In the system account Vietnamese accounting, account financial reserve fund plays a key role in the recognition/management of the reserves of finance. Understanding/applying the correct account this not only helps businesses protect assets but also creates transparency in financial reporting. So financial reserve fund is any account? Let's Accnet read below the article below!

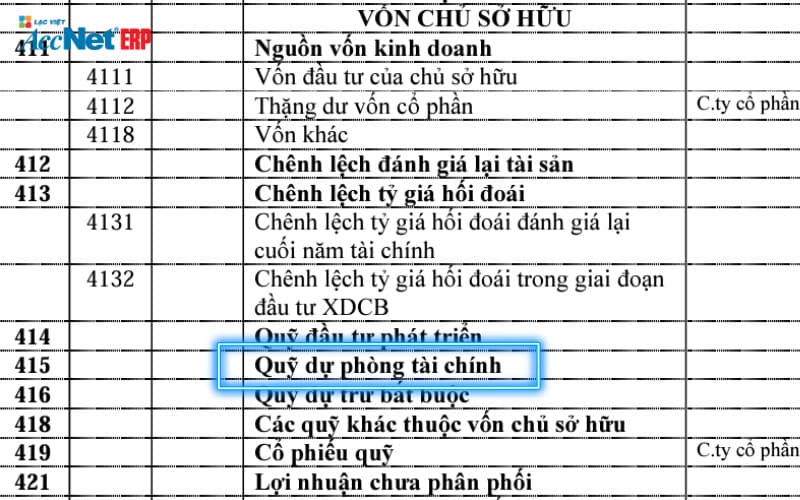

1. Financial reserve fund is any account?

|

Financial reserve fund account is 415 under the system account, accounting |

Account 415 is used to record the financial reserve of the business, purpose reflects the amount that the business provisioning to deal with the financial risk in the future.

The provisions relating to accounts 415:

- The finance department must be recorded in an honest way, based on an estimate of the financial risks that can occur.

- When setting up reserves, funds appropriated must be recorded at the cost of the accounting period current at the same time reflect on account of 415 to track.

Read more:

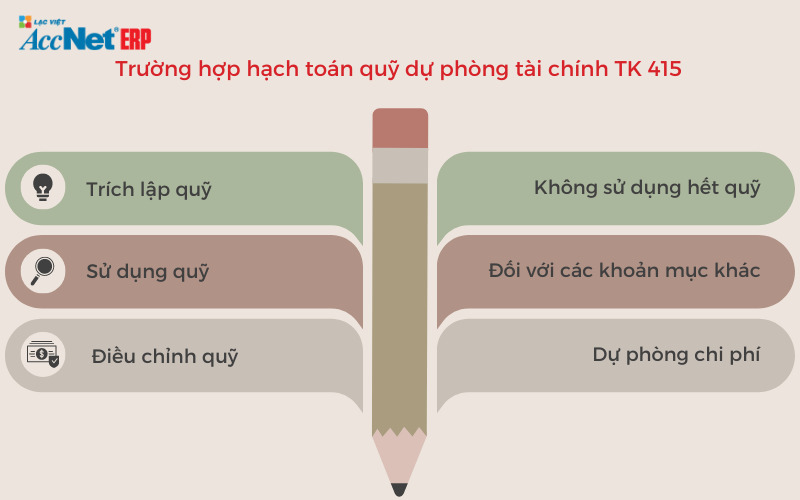

2. The case of accounting for fund financial reserve account 415

Here is the case of accounting, specific to business reference, apply the right accounting regulations.

2.1. Fund financial reserve

Business determine the need to establish a reserve fund financing for the potential risks, the amount will be credited to the cost management business account, 415.

For example: company A established risk reserve fund and financial 100 million for the account to be uncollectible.

- Debt TK 642 - Cost management business: 100 million

- Have TK 415 - financial reserve Fund: 100 million

2.2. Use of the reserve fund financial accounts 415

Business encountered financial risks have the room earlier, the reserve fund will be used to compensate for this loss.

For example: Business A used 50 million from the reserve fund to compensate for a bad debt not be recovered.

- Debt TK 415 - Fund financial reserve: 50 million

- Have TK 131 - customer receivables: 50 million

2.3. Adjusted financial reserve fund account 415

Adjust to increase the reserve fund

Business reviews back, and saw the need to increase the level of redundancy, additional funds will be credited to the cost management business, increase added to the reserve fund.

For example: Business A definite need to increase more 20 million in the fund financial reserves.

- Debt TK 642 - Cost management business: 20 million

- Have TK 415 - financial reserve Fund: 20 million

Adjustable reduction reserve fund

Business file level backup current exceeds demand, the redundancy is not required will be entered into income.

For example, company A determines that the standby current exceeds demand and complete import 10 million.

- Debt TK 415 - financial reserve Fund: 10 million

- Have TK 711 - other income: 10 million

Read more:

2.4. Accounting when not using all financial reserve fund account 415

Business check back the reserves at the end of the accounting period, if the amount of the non-use of business will fully enter the balance on income.

For example: business A review, complete, enter 15 million reserve not used before.

- Debt TK 415 - Fund financial reserve: 15 million

- Have TK 711 - other income: 15 million

2.5. Accounting reserve fund with respect to the item other

Provision for diminution in value of inventory

When making provision for diminution in value of inventory, business will be extracted into cost of goods sold, credited to the reserve fund.

For example: Business B provision for decline in value of inventories 30 million.

- Debt TK 632 - cost of sales: 30 million

- Have TK 415 - financial reserve Fund: 30 million

Use of the reserve for impairment of inventories

When inventory is reduced real prices, the business will use the reserve fund was set up to record the decrease in inventory value.

For example: company B is determined to have 20 million inventory is reduced by the actual price.

- Debt TK 415 - financial reserve Fund: 20 million

- Have TK 156 - inventory: 20 million

2.6. Accounting contingency costs

Provisioning cost product warranty

Provision for warranty costs, product business will be recorded in cost of sales and in the reserve fund.

For example: Business C provision for warranty costs, product 10 million.

- Debt TK 641 - Cost of sales: 10 million

- Have TK 415 - financial reserve Fund: 10 million

Use of the reserve cost product warranty

Incurred warranty costs fact, the business will use the reserve fund was established.

For example: Business, C to use 7 million from the reserve fund to product warranty.

- Debt TK 415 - Fund financial reserve: 7 million

- Have TK 641 - Cost of sales: 7 million

3. Benefits and limitations of financial reserve fund account 415

Benefits for business:

- Reserve fund to help businesses have the resources to deal with the financial risks surprises, ensure the stability and sustainability.

- The provisioning, management, reserve funds in accounts 415 help businesses recorded, reflecting faithfully the financial risks, create transparency in financial reporting.

Difficulties encountered when using accounts 415:

- Determining the level of provisioning reasonable may be difficult due to the requirements should be based on accurate estimates of financial risk.

- The management and use of the reserve fund requires caution, comply with the accounting principles, avoid the use of funds in an arbitrary way.

4. Note when using account reserve fund financial 415

Remembering the note below to use financial reserve fund account 415:

- Businesses need to comply with the regulations on accounting/legal

- The reserve fund should be evaluated periodically to ensure the project is consistent with the actual situation.

- The change in price can affect the real value of the reserve fund.

- The economic fluctuations can increase the level of financial risk, which requires businesses to adjust the level of room accordingly.

- Business should have a detailed plan about the set up/use of the reserve fund, ensuring funds are used for the right purpose.

- The track/regular reviews help businesses make timely adjustments in reserve funds when necessary, ensuring reflect the true financial situation.

Learn more:

5. Tối ưu quản lý quỹ dự phòng tài chính (TK 415) qua nền tảng AccNet ERP

Việc xác định, hạch toán đúng quỹ dự phòng tài chính thông qua tài khoản TK 415 (hoặc TK 613 với các tổ chức tài chính vi mô) là cực kỳ quan trọng—giúp doanh nghiệp dự phòng cho biến động, tổn thất, hoặc các rủi ro phát sinh trong tương lai. Thông thường, nghiệp vụ này hạch toán như:

-

Khi trích lập: Nợ TK 421 (Lợi nhuận chưa phân phối) / Có TK 415;

-

Khi sử dụng hoặc nộp lên cấp trên: Nợ TK 415 / Có Các TK 111, 112, 336…

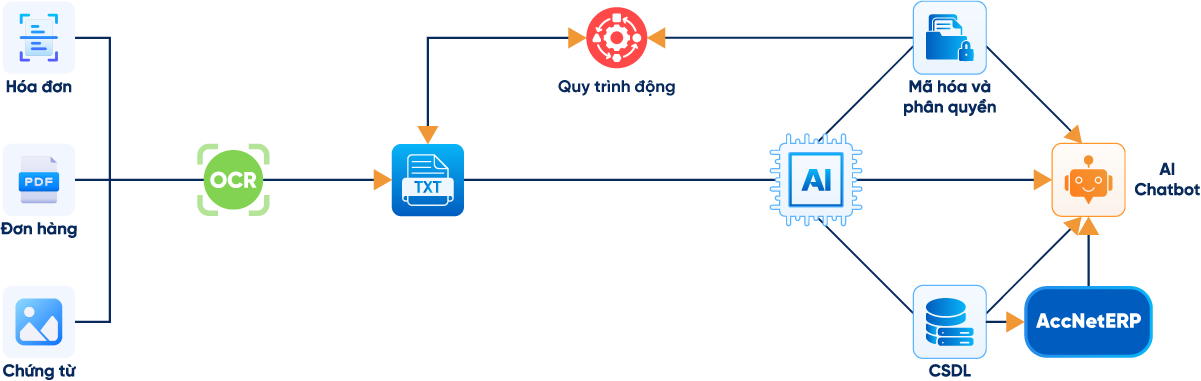

Tuy nhiên, nếu xử lý thủ công qua Excel hay phần mềm kế toán rời rạc, rất dễ xảy ra sai sót, kiểm soát kém, thiếu audit trail. Đó là lúc AccNet ERP – Giải pháp quản trị tài chính kế toán toàn diện trở nên rất cần thiết. Lợi ích khi sử dụng AccNet ERP để quản lý TK 415

| Vấn đề thường gặp | Cách AccNet ERP xử lý hiệu quả |

|---|---|

| Xử lý nghiệp vụ thủ công, không liên kết | Tự động hóa nghiệp vụ trích lập, sử dụng quỹ dự phòng, liên kết đầy đủ với phân hệ Tài chính – Kế toán. |

| Sai sót dữ liệu khi chuyển sổ thủ công | Khi nhập phát sinh quỹ dự phòng, hệ thống ERP tự động ghi bút toán đúng: Nợ TK 421 / Có TK 415, hoặc ngược lại, đảm bảo chính xác từng phép hạch toán. |

| Thiếu kiểm soát dòng audit trail | Mỗi thao tác trên hệ thống đều lưu lại thời gian, người thực hiện — tăng độ minh bạch, hỗ trợ kiểm toán hiệu quả. |

| Khó theo dõi báo cáo tài chính, ngân sách quỹ | AccNet ERP cho phép theo dõi trực quan số dư quỹ, biến động tăng giảm, báo cáo chi tiết theo thời điểm, kịch bản. |

| Không tích hợp với kế hoạch ngân sách hoặc phân tích rủi ro | Có thể kết hợp với AccNet Budget (quản lý ngân sách dự án), AccNet BI Dashboards (báo cáo phân tích tài chính), giúp lập kế hoạch trích quỹ dự phòng phù hợp theo chiến lược tài chính. |

| Chưa đồng bộ nghiệp vụ giữa các phòng ban | Các phòng ban như Kế toán – Tài chính – Quản trị chảy dữ liệu xuyên suốt trên cùng nền tảng, nâng cao hiệu quả, giảm sai lệch dữ liệu. |

Với AccNet ERP, không chỉ đảm bảo hạch toán chính xác, theo chuẩn TK 415, bạn còn được hỗ trợ toàn diện trong việc giám sát, báo cáo, ra quyết định chiến lược cho quỹ dự phòng tài chính. Đây là công cụ đắc lực bảo vệ doanh nghiệp trước biến động tài chính, nâng cao hiệu quả vận hành.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Phương pháp ghi chép và kiểm soát các giao dịch kết chuyển định kỳ

Through the article on you have grasped the knowledge of financial reserve fund is any account? Understand and effectively use accounts 415 main step is smart for business advanced management capabilities, risks, achieve financial goals in a sustainable way.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: