Accrual accounting is an important concept in the field of accounting, strategic for businesses. This method is not merely a method of recording of financial transactions, which is also effective approach to construct a solid financial foundation. So accrual accounting is what? Let's Accnet explore deeper in the article below.

1. Accrual accounting is what?

Accrual accounting is a method in financial accounting, recognition of revenue/expenses in the accounting period based on the time arises, does not depend on the time of cash payment. This method allows the business to have more comprehensive overview about the financial situation and business performance.

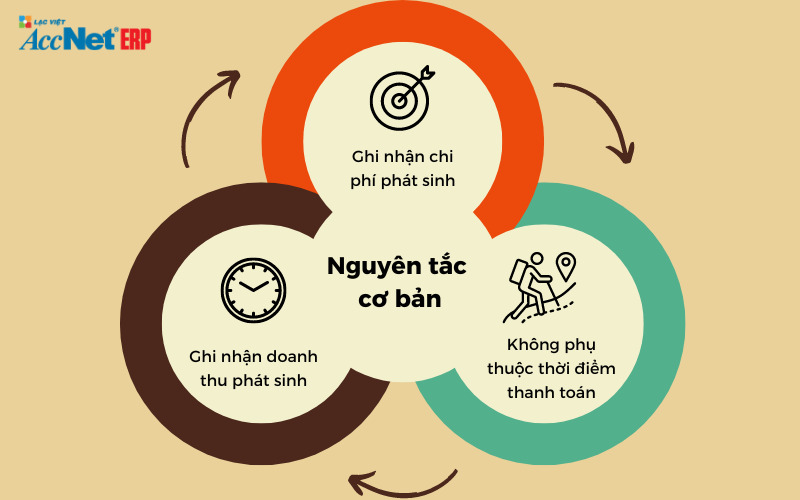

2. Basic principles of accrual accounting

2.1. Recognize revenue when incurred

Methods recognize revenue in the accounting period when the business transaction arises, regardless of whether the customer can pay immediately or not, make sure that financial statements accurately reflect the amount of revenue that the business has created in the accounting period, is not affected by the time of payment of the customer.

Read more:

- Kế toán là gì? Khám phá vai trò và công việc năm 2025

- Accounting what are the payment and role in the business

- The accounting profession cơ bản trong doanh nghiệp hiện nay

2.2. Accrual accounting recognition of expenses when incurred

Method recognized at cost in the accounting period when incurred, not dependent on time, cash payments to help businesses be more accurate view on the cost spent in the process of production/business. This principle supports leaders strategic decisions, forecast financial efficiency.

2.3. Do not depend on the time of payment

One of the key principles of accrual accounting is not dependent on the time of cash payment. This is completely different compared with the method of accounting for cash, where the revenue/expense is recorded only when cash has been paid/earned.

3. Application of accrual accounting in practice

3.1. Financial reporting accuracy

Financial statements true about the business situation of enterprises. Instead of just reflecting the cash transactions have been made, this method provides more comprehensive view of revenue generated, the cost was borne in an accounting period certain.

3.2. Manage cash flow effectively

Accrual accounting to help businesses manage cash flow efficiently thanks to the ability to forecast/cash flow management short term correctly, minimize risk, optimize the use of capital.

3.3. Support strategic decisions

Through the analysis of the data on financial reporting, business managers can take out the strategic decisions such as investments in production expansion, new product development or market expansion potential.

Read more:

- The duties of the chief accountant trong quản lý tài chính doanh nghiệp

- Provisions store accounting documents latest kế toán cần biết

- Thời hạn lưu trữ chứng từ kế toán according to the latest regulations

3.4. Accrual accounting financial forecast for business

Information about revenue/expenses are recorded timely and accurately will support the budget planning, management of financial risks of the business.

3.5. Deal with economic fluctuations

This accounting method to help businesses better cope with the fluctuations of the market economy because there are clear insight about the ability to forecast accurate financial, business can adjust the business strategy to adapt when the business environment changes.

3.6. Accrual accounting regulatory compliance legal

The information provided correct, complete, financially that will help the business comply with the provisions of the agency management economic/tax under current law, the latest

4. Compare accrual accounting and cash accounting

The comparison table to help businesses understand the differences and advantages of each method of accounting. Below is the comparison table, in particular:

| Characteristics | Accrual accounting | Cash accounting |

| Definition | Recorded revenue/expenses when incurred | Recorded revenue/expenses when cash payments |

| Time recorded | When the transaction arises | When payment or cash collection |

| Flexibility | Has high flexibility in the recognition of assets/liabilities | Little more flexible because depending on the time of payment |

| Financial information | Provide detailed information, exactly on the financial situation | May cause false financial information due not recorded timely transactions |

| Financial forecast | Support financial forecasting easier | Financial forecasting more difficult due to not fully reflect the transactions |

| Cash flow management | Manage your cash flow more effectively | Difficulties in the management of cash flow do not have a comprehensive view |

| Compliance with laws | To comply with the laws and regulations financial statements | Difficult to comply with regulations on financial statements due to the method recorded |

| Applicable objects | Suitable for businesses with large-scale, complex operations | Apply for the small business, simple operation |

Learn more:

- Nội dung chính và hướng dẫn áp dụng luật kế toán số 88 2015 QH13

- Hướng dẫn nắm vững nguyên tắc kế toán cơ bản

- Đối tượng kế toán là gì và phạm vi áp dụng trong doanh nghiệp

5. Specific examples

5.1. Example of accrual accounting for business automobile manufacturing

Business automobile manufacturer A have time accounting from January 1 to march 12 every year. In year 3, company A has received orders from a major customer to produce 100 cars. According to the contract, the customer will pay the full amount after received the goods on march 5.

Business A will recognize revenue from this order on the financial statements of September 3, immediately after the contract signing, committed to producing. Even if the money has not been paid, the revenue will be recorded according to the time of the transaction arises.

5.2. Example of accrual accounting for construction business

Business X specialized construction works. On January 7, the business receives the contract to build an office building from a major customer. Execution time expected is 9 months, the customer will pay 30% contract value as soon as signed, the rest after the completion of the project in months 4 years later.

First, on December 7, company X will recorded 30% of the revenue from the contract value on the financial statements of that month, although only receive part of the money of the initial payment. The expenses related to the project are also recorded when incurred, including the cost of materials, labor, equipment.

6. AccNet ERP – Giải pháp hiện đại hóa kế toán dồn tích, số liệu chuẩn xác

Phương pháp kế toán dồn tích (accrual accounting) yêu cầu ghi nhận doanh thu, chi phí ngay khi phát sinh—không phụ thuộc vào dòng tiền vào ra—giúp báo cáo tài chính phản ánh chính xác hiệu quả kinh doanh thực tế. Tuy nhiên, áp dụng bằng cách thủ công dễ dẫn đến thiếu kiểm soát, sai thời kỳ ghi sổ, thiếu minh bạch trong audit trail.

Chuyển qua AccNet ERP chính là cách bạn nâng phương pháp ghi nhận này lên… một tầng cao mới—nơi mỗi nghiệp vụ dồn tích được tự động hạch toán, theo dõi biến động, truyền sống qua dữ liệu thời gian thực.

Khi AccNet ERP hóa phương pháp dồn tích thành hệ thống tự động

-

Ghi nhận phát sinh – không bỏ sót, luôn đúng kỳ: Khi giao dịch xảy ra—bán chịu, chi phí phát sinh, phân bổ – ERP sẽ tự động định khoản đúng tài khoản doanh thu/chi phí, giúp đảm bảo nguyên tắc phù hợp giữa doanh thu, chi phí một cách chính xác

-

Tự động xử lý nghiệp vụ kết chuyển, điều chỉnh cuối kỳ: Hệ thống hỗ trợ tự động lập bút toán kết chuyển doanh thu, chi phí, phân bổ khấu hao hoặc chi phí trả trước… mà không cần thao tác thủ công, giảm sai sót, đảm bảo số liệu sổ sách luôn cập nhật chính xác.

-

Audit trail rõ ràng – mọi phát sinh đều được công khai: Mọi thao tác đều được ghi lại đầy đủ: ai thực hiện, thời điểm, nội dung điều chỉnh, tạo nên hệ thống audit trail đáng tin cậy, hỗ trợ kiểm toán, truy vết dữ liệu nhanh chóng.

-

Liên kết dữ liệu giữa các phòng ban – không còn “phân mảnh”: Các phân hệ như Bán hàng, Mua hàng, Tồn kho, Ngân sách… được kết nối chặt chẽ. Do đó, nghiệp vụ phát sinh ở đâu sẽ được phản ánh ngay trong hệ thống kế toán dồn tích, góp phần tạo báo cáo tài chính thật sự toàn diện.

-

Báo cáo tài chính phân tích – không chỉ số mà có “chữ biết nói”: Thay vì chỉ đọc số liệu trên báo cáo, AccNet ERP cho phép phân tích sâu: theo thời kỳ, loại nghiệp vụ, dự báo dòng tiền, hiệu suất chi phí, cảnh báo khi phát sinh trệch… hỗ trợ lãnh đạo ra quyết định đúng thời điểm, đúng ngữ cảnh.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Số dư kế toán là gì và cách xác định trong các sổ sách doanh nghiệp

Accrual accounting is what have you see this is a tool to manage important financial help businesses have more complete view of business performance. The application of this method helps to optimize the management of cash flow, minimize business risk. To achieve high efficiency, businesses need to follow the system. I wish you success!

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: