From the date of bill electronic become a mandatory requirement for every business, understanding the latest regulations about electronic invoices no longer a choice – which is a legal obligation. Just a little mistake in the way the establishment, store, or send electronic invoices can also make business sanctioned dozens of million, or type the full cost of the tax.

So businesses need to comply with the regulations, what about bill electronic today? Is there any point to change than before? Must apply to the law, limit the risks? The article below – from the perspective accounting professionals bills – will full synthetic, latest content regulation bill latest electronicbusiness help correct implementation, safety and sustainability.

1. Overview of regulation bill electronic current

Legal background adjustment bill electronic current

To the present time, the legal system of electronic invoices shall be governed by the following documents:

- Decree 123/2020/ND-CP (issued on 19/10/2020): clearly stated on invoices, vouchers, format, application objects, the time required to use electronic invoices across the country.

- Circular 78/2021/TT-BTC (issued on 17/9/2021): detailed instructions Decree 123, the standard XML format, registration process, use, transfer, exchange electronic invoices.

- Decide 206/QD-TCT of the General department of Taxation: issued date 24/2/2022, deployment, bill electronic phase 2 across the country from 01/7/2022.

- Circular no. 39/2014/TT-BTC (expired): old Text before the specified electronic invoice required.

Note: all businesses that operate legally in Vietnam (except for some special cases such as individual households, the deep, no infrastructure) must apply the electronic invoice under the new rules.

The difference between regulated electronic invoice, latest and old

| Content | Ago (according to TT39/2014) | Currently (according to ND 123 & TT78) |

| Bill form | Paper invoice, print, put in | Only electronic bills (yes/no code CQT) |

| Format | Word, Excel, PDF | Mandatory XML – a standard format of TCT |

| Authentication mechanism | Hand signed, stamped | Register number + authentication code CQT (with bill code) |

| Roadmap development | Purchase local | Nationwide, mandatory from 01/7/2022 |

| Send an invoice for the tax authority | Not required | Obligatory send up system CQT before use |

This change creates huge request about converting software, internal processes, training of accountants in business.

Read more:

- Software invoice electronic fast, standard provisions

- Quotes software electronic invoice all-inclusive, transparent

- Software creates bill of sale easy to use

2. The latest point in the specified electronic invoice from 2022 – 2025

Mandatory use of electronic invoices across the country from 01/7/2022

According to the Decision 206/QD-TCT, from day 01/7/2022:

- 100% of enterprises, economic organizations, households and individuals and business to use electronic invoices instead of paper bills.

- The tax authorities will not receive register using bill book printing, self-printed invoices.

- The new business establishment must register to use electronic invoice as soon as you tax code.

Exception in regulation bill electronic new only apply for remote areas not yet have the infrastructure, information technology – must have documents confirming your local tax authorities.

Invoice template, symbol, number of bills under the new rules

Business must comply with the coding system uniformly across the country:

- Sample invoice number: For example, “1C21TAA”, in which:

- 1: type of bill (VAT invoice)

- C: there is a code of CQT

- 21: year released

- TAA: symbol issuer

- Bill number: Consists of 8 digits consecutive, non-duplicate in each sample invoice.

- Sign the bill: For example “AA/21E”, used to distinguish each category, ever released.

The information in this regulation bill latest electronic must be initialized properly in the software, electronic invoice registration with The Tax authority before use.

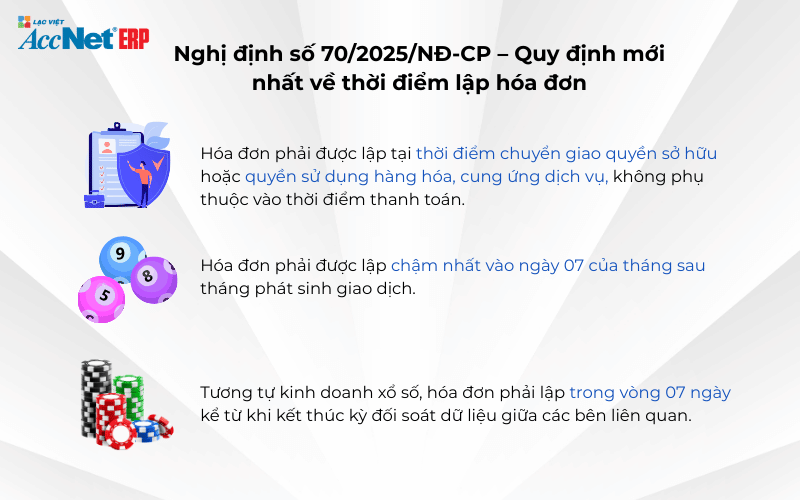

New regulations on the time of establishment, send electronic invoices

Business to set up, send invoices right time rules, avoid sanctions:

- The time of invoicing: Is the time of completion of the provision of services or delivery, not when the cash.

- The deadline to send invoices to buyers: Within 2 working days from the time of establishment.

- Case adjusted invoice: Business't get bills wrong, which to invoice adjustment, attach a written certification error between the two sides.

Regulation bill electronic latest standard format, mandatory use XML file

Under circular 78:

- XML format is format only accepted, including:

- Business data services (InvoiceData)

- Technical data (Metadata), such as encryption, digital signatures, code CQT

- Do not accept PDF, photo scan, file Word/Excel if there is no XML attachment.

Business must use software can function properly formatted, ensure the integrity, no editing after the number.

Regulatory updates electronic invoice of the latest on research, archives, reports, bills

- Store a minimum of 10 years for businesses, according to the Law on accounting, the Law on tax Administration.

- Must have the ability to lookup bills anytime, anywhere, even when the tax inspection.

- Report recurring bills can be replaced by data connection directly to the tax authority, if the business use the invoice is code.

Read more:

- Manage electronic invoice efficiently, avoid errors and books

- How to export electronic invoice the right process and legal

- Electronic invoice is lost how to handle properly defined

3. The bugs businesses often make when applying regulation bill latest electronic

Though regulations on the electronic invoice has been issued sync from 2020, the practice shows that many businesses are still not properly implemented or understood fully, which leads to more frequent errors below:

Not bill the right time

An error extremely popular is billed not true to the time the tax obligations:

- Set up after delivery several days → infringe on the time of invoice

- When not completed service → is considered the bill at the wrong time

- When no authentication code of the tax authority (with bill code) → invalid

Consequences: the Bill was eliminated as a tax deduction, be fined from 4 – 8 million according to the Decree 125.

Do not send the invoice data to the tax regulations

Many businesses think that just invoicing, sent to the client is done, but the fact:

- With bill code, business required to send up system CQT before use.

- With invoice no code, must be registered using the correct type, send periodical report template.

If not send data right time - right rule bill latest electronic business can be risk assessment or collection of tax arrears or coerced bill.

Invoicing wrong model, wrong sign under the new system

A number of businesses:

- Still taking sign template old bills (AA/19E...)

- No system updates the invoice number 8 digits

- Using the software not the right standard XML format

These errors can cause bill is tax authorities refused to receive or not recognized valid when the settlement.

Not properly save the XML format or lost data bill

Many businesses:

- Just save the PDF or print to paper, don't save the original XML

- Storage bills scattered on email, hard drive personal, non-concentrate

- There is no solution, data backup and safety

In the tax inspection, if not present get the bill correct XML format – business is considered no bills, may be excluded at a reasonable cost.

4. Sanctions violations of regulations bill latest electronic

Legal basis: Decree 125/2020/ND-CP

Decree 125 is adjustable text acts of administrative violations of bills and vouchers, which includes:

- Violation of the time of establishment

- Violation of the format, content, bills

- Violation of obligation to send, store and sign up form

Content decree classification of the fine clear by level, behavior-specific help business can reference it directly.

The penalty according to each violation of rules bill latest electronic

Below is the synthesis of a number of violations popular, the penalty corresponding:

| Violation | Penalties |

| Not bill the right time | From 4 – 8 million |

| Invoicing wrong content required (tax code, amount...) | From 3 – 5 million |

| Do not send invoices to buyers within the allotted time | From 2 – 4 million |

| Do not send bills have the code up CQT before use | From 5 – 10 million |

| Does not store bills format, time limit | From 10 – 20 million |

Note: The penalty can multiply up by the number of bills offense, do not apply mitigating if the behavior is repeated many times.

Tìm hiểu thêm: Hướng dẫn xuất hóa đơn trên sàn thương mại điện tử details

5. Business need to do to comply with latest regulations?

After the identification is clearly the provisions bill latest electronics, the penalty stern from tax authorities, businesses need to take action proactively, work promptly to deploy properly, avoid risks.

Updated legal documents from the tax authorities – continuous

- Regularly monitor the website, the General department of Taxation (gdt.gov.vn), local tax Administration or Port information law (legal documents.vn) to:

- Get a new circular issued or alternate text

- Know the deployment or renew peculiarities in local time

- Election department tax accountant responsible for reviewing text, common internal periodically

For example: Business't even hold circular 78 can still use self-printed invoices, leads to serious violations.

Check - standardized invoice template, the format, the time of establishment

- Revise the entire invoice template, sign, information identifier on software: model number, symbol, type, code or no code

- Check back time of invoicing compared to the time of the transaction, export warehouse

- Ensure the system is properly formatted XML under circular 78, have enough digital signatures, code CQT (if available)

This should be done even if the business has applied electronic invoices from before the year 2022.

Use software electronic invoice standard Decree 123

To minimize the risk of errors due to manipulation or error, service and business should be using software to meet:

- Standardized XML format

- Directly integrated with the system of the General department of Taxation

- Support set, sign, send, store, lookup, bill focus

- Warning flaws before releasing the bill

- Auto correct storage period prescribed (≥10 years)

Solution hints: AccNet eInvoice

AccNet eInvoice is the solution bill electronic specialized developed to:

- Strict compliance with the Decree 123, circular 78

- Tightly integrated with accounting software AccNet, avoid skewed data

- Automatically send invoices up CQT – don't worry about forgetting, or at the wrong time

- Supports standard XML format, long-term storage, high security

The solution is suitable for businesses small, medium and large are in need of upgrade system accounting – tax-a-way sync, save cost management, ensure compliance with regulations bill latest electronics.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

When digitized accounting – tax update regulation bill latest electronic no longer is the option, which is responsible for strategy survival of the business. Just a little mistake – set at the wrong time, saved in the wrong format, do not send data right process – can also make business fined tens of million, lost the right to a tax deduction, or be forced mode.

To avoid that, businesses need to:

- Timely updates legal documents

- Standardized billing system, storage, control

- Deployment solution software electronic invoice standard as AccNet eInvoice, to ensure safe, economical, true law

You're want to deploy electronic invoice of the law effective? Experience consultation and free demo AccNet eInvoice TODAY – software electronic invoice help thousands of businesses, Vietnamese, regulatory compliance, process automation, protect the business from legal risks

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: