Tax is always an integral part in the work of accounting, but also the area prone to errors if the business handling, lack of standardized system. If you are confused among too many options on the market, this article from AccNet will help you quickly find the accounting software tax latest most appreciated today. Just a few minutes of reading – you will have a clear view to choose the most suitable software for your business.

1. Synthesis of the accounting software tax new, most popular, most current

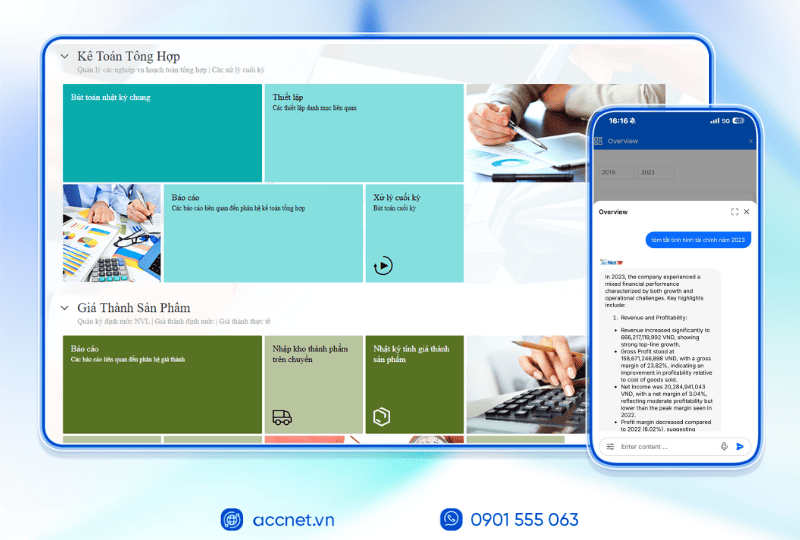

AccNet ERP – Giải pháp kế toán thuế chuyên sâu

AccNet ERP là phần mềm kế toán trên nền tảng đám mây được phát triển bởi Lạc Việt – một trong những công ty CNTT uy tín tại Việt Nam với hơn 30 năm kinh nghiệm. Phần mềm hỗ trợ đầy đủ nghiệp vụ kế toán, thuế, đặc biệt mạnh ở khả năng tích hợp quản trị nội bộ – tài chính.

Feature highlights:

- Automatic reporting of VAT (according to the method of deduction, or direct), CIT, PIT, financial reporting, usage reports, bills.

- Closely connected with the system, warehouse, sales, debts, electronic invoicing, fixed assets.

- Automatically the pen tax payments from business arising and limit errors.

- Features alert the deadline for the declaration, prompt submission of tax reports periodically.

Ưu điểm của phần mềm kế toán thuế AccNet ERP:

- Operating on the cloud platform, flexible, anywhere – anytime.

- Standardized circular 200, 133, support full form according to current tax laws.

- Match the business needs financial management – tax comprehensive, deeply integrated.

Restrictions: Must have internet connection to use.

Fit: Small and medium enterprises, there are processes financial – accounting strictly necessary management reports.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

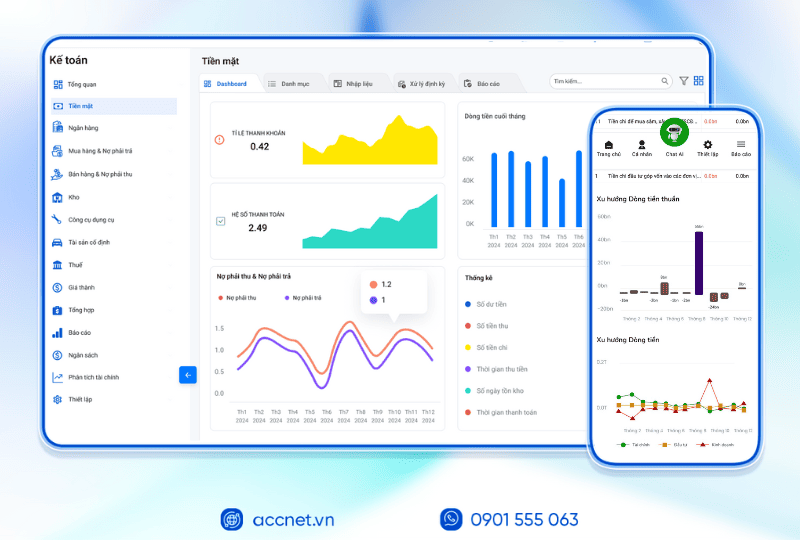

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

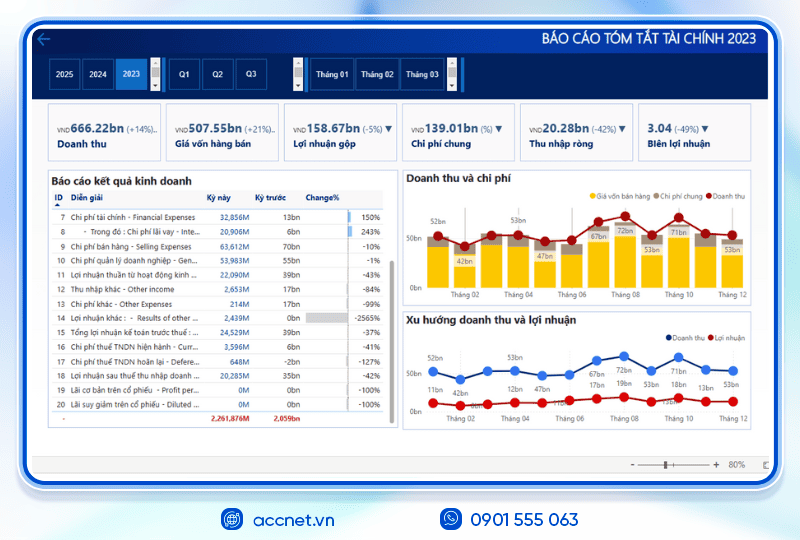

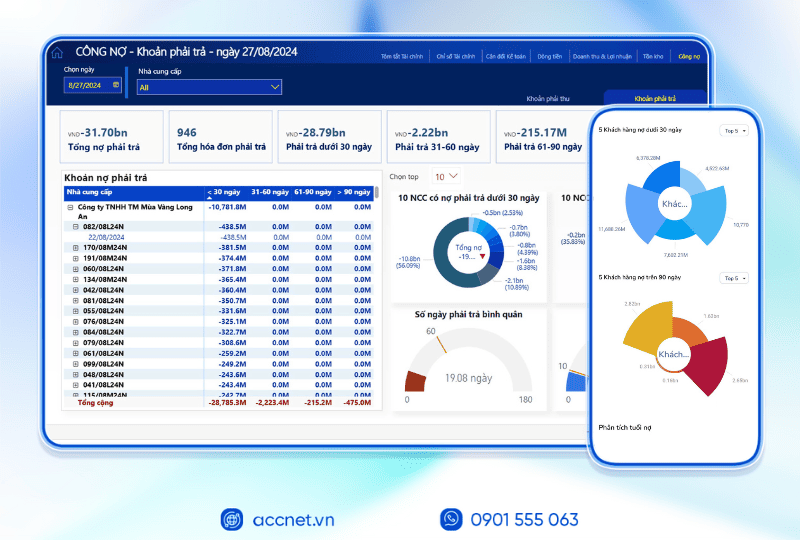

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

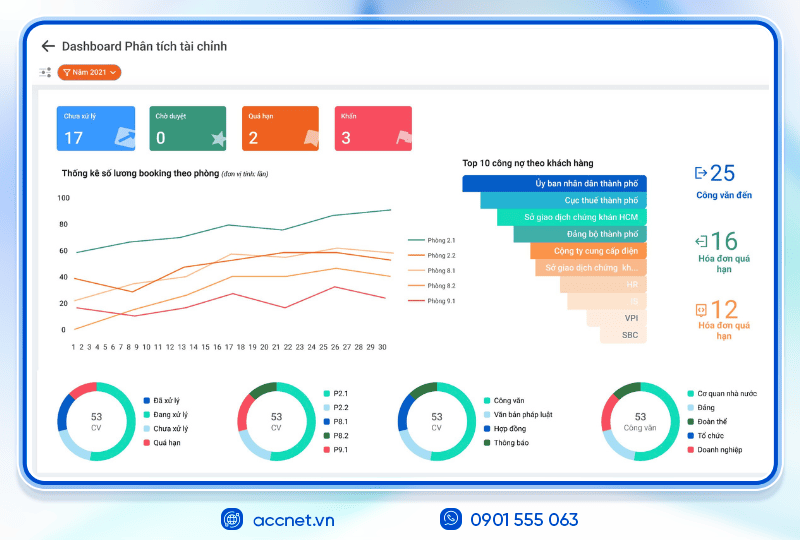

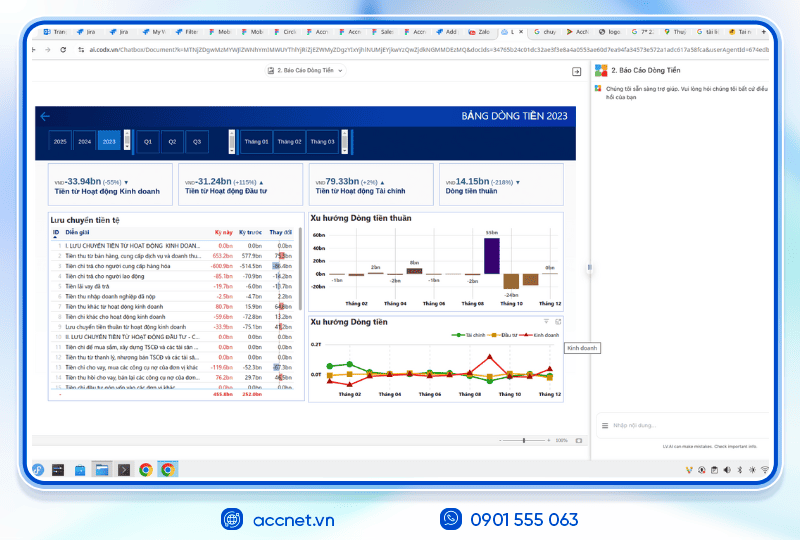

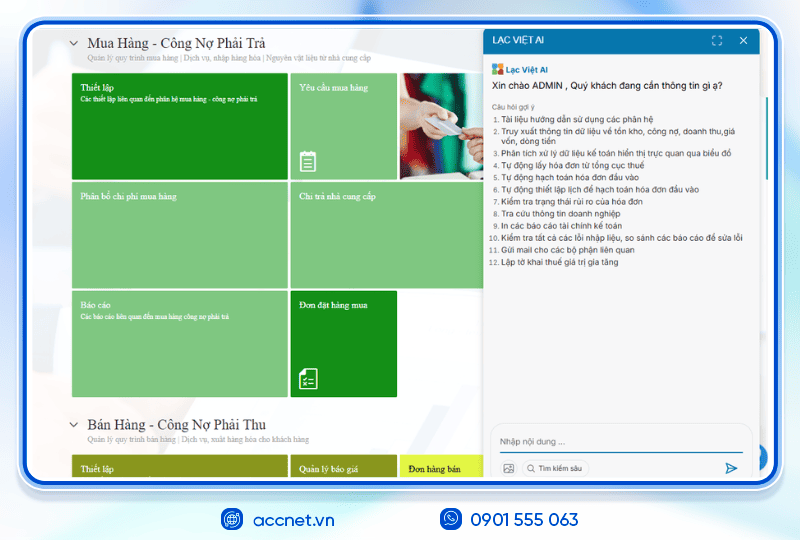

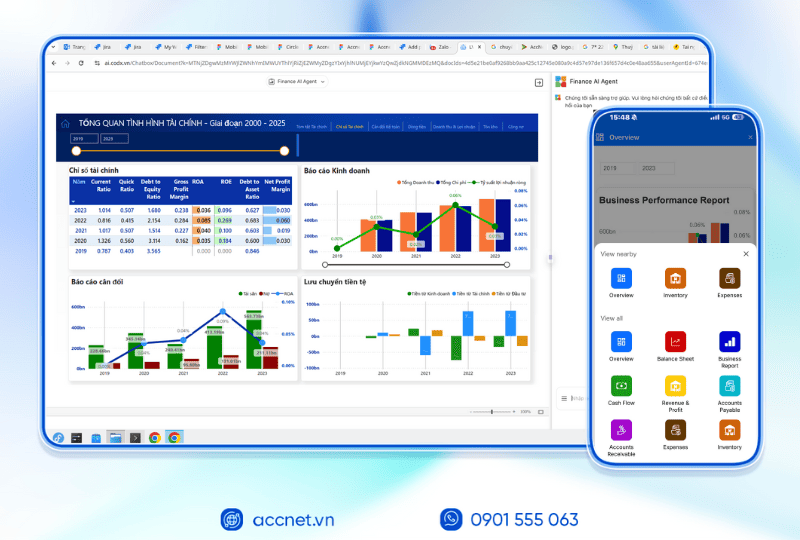

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Read more:

- Management software, financial accounting optimize cash flow

- Management software revenue for small and medium enterprises

- Management software sales and public debt increase sales effectiveness

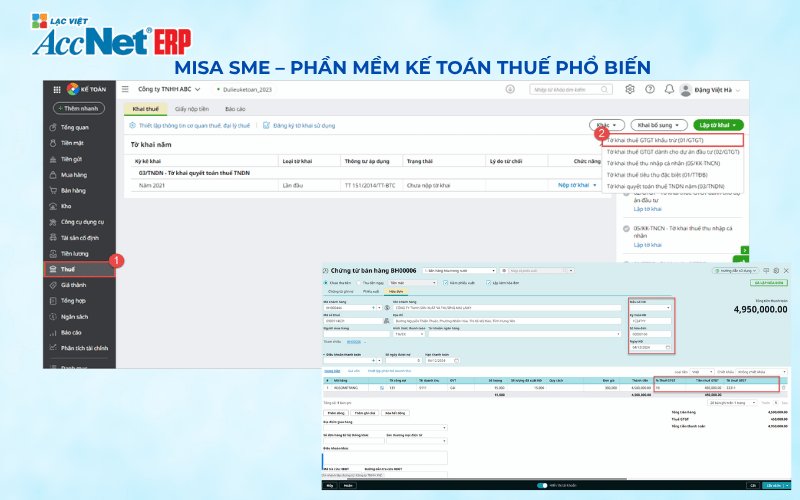

MISA SME – software tax accounting downloads

MISA SME is accounting software developed by corporation MISA, is accounting software popular in Vietnam, with more than 250,000 business use. Software fully meet the accounting profession, particularly strong in management – tax returns under the provisions of the tax authority.

Feature highlights:

- Support establishment tax, VAT, PIT, CIT, usage reports, invoices, tax settlement by quarter/year.

- Automatic synthesis of data from the distribution system to report taxes quickly and accurately.

- The export tax reports according to standard XML, easy filing system iHTKK or eTax.

- Tightly integrated with software electronic invoice MISA meInvoice, software registration number.

Advantages of accounting software latest tax MISA:

- Friendly interface, easy to approach, in accordance with new accounting.

- System tax form is always updated according to the latest regulations.

- Can be deployed on the installation platform or cloud.

Restrictions:

- Does not fit with the business are accounting process too complicated or requires customization.

- Some advanced features require a paid or purchase additional services.

Fit: Small and medium business, every industry, accounting, general or specialized tax internal.

Read more:

- Software inventory management automatically update the status of goods in real time

- Software asset management to help businesses reduce losses and waste

- Software solution to help manage the purchase process efficiency

FAST Accounting / FAST Accounting Online accounting software tax flexibility

FAST Accounting is accounting software tradition also FAST Accounting Online is a cloud modern, are due to the software company, FAST growing – one of the supplier for long atony, prestigious in Vietnam.

Feature highlights:

- Support establishment of the declaration, report, tax: VAT, CIT, PIT, financial reporting, usage reports, bills.

- Connect with bill electronic export XML file according to standard filing tax authorities.

- The system automatically check the data arising from the analysis, suggestions up the declaration.

- Allows to customize the category, form, fit particular industry.

Advantages:

- Familiar interface with accounting, easy to manipulate.

- There are both offline version, online to flexible options.

- Technical support is quite good, easy to integrate bills.

Limitations of accounting software latest tax FAST:

- Some advanced features need to implement own.

- Configure authorization is not really as flexible as the software large ERP.

Fit: Business small and medium-sized businesses want flexibility in deployment models, the optimal cost.

Bravo ERP – accounting software integration latest tax

Bravo ERP is the system management software, enterprise resource planning (ERP) free Stock company Bravo software development. In that module, accounting – finance of Bravo is tightly integrated with the tax act.

Salient features of accounting software latest tax Bravo:

- Automatically recorded, synthesized tax figures from the modules: purchasing, sales, warehouse, manufacturing, public debt...

- Customized form to report the VAT, PIT, CIT demand management.

- Support for projection between metric, accounting, tax reporting – detect the difference.

- Warning limit to file tax returns, tax settlement, handling discrepancies periodically.

Advantages:

- Ability to customize high, suitable to the peculiarities of each business.

- Connection data, multi-departments – the department of accounting – sales – hr.

- Tax report is part of the ERP system in sync.

Restrictions:

- Deployment time long, high cost.

- 't fit or small business only needs basic accounting.

Accounting software tax Bravo fit: Big business, manufacturing business unit can process internal administration, tax complexity.

Learn more:

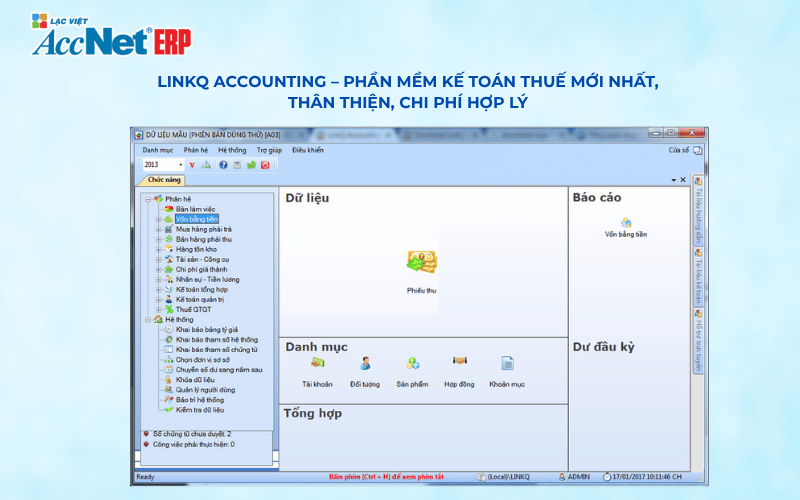

LinkQ Accounting – accounting software latest tax, friendly, reasonable cost

LinkQ Accounting is accounting software co., LTD. software development ASIA development, is widely used in the small and medium enterprises, especially trading company – services.

Feature highlights:

- Establishment, management reports, tax, VAT, PIT, CIT, financial reporting period-end.

- Accounting vouchers in standard form, support for connecting electronic invoice.

- Allows access to the data and reports in real-time.

Advantages of accounting software latest tax LinkQ:

- Easy to use, friendly interface.

- Software costs reasonable, in accordance with the DN new establishment.

- Good support, service tax, regular text updates in a timely manner.

Restrictions:

- Don't have a cloud – only running form traditional offline.

- The lack of a number of functional analysis, management intensive.

Fit: Small and medium enterprises, business services trade does not require customization complex.

2. Table a quick comparison of accounting software latest tax

| Criteria | AccNet ERP | MISA SME | FAST | Bravo ERP | LinkQ |

| Full support tax reporting |  |

|

|

|

(basic) (basic) |

| Automatically declarations from data |  |

|

|

|

|

| Integrated electronic invoice & eTax |  |

|

|

(custom) (custom) |

|

| Deployed on the cloud platform |  |

|

|

|

|

| Fit any business | Lớn, vừa & nhỏ | Small & medium | Small & medium | State | Small BUSINESSES |

| Easy to use interface |  |

|

|

|

|

| Customizable by industry |  (very high) (very high) |

(average) (average) |

(basic) (basic) |

(average) (average) |

|

| Deployment costs | Reasonable | Flexible | Average | High | Low |

Suggestions choosing accounting software latest tax:

- Cần phần mềm cloud, quản lý thuế chuẩn chỉnh → AccNet ERP

- Want to popular, easy-to-deploy → MISA SME

- Need flexible offline/online → FAST

- Large COMPANIES, like ERP custom deep → Bravo ERP

- Small BUSINESSES, low cost → LinkQ

Each accounting software tax the latest has its own strengths, to suit each business model is different. If you need a modern solution, operating on the cloud, deeply integrated with the system bill – of financial statements, AccNet Cloud is a prominent option. Hope the comparison chart above analysis will help you make the right decision when choosing software for your business.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: