Nowadays, more and more business transaction with the business – a popular type, accounted for a large proportion in the Vietnamese economy. Though it is not the organization, but business is still the object of consumption, distribution significantly in the supply chain of goods and services. From there, demand company invoice maker for business are increasing day by day. However, a lot of businesses still perplexed in the invoice processing for this: There is to be no? Need to write information? There are rules violation if the wrong name, black? Need tax code of them?...

This article will provide complete information legal process, detailed instructions to help businesses handle true enough when you need the invoice for business – particularly in the context of transition to electronic invoices according to the mandatory rules of the government.

1. Why business interested in invoice maker for business?

According to data from the General department of Taxation, by the end of 2024, Vietnam has more than 2.2 million of private business activities, primarily in the areas of trade, services, manufacturing, retail. As distributors, customers, even as sales agents, intermediaries, business is the important link in the network operation of many companies.

Therefore, the regular business of the transaction sale of goods or provide services for this target group. However, when billing for the business, if recorded, wrong information or do not comply with the process, businesses can:

- Is the tax handling of violations of invoicing is not valid.

- Cause difficulties in the accounting, tax withholding output.

- Affect the relationship with the customer business, especially when they need invoices to prove the cost of legitimate business.

Added to that, since the day 01/07/2022, electronic invoices becomes mandatory form for the majority of the business according to the Decree 123/2020/ND-CP, circular 78/2021/TT-BTC. So the bills for the business not just the accounting profession often, but also the legal requirements required in the operating procedures of modern business.

Read more:

- Hộ kinh doanh xuất hóa đơn đúng quy định cho doanh nghiệp

- Business can be VAT invoice no? Hướng dẫn chi tiết

- Business have the invoice is not? Giải đáp chi tiết

2. “Company invoice for business” mean?

The phrase “company invoice for business” actually describes the situation in which a business made bill value-added tax (VAT) or sales invoice for the buyer is the individual business, when legitimate trading as:

- Sale of goods;

- To provide the service;

- Franchise and product distribution.

In this relationship:

- Company as the seller, are responsible for invoicing in the correct tax rules.

- Pussy business as buyer may or may not have the tax code, but still have the right to request invoice if desired, the input costs.

A number of characteristics need to clarify:

- Big business is not required to have the bill when shopping, but if required, the enterprise must produce.

- Buyer information may not be sufficient as business (for example: there is no tax code, the address is not clear...).

- The recorded wrong or missing information on the bill can make invoices invalid, or the tax authority denied the deduction.

So, to understand, right handle situation "company invoice for business," business need to master the legal regulation related, as well as have technology solutions and test support, set up, storage bills accurately.

3. The legal regulations relating to the company, invoice for business

To invoice for the right business rules, businesses need to keep abreast of the text to the current legislation, in particular:

- Decree 123/2020/ND-CP on bills and vouchers.

- Circular 78/2021/TT-BTC guiding the implementation of electronic invoice.

- The dispatch instructions of the directorate General of Tax, local tax Administration.

Here are the points that need special attention when company invoice for business:

Business received a bill or not?

As prescribed in Clause 1, Article 4, Decree 123/2020/ND-CP, the sale of goods, service providers are responsible for invoicing to delivery to buyer, regardless of the buyer's personal, business, or organization.

→ Mean:

- Business is fully licensed to invoicing for business if there arises transaction.

- Business't need a tax code still get a bill.

- If the business requires invoice, business imperative must not be denied with reason, not legal entities.

Business must use the type of bill when casting for big business?

Pursuant to circular 78/2021/TT-BTC, dated from the day 01/07/2022, the whole business (except for a few exceptions) must use electronic invoices, include 2 types:

- Bill electronic code of the tax authority.

- Bill electronic't have the code, apply to the eligible business.

Choosing the type of invoice does not depend on who was the buyer, which depends on:

- Scale, industry of the business.

- Classified by the tax authorities licensing.

→ With business still uses electronic invoices according to the current model, there is no kind of separate bills for households.

Need buyers (businesses) sign your name on the bill electronic't?

According to Point d, Clause 1, Article 10, circular 78/2021/TT-BTC, content electronic invoice is not mandatory, signed by buyer, except some special cases (for example, financial documents in the special field).

→ Mean:

- When company invoicing for business, do not need the signature of the buyer, even when there is no digital signature.

- This is very important because the majority of individual business households don't have the tools to sign out → work for up help process the invoice takes place more favorable.

Case does not need to invoice for business?

According to Paragraph 4, Article 4, Decree 123/2020/ND-CP, the seller is not mandatory billing if:

- Value of each sale under 200,000,

- The buyer is not required to invoice.

If you meet both conditions, the enterprise can not bill. However:

- If the business requires invoice then the business must be billed additional time is the time the buyer requires, not depending the time of delivery.

Content regulations bill when planning for business

Based on the 10, circular 78/2021/TT-BTC, content invoices must ensure the minimum criteria below:

| Ingredients | Mandatory provisions | Apply with household business is as below |

| Buyer name | Mandatory | Write “business A” or “A” |

| Tax code | Not required if the buyer does not have | So, remember, there is no vacant |

| Address buyer | Not mandatory, but should be recorded if there is | Can leave blank if don't know |

| Email/PHONE number | Not required | Used to send invoice, not listed on the bill |

| Content goods | Mandatory | Properly documented, product description, unit |

| Amount/VAT | Mandatory if the business tax calculator | Depending on the type of tax applied |

→ Special note:

- If the wrong name the buyer or vacant no reason → bills can be evaluated as invalid when check out.

- If the invoice for business, but remember no adequate information (for example: the wrong type of restaurant, teen, the unit price) → tax risks increase.

Responsible for storage, presentation of bills

According to Article 11 of Decree 123/2020/ND-CP, electronic invoice must be stored a minimum of 10 years guarantee:

- The ability to lookup, print when needed.

- Checking service tax, reconcile transactions.

→ Business must have a process for storing bills, scientific avoid data loss. Though the business does not need regular bills, but businesses still have to save, present when the tax authority request.

The violations of common, sanctions related

Some of the common errors when a business invoicing for business:

| Violation | The penalty according to the Decree 125/2020/ND-CP |

| Not billed as sales/service | Punishment from 4 million to 8 million |

| Invoicing is not the right time | Punishment from 4 million to 8 million |

| Wrong buyer name, tax code, content | Penalty from 2 million to 4 million |

| Do not send invoices to buyers | Penalty from 2 million to 4 million |

→ Business need to check carefully before issuing the invoice to avoid administrative sanctions, affect the cost and prestige.

4. The guide details processes, company, invoice for business

The invoice for business requires not only understand the business, the legal regulations, which must also comply with the process to avoid errors, ensure the validity and legality of the bill, especially in the environment of culture, bill electronic today. Below is the detail process that businesses need to make:

Step 1. Determine the true nature of transactions

Before invoicing, businesses need to determine:

- Pussy business as a seller or a buyer in a transaction? (In this article, assuming business is the buy side).

- Trades can actually arise? There are contracts, handover, or proof of payment?

- Goods/services provided are subject to invoicing you?

The defined nature deals help companies avoid in case an invoice, cumshot, wrong information, causing legal risks.

Step 2. Check the information of business

Businesses need to collect complete, accurate information of the business to record on the bill, including:

- Name of business (properly recorded in the certificate of registration of business or tax code).

- Tax code (if any).

- Address business (recording full, correct legal).

- Form of payment: bank transfer, cash, or other form.

Note: Many businesses do not have the tax code (because of activity below the threshold of 100 million/year), but businesses still allowed to bill for them. In that case, the “tax Code” on the bill can be empty.

Step 3. Electronic invoicing right model, the right time

After verification of information, business conduct electronic invoicing in accordance with the regulations:

- The time of invoicing: circular 78/2021/TT-BTC, the Decree 123/2020/ND-CP, the bill must be set right when the transaction (sale, service provider).

- Sample invoice number, symbol, number order: must follow the regulations are already registered with tax authorities (through notification issued bills or register template bill electronic).

- Mandatory content on the invoice: name of goods/services, unit, quantity, unit price, amount, VAT (if any), the total payment amount, buyer information (business), tax code the seller, the time of invoicing, electronic signatures,...

Note: The companies bill electronic business need to adhere strictly to the XML format (original file), PDF (version shown), at the same time sent to the buyer via email or electronic platform.

Step 4. Send an invoice for business

After signing numbers, business need:

- Send invoice version shown (PDF), XML file to big business.

- Can send via: email, Zalo, or download link from the system of electronic invoices.

- Recorded date submit, status, sent feedback (if any) from the business.

Note: in case your business requires invoice paper, business can print convert from electronic invoices in accordance with Article 7, circular 78/2021/TT-BTC. However, in convert has no legal value if there is no red mark of the released parties (except when serving internal).

Step 5. Storing bills, notes on ledger

After the company invoice for business is complete:

- Business need to store the original file XML of bills in minimum duration of 10 years under the provisions of the accounting Law.

- Revenue recognition, receivables from the business (if any) on accounting software.

- Update report output tax, the use of recurring bills.

5. The point of business is to note when the invoice for business

When the invoice for business, there are 3 factors to cause errors, make bill denied the deduction or administrative penalty if the tax inspection. Businesses need special note:

Have to keep tax code of business?

- Not required if the business does not provide.

- If the business tax code, the write request on the invoice, the business should be recorded full to the invoice has legal value higher.

Note: If the wrong tax code → to invoice adjustment.

Username purchase on invoice, how to correct?

- Case 1: registered business → record “Big business [The black]”.

- Case 2: unknown name pussy → write “brother/Sister [personal Name]” according to the CCCD or transaction.

The record name buyer as complete and accurate as possible, help the invoice is accepted when the tax inspection or when the business use the invoice to testify from cost.

Address, contact information of the buyer

- There are no rules required the address or email on the bill, but this makes it easy to lookup, verify later.

- In case of no email, businesses can send a PDF via Zalo or printed out to send the hard copy.

6. Real-life situations, enterprises often encounter when invoice maker for business

The company, invoice for business simple idea but it's actually more awkward situation. Here are 3 practical example:

Situation 1: no business tax code, does not provide address

→ Accounting embarrassing't know what → remove blank or incorrect entry → invoice is returned.

Solution: Just write the name buyers, transaction description, do not need a tax code or address, if the buyer is not required.

Situation 2: Write the name wrong business (for example, missing word “business”)

→ The tax authority does not recognize the bill is valid → device type cost when the settlement.

Solution: collated with the business license (if available), or to verify naming business through the tax system. Software AccNet eInvoice can save, name suggestions were right format before that.

Situation 3: business no email to receive electronic invoices

→ Business invoice printing out paper or send the software via Zalo → need to save the proof has been sent.

Solution: AccNet eInvoice save the entire history send invoices, support verification when needed.

7. The solution helps the company invoice for business easy

To invoice for business fast, accurate, properly regulated, the business should invest in a solution electronic invoice flexible, strong on service.

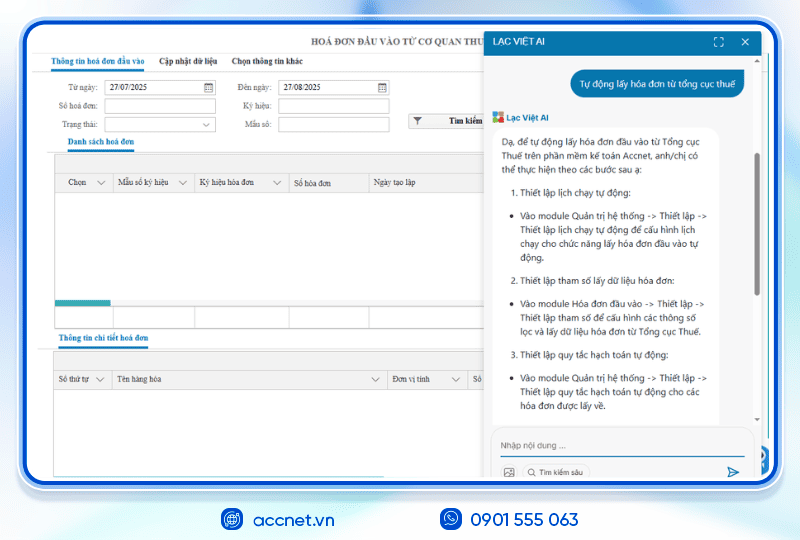

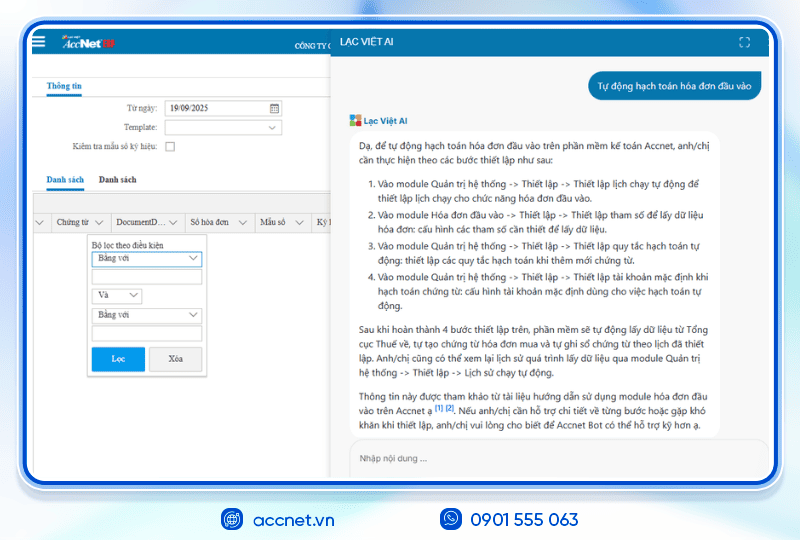

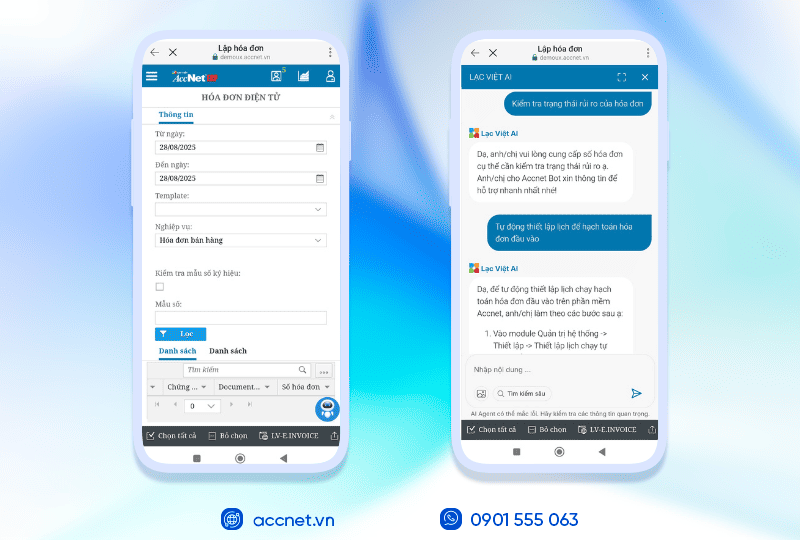

AccNet eInvoice – solution electronic invoicing for the smart business modern

AccNet eInvoice designed exclusively for Vietnamese businesses to meet comprehensive situations invoice multi-object – even when the purchase is for individual business households. Highlight features:

- Hint buyer information each transaction → restrict entry wrong.

- Flexible in case the buyer does not have a tax code or address.

- Register number, deposit, adjustment, replacement bills on a single platform.

- Sync with accounting software, sales manager (if any).

- Supports lookup, save the invoice as prescribed for 10 years.

Investing in solutions such as AccNet eInvoice help businesses not only legal compliance, but also increase the processing speed, reduce errors, improve customer experience business.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

The company invoice maker for business today is no longer the exception – it is a part in the process of normal operation of the business when working with the retail market, dealer, distributor. If no master specified business, very easy to make mistakes business guide to legal risk or cost should not be. What is the solution? Actively updated with new rules, system deployment, electronic invoice matching, just ensure the correct law, just optimal time and cost.

👉 If you are looking for a software electronic invoice:

- Meet strictly defined by law

- Flexible when invoice for all subjects

- Easy integration with existing system

Let's deployment considerations AccNet eInvoice – solutions are trusted by thousands of enterprises in Vietnam.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: