In the financial statements in businesses, in addition to the table reports like balance sheet, accounting, reporting results, business...faithfully Reflect financial situation, it notes to financial statements for you the most detailed information about the financial situation of the business. To understand the information in the article will guide you on the content presented in sample notes to financial statements according to circular 133.

1. Notes to financial statements what is?

Notes to financial statements is a division of financial statements in business used to describe the narrative or analyze in detail the information data. The data was presented in the balance sheet reports the results of business activities report cash flows as well as the other necessary information according to the requirements of the accounting standards.

1.1 purpose and meaning

Notes to financial statements is kind of important documents can not separate financial statements. It has the specific meaning the following:

- Narrative financial reports provide data and information to analyze and evaluate more details about cost, revenue, and operating results of business enterprises.

- Provide information and data to analyze and evaluate the change increase or decrease fixed assets, fixed equity, the ability of the company...

- Get to know the mode of business accounting applied through notes to financial statements, so that users can check for compliance with the rules, system, account, accounting, accounting methods that companies are using.

1.2 basis for The implementation

Sample notes to financial statements made based on the following premises:

- Balance sheetreport results of business activities report cash flows.

- Ledger general ledger details, the other details.

- Narrative report financial year ago.

- The real situation of business activities of the enterprise and the other relevant documentation.

Read more:

- How to create financial statements đơn giản, dễ hiểu cho doanh nghiệp

- How to report cash flows detailed, easy to understand

- How to set up the balance sheet theo Thông tư 200 chi tiết

2. Sample notes to financial statements most standard

| Company name:................................... Address:............................................ |

Model number B09 - DNN (Issued under circular no. 133/2016/TT-BTC dated 26/8/2016 of the Ministry of Finance) |

NARRATIVE REPORT FINANCING

Year ...

(Applicable for business responsive assuming continuous operation)

I. Characteristics of business operations

II. Accounting period, the monetary unit used in accounting

III. Standards and accounting Regime applicable

IV. The accounting policies applied (details according to the content here if there arises)

V. additional information for items presented in the statements of financial position

Unit: copper

| 1. Cash and cash equivalents

Public |

End of the year ... |

Beginning of the year ... |

| 2. The financial investments |

End of the year ... |

Beginning of the year ... |

| 3. Accounts receivable | End of the year | Beginning of the year |

| ... | ... | |

|

4. Inventory (Code 141) Public |

... ... |

... ... |

5. Increase and decrease of fixed assets (Details each asset type according to regulatory requirements of the business):

| Item | Balance, beginning of year | Increase during the year | Decrease during the year | Balance end of year |

| A. fixed assets tangible | ||||

| B. fixed assets intangible | ||||

| C. fixed assets finance lease |

6. Increase and decrease real estate investment (Details as required by the management of the business):

| Item | Beginning balance | Increase during the year | Decrease during the year | The last number of years |

| a) investment Real estate for rent | ||||

| b) Real estate investment holding wait for price increase |

| 7. Construction in progress | End of the year | Beginning of the year | |||||

| Public | ... ... | ... ... | |||||

| 8. Other assets | ... | ... | |||||

| 9. Accounts payable | End of the year | Beginning of the year | |||||

| ... | ... | ||||||

| 10. Taxes and other payables to the state budget | Beginning of the year | Numbers must be filed during the year | The number has actually filed during the year | End of the year | |||

| - Fees anal lesson

Public |

... ... | ... .... | .... .... | ... ... | |||

| 11. Loan and debt finance lease | End of the year | In years | Beginning of the year | ||||

| Increase | Discount | ||||||

| ... | ... | ... | ... | ||||

| Public | ... | ... | ... | ... | |||

| 12. Redundancy pay | End of the year | Beginning of the year | |||||

| Public | ... ... | ... ... | |||||

| 13. Equity | |||||||

a) Sheet volatility of equity

| Content | The item under equity | ||||||

| Capital contributed by the owner | Capital surplus | Other equity of the owner | Stock fund | Exchange rate differences | Net profit tax has not distributed and the fund | Public | |

| A | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Balance, beginning of year | |||||||

| Capital increase during the year | |||||||

| Reduction in capital during the year | |||||||

| Balance end of year | |||||||

14. The item in addition to reporting financial situation

15. Explanations on related parties (list of related parties transactions and other information about the parties involved has not yet been presented in the contents above)

16. In addition to the content already present on the business are explanation, demonstration other information if necessary

VI. Additional information for items presented in the statement of activities the business

Unit: ................

| 1. Total revenue sales and service provider | Year | Year ago |

| Public | ... | ... |

| 2. The sales deductions | Year | Year ago |

| Public | ... | ... |

| 3. Cost of goods sold | Year | Year ago |

| Public | ... | ... |

| 4. Revenue financing activities | Year | Year ago |

| Public | ... | ... |

| 5. Financial expenses | Year | Year ago |

| ... | ... | |

| 6. Cost business management | Year | Year ago |

| ... | ... | |

| 7. Other income | Year | Year ago |

| Public | ... | ... |

| 8. Other expenses | Year | Year ago |

| Public | ... | ... |

| 9. Income tax expense current corporate | Year | Year ago |

| ... | ... |

VII. Information additional for the items presented in the statements of cash flows

VIII. Other information

| TABLE OF CONTENTS

(Signature, name) |

CHIEF ACCOUNTANT

(Signature, name) |

Establishment, day ... month ... year ... THE LEGAL REPRESENTATIVE (Signature, name and seal) |

Download file template sample notes to financial statements according to circular 133 here:

3. How to set notes to financial statements

After reference sample notes to financial statements according to circular 133, AccNet will guide you how to set notes to financial statements a most detailed way.

3.1 principles and presents

Principles and present notes to financial statements is prescribed in the circular 133/2016/TT-BTC as following:

a) When performing financial reporting mandatory business to provide notes to financial statements according to the instructions in this circular.

b) notes to financial statements comply with circular 133, including the content below:

- The information about the basis of preparation, presentation, financial statements and information about the accounting policies are selected and used for the transaction, and important events.

- Provide the additional information has not been presented in the other financial statements, but necessary for the presentation of honest and reasonable about the financial situation, business results of the unit.

c) Need to present in a systematic way on the notes to financial statements. Business can be arbitrary arrangement of the order in the notes to financial statements in a manner consistent with the characteristics and peculiarities of the business according to the principle of each item on the balance sheet, the statement of business activities report cash flows need to be highlighted and lead to the related information in the notes to financial statements business.

Đọc thêm: Hướng dẫn lập the balance sheet of arise chuẩn xác

3.2 How to set the targets in the sample notes to financial statements

The only goal in sample notes to financial statements according to circular 133 be set as follows:

| I. Characteristics of business operations | |

| 1. Form of ownership of capital | Depends on the type of business (corporation, company, limited liability company, partnership or private enterprise) |

| 2. Business areas | Specifies the operation of industrial production, trade, services, construction or combine multiple lines of business |

| 3. Industry business | The main business activities and characteristics of the products manufactured or services provided by the company |

| 4. Production cycle, business casual | If the cycle is longer than 12 months, please describe the production cycle and business average for the industry or field. |

| 5. Characteristics of business operations in the financial year that affect the financial statements. | The legal framework, market developments, operation details, business management, finance, mergers, merge, split, change the scale,... It affects the financial statements of the company. |

| II. Accounting period, the monetary unit used in accounting | |

| 1. The annual accounting period (start from the date of..../..../.... end on..../..../....) | If the business has the financial year does not coincide with the calendar year, you must present clear start date and end date of the financial year. |

| 2. The monetary unit used in accounting | Is Vietnam dong currency or accounting be selected according to provisions of the law on accounting |

| III. Standards and accounting Regime applicable | |

| Statement on the compliance with accounting Standards and accounting Regime applicable | Clearly state whether the financial statements have been prepared and presented in an appropriate manner according to the standards and accounting system in Vietnam or not. |

| IV. The accounting policies applied | |

| Exchange rates applied in accounting |

|

| The principle of converting FINANCIAL statements of foreign currency into Vietnam Dong | Establishment in foreign currency to English |

| Principles recorded in the account cash and cash equivalents | Stated the basis for determining the cash equivalents |

| Accounting principles of financial investments | a) with Respect to securities business:

|

| Accounting principles receivables |

|

| Principles of inventory recorded |

|

| Principles recorded and the depreciation method of fixed assets, fixed assets finance lease, investment property | a) principles of accounting, fixed assets, tangible fixed assets intangible:

|

| Accounting principles liabilities |

|

| Principles of recognition and capitalization of expenses borrowers |

|

| Principles recorded equity |

|

| Principles and methods of revenue recognition |

|

| Principles of cost accounting |

|

| V. additional information for items presented in the statements of financial position | |

Requires businesses to analyze in detail the data presented in the reports, financial situation to help users report better understand the structure of assets and liabilities, liabilities, and equity.

Unit values presented in section “additional information for items presented in the statement of financial position” is the unit of measurement used in financial statements. The data in column 'early states' based on data in column “end states” of notes to financial statements years ago. Data are reported in the column end of the year based on the following data:

|

|

| VI. Additional information for items presented in the report results of business activities | |

Requires businesses to analyze in detail the data to be reported in the report on the results of business activity to better understand the content of the item revenue.

Unit values presented in section “additional information for items presented in the report results of business activities” is the unit of measurement used in reporting the results of business activities. Figures in the column “Years ago” is taken from the notes to the financial statements of the previous year. Data are reported in the column “year” based on:

|

|

| VII. Additional information for items presented in the statements of cash flows | |

Requires businesses to analyze and present the data was shown in the cash flow statement to understand more about the factors that affect cash flow in the period.

Unit price calculation presented in section “additional information for items presented in the statement of cash flows” is the unit used in the cash flow statement. Data recorded in the column “Years ago” is taken from the notes to financial statements year ago, the data recorded in the column “Year” is based on:

|

|

| VIII. Other information | |

| Business need to present the other important information (if any) in addition to the information presented aims to provide more other information if it considers that the need to help users understand the financial reports of the business has been presented, honest and reasonable. | |

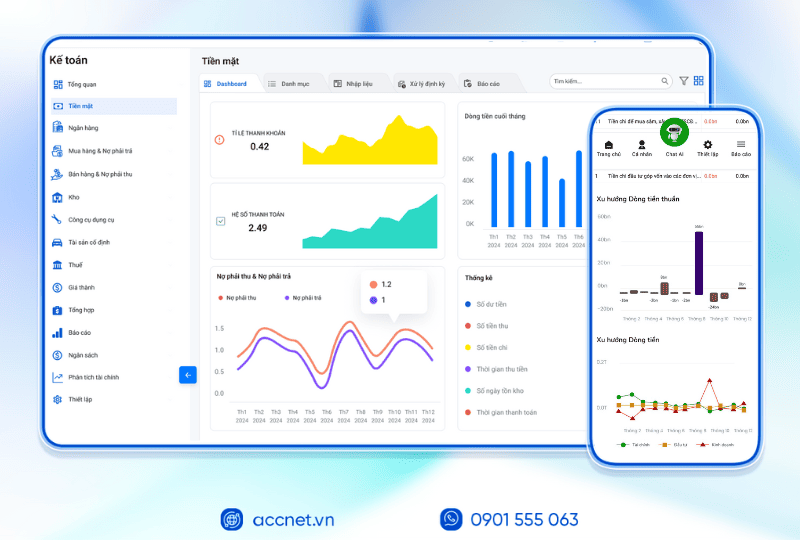

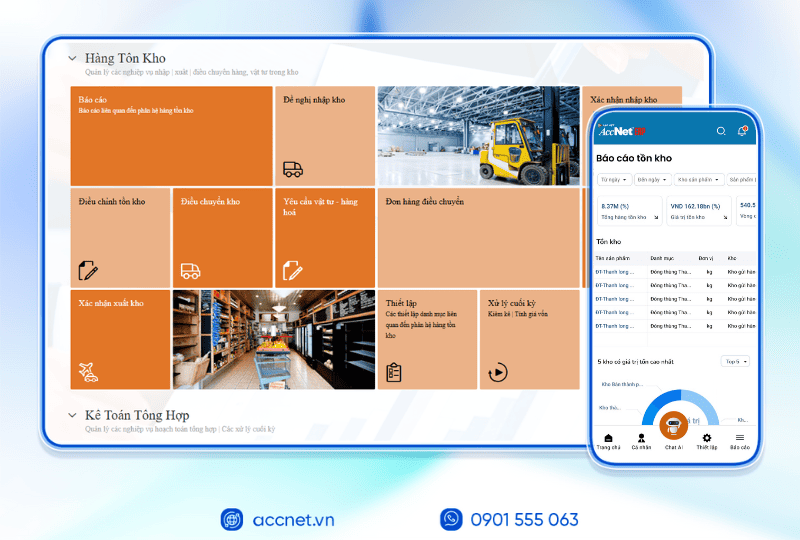

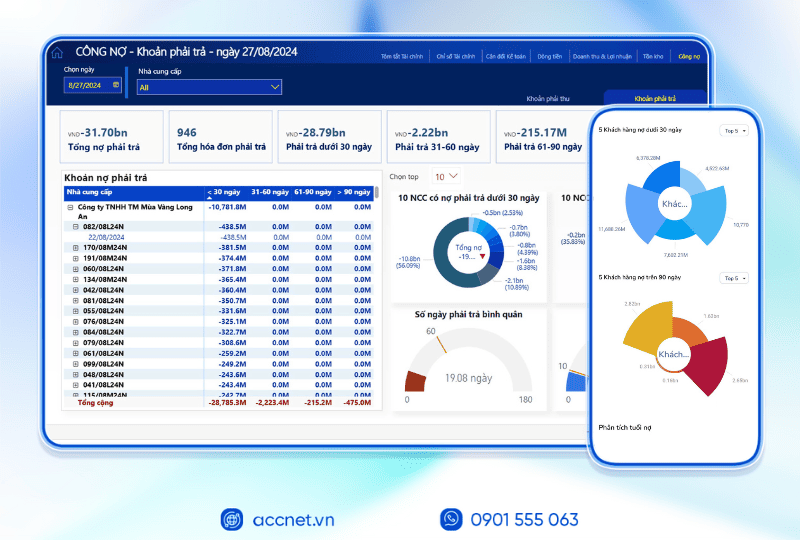

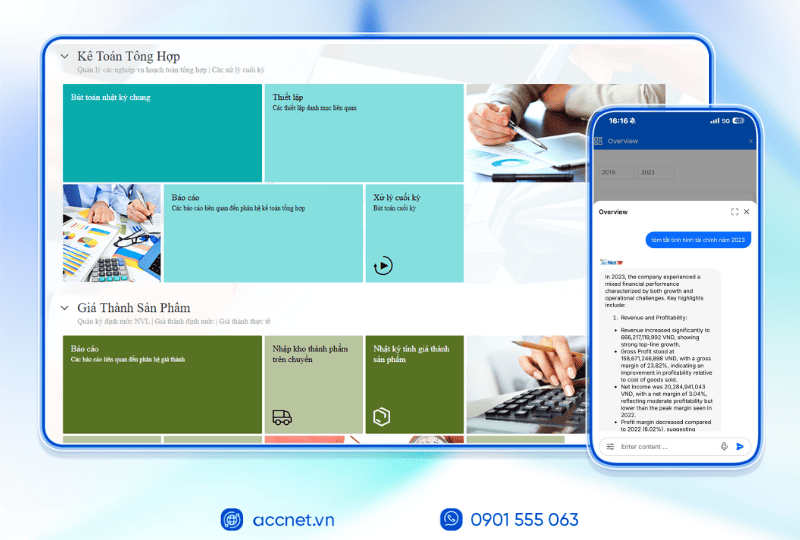

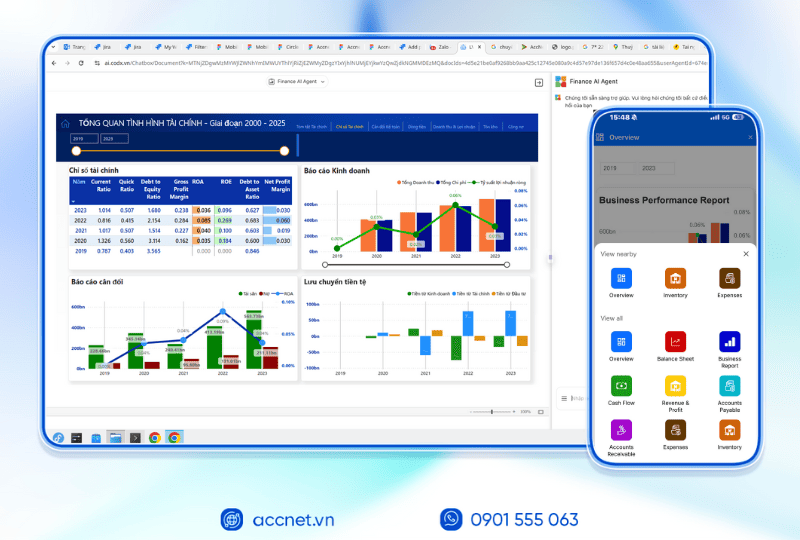

4. Quản lý Thuyết minh BCTC chuẩn xác với AccNet ERP

Trong bài “Mẫu thuyết minh báo cáo tài chính theo Thông tư 133”, bạn đã được hướng dẫn cách trình bày các phần như đặc điểm hoạt động, chính sách kế toán, biến động tài sản – vốn – nợ, các thông tin bổ sung… để đảm bảo báo cáo tài chính phản ánh trung thực và đầy đủ.

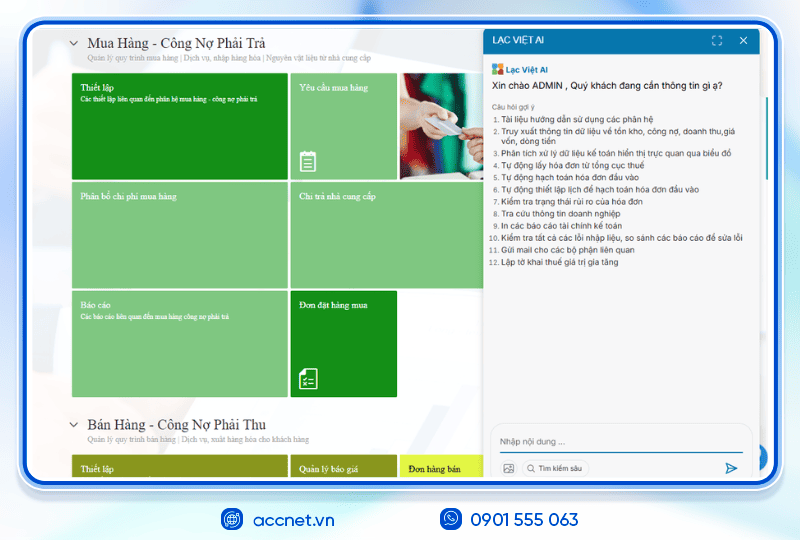

Tuy nhiên, khi lập thuyết minh bằng Excel hoặc xử lý thủ công, kế toán dễ mắc sai sót khi đối chiếu dữ liệu giữa các bảng và phần “thông tin bổ sung” cũng dễ bị bỏ sót hoặc trình bày thiếu logic. Đây chính là lúc AccNet ERP trở thành công cụ hỗ trợ đắc lực:

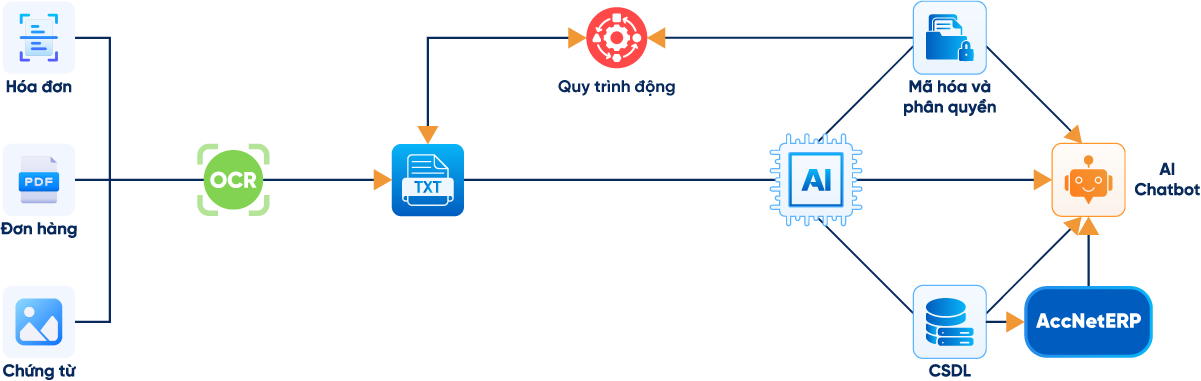

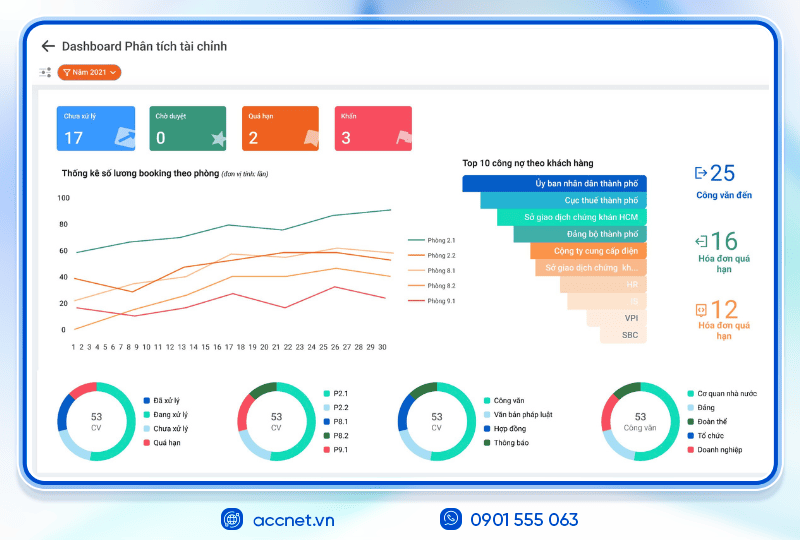

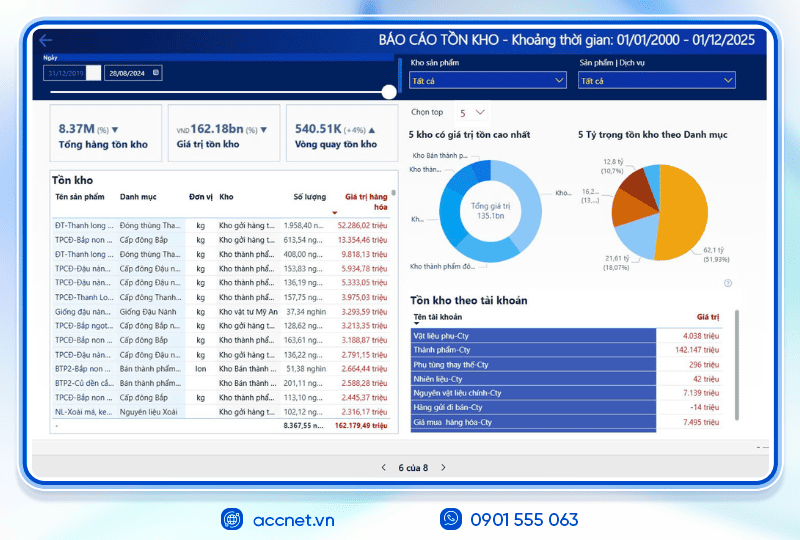

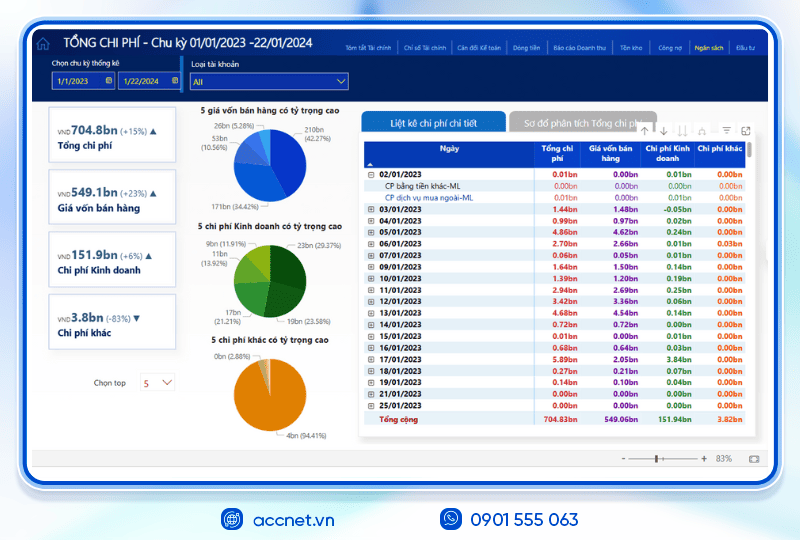

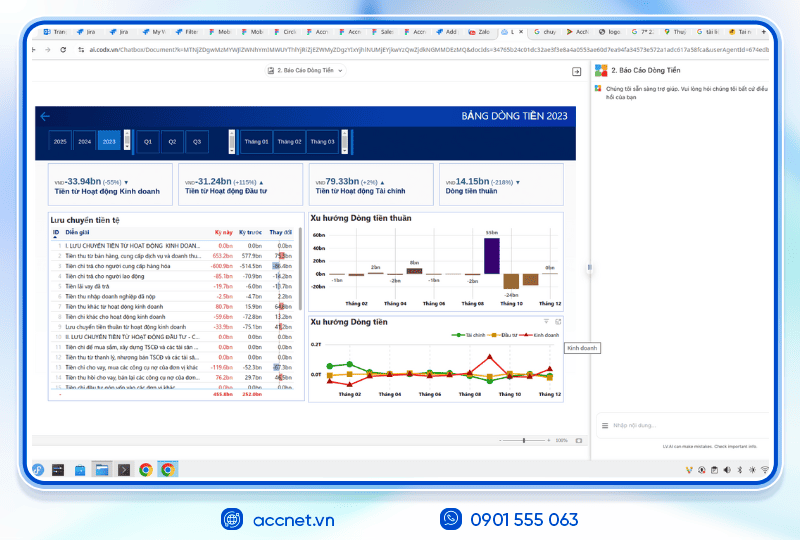

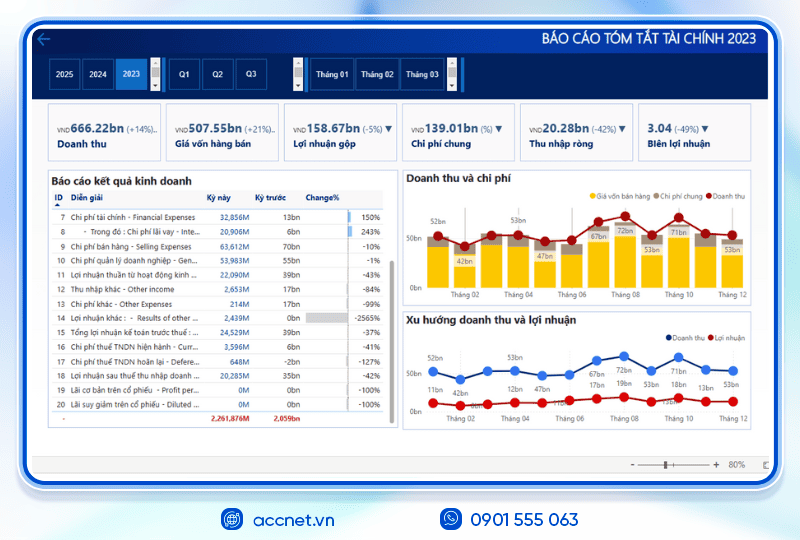

- Tự động ghi nhận & liên kết dữ liệu: các số liệu phát sinh từ báo cáo tài chính, báo cáo lưu chuyển, bảng cân đối… đều được cập nhật cùng hệ thống, giúp phần thuyết minh có dữ liệu thống nhất, không lệch.

- Tạo mẫu thuyết minh theo chuẩn Thông tư 133: bạn có thể xuất bản thuyết minh sẵn sàng nộp với đầy đủ các mục bắt buộc mà không cần ngồi sửa định dạng.

- Phân tích thông tin bổ sung thông minh: AccNet ERP hỗ trợ phân tích biến động tài sản, nợ, vốn chủ sở hữu và các chỉ tiêu kế toán khác để gợi ý dữ liệu nên thể hiện chi tiết trong thuyết minh.

- Cảnh báo & kiểm tra tính hợp lệ: nếu có số liệu bất thường hay thông tin thiếu trong phần thuyết minh, hệ thống sẽ cảnh báo để kế toán kiểm tra trước khi hoàn thiện.

Thông qua việc sử dụng AccNet ERP, công tác lập thuyết minh báo cáo tài chính không còn là áp lực về định dạng, đối chiếu hay thiếu sót — trở thành quy trình chuẩn, tự động và chính xác hơn cho doanh nghiệp.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Thus, AccNet just the same you learn the contents of sample notes to financial statements according to circular 133 as well as the establishment narrative. Hopefully this article on useful with you in the implementation of good financial reports.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: