Today, many enterprises have been faced with the risk of accidentally using bills are not legal. The dispatch processing bill illegal due to the General department of Taxation issued as a guideline to help businesses understand, adhere strictly to the legal regulations. This article AccNet will help you understand more clearly about the content of the text mentioned on!

1. Overview of text processing bill illegal

Dispatch processing bill illegal is a document issued by the tax authorities (such as the General department of Taxation/Tax Administration in the provinces and cities) issued to guide, steer, ask the local tax authority/business implementation of measures for dealing with the case of using the bill is not legitimate. The goal of this dispatch is:

- Prevent tax fraud

- Raising awareness comply with the law of business

- Maintain fairness and transparency in the business market

| Bills not legally able to include counterfeit bills, invoice, invoices are issued by organizations that do not have the right to release, the bill has serious flaws of information. |

Read more:

2. The type of dispatch invoice processing illegal, most current

Below is a summary of the contents of the dispatch invoice processing not legal to the present time:

2.1. Dispatch 3385/TCT-TTKT day 01/8/2024

General department of Taxation has issued this dispatch to steer the tax authorities across the country perform reviewing and processing invoices not legal. This dispatch pays special attention to the publication of the list 113 businesses were found to be selling invoices unauthorized. These enterprises have used bill is not legitimate to tax fraud, spleen law.

Goal: strengthen supervision and inspection, strictly handle the act of sale, invoice unauthorized

2.2. Dispatch processing bill illegal 1798/TCT-TTKT day 16/5/2023

Total Tax administration published a list of 524 business is considered high risk on the use of the bill is not legitimate. This requires the local tax authorities strengthen the review, check out the business is located in this list to detect and handle violations.

The goal: Prevent the use of the invoice is not legal in business activities

2.3. Dispatch processing bill illegal 12111/CTTPHCM-TTKT2 day 06/10/2023

The Tax department Ho Chi Minh city, has issued this dispatch to perform reviewing and processing companies using bills of 49 business being discovered selling invoices unauthorized.

The goal is to check, handle the business was purchased, use the menu from the source is not legitimate.

2.4. Dispatch 2812/TCT-TTKT day 07/7/2023

General department of Taxation issued dispatch processing bill illegal this aims to implement the measures to prevent and combat the condition trafficking bill on the space network. The text emphasizes the check, closely monitor the activity on the network for the detection, timely treatment of behavior trafficking bill illegal.

The goal: Prevent the development of the market of commercial invoice on the space network

2.5. Dispatch processing bill illegal 4061/TCT-TTKT day 14/9/2023

This dispatch solve the difficulties relating to sanction administrative violations of use of the bill is not legitimate. General department of Taxation provides specific guidance on the level of penalty, how to handle situations specific to the local tax authorities to comply with regulations.

Goal: Ensure the sanctions violations related to the bill is to comply with regulations

Read more:

2.6. Dispatch 3349/TCT-PC date 14/8/2020

Dispatch processing bill illegal this guide on handling of administrative violations for behavior using bills not legal, use is not legal bills or use bills are not defined properly. General department of Taxation provides the criteria, the legal basis to the tax authorities carry out the sanctions.

Objective: unified way of handling the violations related to bills across the country

2.7. Dispatch 4679/TCT-KTNB 2016

Dispatch processing bill illegal be issued to prevent and reverse the printing, publication, sale and purchase invoice illegal. Total Tax department appealed to the tax authorities to strengthen coordination with the authorities to quarantine, monitor and handle the behavior.

Goal: minimize printing, issuance and sale counterfeit bills

2.8. Dispatch processing bill illegal 2838/TCT-KTNB 2021

Dispatch request to the tax authorities rectifying, check, revise and take preventive measures for handling the business has a high risk of acts of purchase and sale, use of illegal invoices.

Goal: strengthen the initiative in the detection processing of the behavior related to the bill is not legitimate

3. Process processing bill illegal according to the office from the Tax authority

Stage 1: Identify violations

The tax authorities will conduct the inspection, reviewing the transactions of the business in order to detect signs of use invoice illegal. These violations include:

- Use the bill is counterfeit or because the organization does not have the right to issue an invoice created (According to Article 4, Decree 123/2020/ND-CP)

- Phát hành hóa đơn khống, hóa đơn được lập cho các giao dịch không có thực hoặc có giá trị không đúng với giá trị thực tế (Theo Điều 16, Thông tư 39/2014/TT-BTC)

- Use bills of the business has been the tax authority to suspend the operation or withdrawn tax code

Phase 2: published a list of business violations or risk

After determining the violations, the General department of Tax/local tax authority will publish the list of businesses violation/high risk on the use of invoices is not legitimate. Published on dispatch processing bill illegal this aims to:

- Warning the business community

- Strengthen the supervision of the tax authority

According to Article 17, the Decree 125/2020/ND-CP, the business named in this list can be subject to the treatment measures such as inspections, unscheduled inspections, the form of administrative sanctions if a violation is detected.

Stage 3: dispatch invoice processing illegal guide handle and fix

After the acts of use invoice no legitimate business will be required to implement the remedies according to the instructions of the tax authority:

- Set the minutes cancel invoice in Article 20, the Decree 123/2020/ND-CP.

- Adjust bookkeeping

- Declare the bill illegal with the tax authority within 10 days from when a violation is detected, in accordance with Article 47, Decree 125/2020/ND-CP.

Stage 4: sanction administrative violations

If the business is a bill illegal, the tax authorities will conduct penalties as prescribed by law. Based on dispatch processing bill illegalthe level of sanctions may include:

- According to Article 22 of Decree 125/2020/ND-CP, businesses can be fined from 20 million to 50 million depending on the severity of the violation.

- Deprivation of the right to use bill in a certain period of time

- Prosecuted for criminal liability according to Article 200 Of the penal code, the 2015.

Learn more:

Stage 5: prevention of recurrent violations according to dispatch invoice processing illegal

To prevent recurrence behavior using bill illegal, the tax authorities will carry out measures as:

- Enhanced periodic checks with respect to the business have high risks of bills

- Organizing training programs and seminars to raise awareness of the business

- Coordination with agencies, other functions such as public security, bank to check, handle the behavior trafficking bill unauthorized.

4. Xử lý hóa đơn bất hợp pháp hiệu quả với AccNet eInvoice

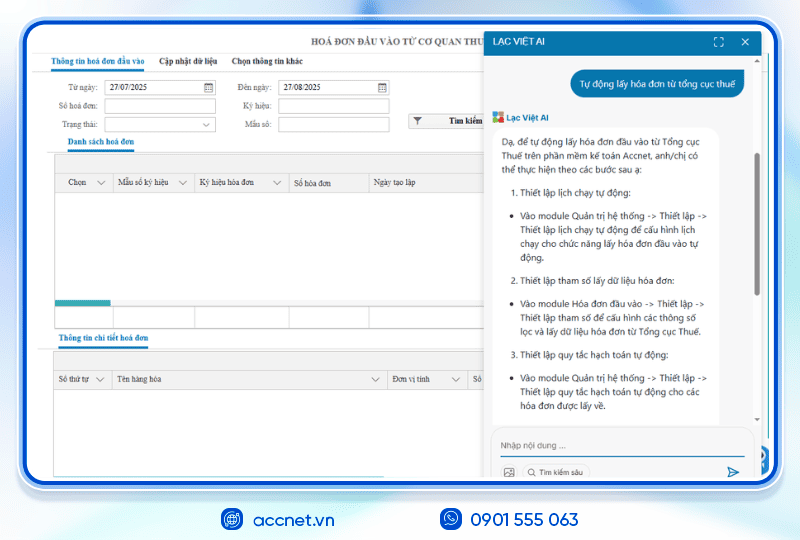

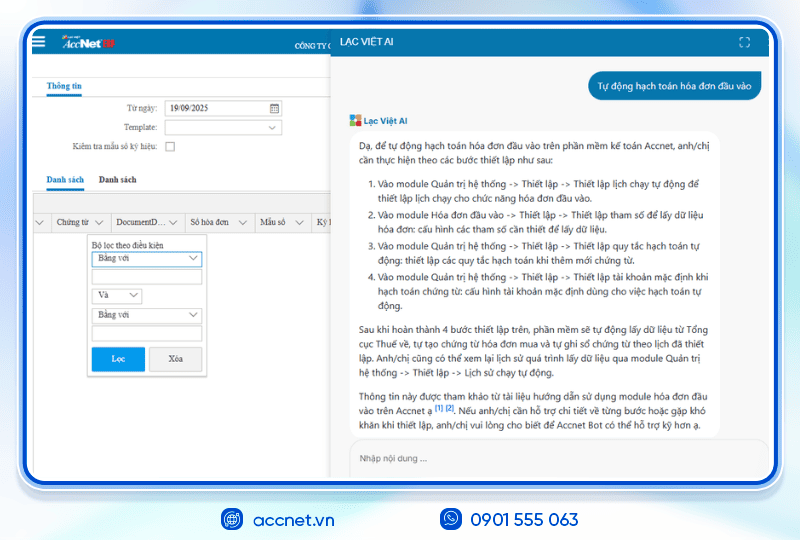

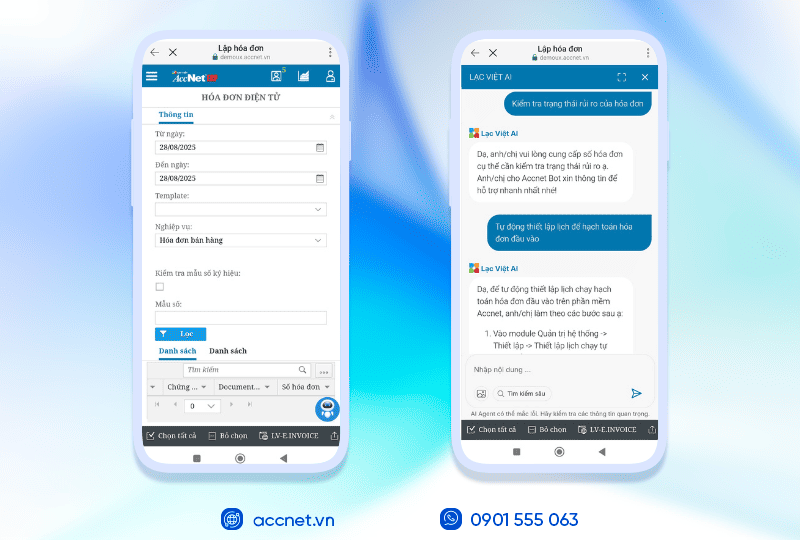

Hóa đơn bất hợp pháp — như hóa đơn giả, hóa đơn không ký số, thông tin sai lệch — là rủi ro lớn về mặt thuế, luật và uy tín doanh nghiệp. Khi gặp trường hợp này, doanh nghiệp cần ban hành công văn xử lý hóa đơn bất hợp pháp — yêu cầu hủy bỏ, điều chỉnh hoặc làm rõ với đối tác/kế toán thuế.

Trong môi trường kế toán truyền thống, việc phát hiện và xử lý hóa đơn sai sót dễ bị chậm trễ, thiếu minh bạch hoặc bị gửi nhầm dữ liệu sang các bộ phận khác. Đây là lúc AccNet eInvoice trở thành công cụ đắc lực để xử lý mọi tình huống hóa đơn bất hợp pháp một cách chuẩn xác:

- Tự động phát hiện sai lệch & cảnh báo: hệ thống kiểm tra tính hợp lệ của hóa đơn (ký số, mã khách hàng, giá trị…) trước khi phát hành, giúp bạn chặn hóa đơn bất hợp pháp từ nguồn.

- Công văn & quy trình xử lý nội bộ: khi hóa đơn bất hợp pháp được phát hiện, AccNet eInvoice hỗ trợ tạo công văn cảnh báo, hủy hóa đơn hoặc lập lại hóa đơn thay thế — tất cả trong giao diện hệ thống.

- Ghi bút toán điều chỉnh: nếu hóa đơn đã hạch toán mà sau đó bị xác định bất hợp pháp, phần mềm sẽ tự động điều chỉnh doanh thu, chi phí và thuế liên quan sao cho thống nhất giữa hóa đơn và sổ sách kế toán.

- Lưu trữ & truy vết lịch sử hóa đơn: mọi bước xử lý — từ công văn, hủy hóa đơn, điều chỉnh, thay thế — đều được lưu giữ, dễ tra cứu và cung cấp minh chứng khi cơ quan thuế yêu cầu.

- Liên kết với module tài chính – kế toán: khi hóa đơn được xử lý, các thay đổi sẽ đồng bộ cập nhật sang module tài chính, đảm bảo báo cáo doanh thu, công nợ, chi phí luôn chính xác.

With AccNet eInvoice, doanh nghiệp không chỉ xử lý hóa đơn bất hợp pháp theo đúng quy định mà còn biến công tác quản lý hóa đơn trở nên tự động, an toàn và chuyên nghiệp — giảm thiểu rủi ro pháp lý và bảo đảm tính minh bạch trong hoạt động kế toán – thuế.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Hope that through this article, you now have more clear view about the importance of the dispatch processing bill illegalknowing how to use correct invoice rules, perform necessary processes when they encounter situations related to the bill is not legitimate. Always be proactive in compliance with the law to ensure sustainable growth for your business.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: