – need to present notes to clearly follow each property group, each method of calculation.

Refer to:

6. Suggestion tool support solutions financial reporting according to circular 200 effective

In the digital era, the establishment of financial statements no longer stop in Excel that should be automated by the software solution specialized – helps to reduce errors, save time, ensure the legality.

AccNet ERP – phần mềm kế toán tích hợp lập báo cáo tài chính

Outstanding advantages:

- Automatic synthesis of data accounting – assets – liabilities – tax to establish a standard reporting template.

- Fast the form B01 – B02 – B03 – B09 circular 200.

- Integrated management module fixed assets: record increase, amortization, liquidation → sync to the balance sheet.

- Export XML file taxes through eTax or HTKK.

Fit: Enterprises, small and medium scale, or manufacturing enterprises need to manage multiple fixed assets.

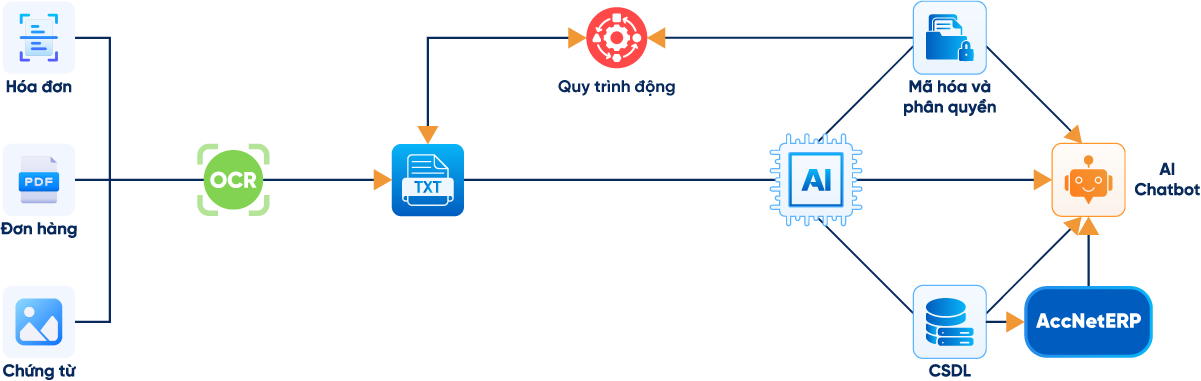

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

How to create financial statements according to circular 200 or on Excel not only the obligation of accounting, which is a summary of financial strategy across your business. In particular, with the ongoing business accounting solution assets, financial statements as required:

- Automation, sync data from the stitch recorded to the stage of synthesis.

- True form – the correct term – the right data to service to internal and external (tax, audit, investor).

Business need done:

- Revise the system of accounts, accounting methods are applied.

- Implementing accounting software has the ability to automatically set FS, integrated assets and tax liabilities.

- Training accounting personnel about the process of – check – to submit reports according to the standard legal.

You are required to prepare financial reports quickly and accurately, automatically? Experience it now AccNet ERP – Accounting solution helps enterprises financial reporting standard circular 200 in just a few clicks!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: