Accounting standards inventory regulations and guidelines/methods for the record, presented inventory in the financial statements. So content standards this refers to what? Let's AccNet learn the basic benchmark that under the articles later!

1. Accounting standards inventory Vietnam (VAS) no. 02

Follow qits the number 149/2001/QD-BTC dated 31 January 12, 2001 of The minister of Finance, the standard inventory be summarized as follows:

1.1. Definition inventory and scope of application

Inventory includes:

- Goods purchased for sale.

- Finished, unfinished products are produced.

- Raw materials, materials, tools and instruments used for the process of production and business.

- Goods are shipped and sent for sale.

Applicable for all the business activities of business, except for a number of professions that a particular norm own.

1.2. Principles recorded/rating inventory

Recorded in accounting standards inventory when a business has control of, the possibility of obtaining economic benefits from inventory.

- Original price (Cost): includes cost of purchase, cost of processing, the cost related to the other.

- Net worth can be realized (Net Realizable Value): estimated selling Price minus the cost of completion and selling expenses.

Read more:

1.3. Method of valuation in accounting standards inventory

- Methods first-ago (FIFO): imports ago is ago the value of inventory end of period is the price of the goods eventually.

- Method enter the following export ago (LIFO): enter the following are prerendered, value of inventory, end of period is the price of the goods previously entered (not applicable according to international standards).

- Method weighted average: inventory value is calculated by dividing the total inventory value for the total amount of inventory.

- Rating method, the actual purpose of the: Recorded value of inventory based on the real price of every particular commodity.

1.4. Wear and tear discount in accounting standards inventory

- Recorded provision for diminution in value of inventory as net worth can be made to be lower than the original price.

- The cost of wear and tear, damaged inventory must be recorded in cost of production and business in the states.

2. Accounting standards inventory international (IAS) no. 2

Accounting standards (International Accounting Standards (IAS) was renamed reporting standards international financial IFRS (International Financial Reporting Standards) in 2003. To 1/1/2011, there were 41 accounting standards, the IASB issued. Content standards are summarized as follows:

2.1. Definition and scope of application

- Definition: Similar to VAS, including buy to sell, unfinished products and materials.

- Scope: applies to all businesses except industry peculiarities.

2.2. Reviews inventory in accounting standards

- Original price in accounting standards inventory: Includes purchase costs, processing costs and other costs related to bringing the inventory to the location/current status.

- Net worth can be done: estimated selling Price in the condition, business casual, minus the cost of completion/cost of sales.

Read more:

2.3. Method to determine inventory value in accounting standards international

- Method FIFO/weighted average accepted.

- Method LIFO is not acceptable under IAS 2.

Inventory must be presented on the financial statements at cost or net worth can be realized, depending on the value any lower. Recorded provision for diminution in value of inventory as net worth can be made to be lower than the original price.

3. Compare accounting standards inventory VAS and IAS

To show clearly the difference between accounting standards in Vietnam (VAS) and standard international accounting (IAS) about inventory, below is the detailed comparison:

| Criteria | VAS (accounting Standards in Vietnam) | IAS (accounting Standards, international) |

| Definition inventory | Every buyer to sell finished products products unfinished, raw materials, materials, tools, goods are transported. | Buy for sale, unfinished products and materials. |

| Scope of application | All the business activities of business, except for some occupations are regulated separately. | All businesses, there are separate regulations for each industry peculiarities. |

| Assessment methods in accounting standards inventory | FIFO, LIFO, weighted average (can apply LIFO in some cases). | FIFO, weighted average (does not accept the use LIFO). |

| Impact on business | Support for effective management of inventory, there is transparency, accuracy in financial reporting. | Ensure transparency, consistency in financial reporting. |

| Risk management | Support minimize the risks and costs related to inventory. | Help optimize risk management, costs related to inventory. |

| Apply international | There is no mandatory requirement to apply the international standards. | Requires application of the accounting standards the international. |

4. The role and application of the standards

4.1. The role of norms inventory

- Clear rules about credits, reviews, inventory reports help stakeholders, such as investors, banks, regulators better understand the financial situation of the business.

- Improve inventory management, optimize the production process, supply chain, customer service.

Learn more:

4.2. Practical application of accounting standards inventory

- To minimize risks related to inventory, improve the ability to forecast and plan production.

- Provides important information for business decisions of the enterprise.

- Construction support strategic operational efficiency/sustainability of the business.

- Avoid wasting resources.

Thảm khảo thêm: Hướng dẫn phân tích biến động hàng tồn kho trong doanh nghiệp

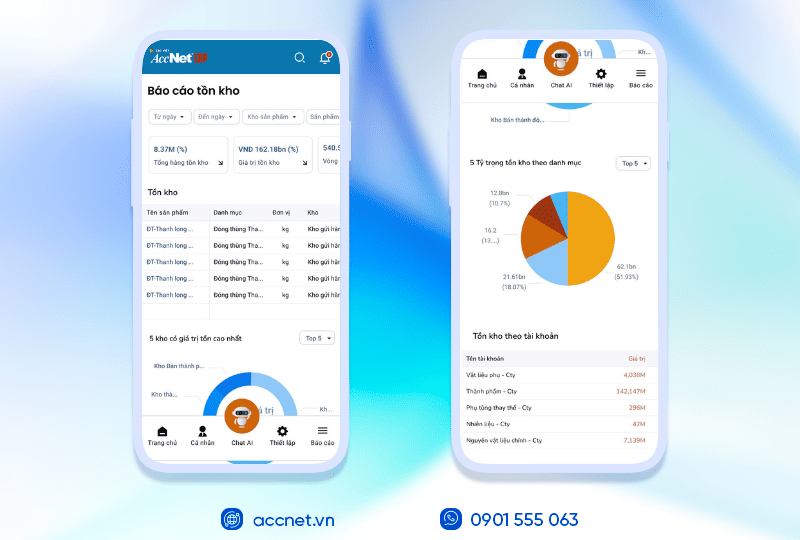

5. Quản lý hàng tồn kho theo chuẩn mực kế toán với phần mềm AccNet ERP

Tuân thủ chuẩn mực kế toán hàng tồn kho là yếu tố quan trọng giúp doanh nghiệp ghi nhận giá trị tồn kho, chi phí sản xuất và giá vốn hàng bán một cách chính xác, minh bạch. Tuy nhiên, quản lý thủ công qua Excel hoặc sổ sách giấy dễ dẫn đến sai sót, dữ liệu không đồng bộ, đặc biệt khi doanh nghiệp có nhiều kho và đa dạng mặt hàng.

Với AccNet ERP, doanh nghiệp có thể theo dõi tồn kho theo thời gian thực, tự động tính giá vốn, ghi nhận chi phí và xuất báo cáo minh bạch theo đúng chuẩn mực kế toán. Phần mềm còn hỗ trợ quản lý nhiều kho, cảnh báo tồn kho, kiểm kê nhanh chóng và lưu trữ dữ liệu an toàn. Nhờ đó, các kế toán viên và quản lý có thể ra quyết định dựa trên dữ liệu thực tế, giảm rủi ro thất thoát và tối ưu hóa quy trình nhập – xuất – tồn.

Áp dụng AccNet ERP không chỉ giúp tuân thủ chuẩn mực kế toán hàng tồn kho mà còn nâng cao hiệu quả vận hành, minh bạch hóa tài chính và tạo nền tảng vững chắc cho chuyển đổi số, giúp doanh nghiệp cạnh tranh hiệu quả trên thị trường.

PHẦN MỀM QUẢN LÝ KHO ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” Không chỉ là một phần mềm nhập – xuất thông thường, AccNet ERP chính là nền tảng quản lý kho thông minh, tích hợp thiết bị, kết nối dữ liệu, cảnh báo tức thời, giúp doanh nghiệp: AccNet ERP mở ra một bước tiến mới trong quản lý kho khi tích hợp trợ lý tài chính AI, giúp doanh nghiệp vận hành chủ động và ra quyết định chính xác hơn. ✅ Quản lý kho chủ động – Không còn “tồn kho ảo, thất thoát khó kiểm soát” ✅ Hiệu quả rõ rệt khi ứng dụng quản lý kho tích hợp AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

This article will help readers better understand the basic problems related to accounting standards inventory. Standard inventory plays an important role in the financial reporting of the business, compliance with these standards help ensure consistency of information that helps leaders take the right decision.

Tuân thủ chuẩn mực kế toán hàng tồn kho đòi hỏi độ chính xác cao, hệ thống hóa chặt chẽ. Với phần mềm AccNet ERP, bạn không còn phải lo lắng:

- Tự động áp dụng các phương pháp định giá như FIFO, LIFO, giá bình quân.

- Đảm bảo số liệu tồn kho chính xác, minh bạch, phù hợp chuẩn mực kế toán.

- Tạo báo cáo chi tiết, đáp ứng đầy đủ yêu cầu kiểm toán.

- Tăng hiệu quả quản lý, giảm thiểu rủi ro sai sót.

Hãy nâng cấp quản lý hàng tồn kho của bạn với AccNet Inventory – công cụ đắc lực để đảm bảo chuẩn mực!

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: