Property of business is a valuable asset which should be preserved and managed carefully. Accounting is one of the important tool to help businesses accomplish this. So, the term storage of accounting documents latest year 2024 is how long? Let's Accnet learn to ensure compliance with legal provisions, okay!

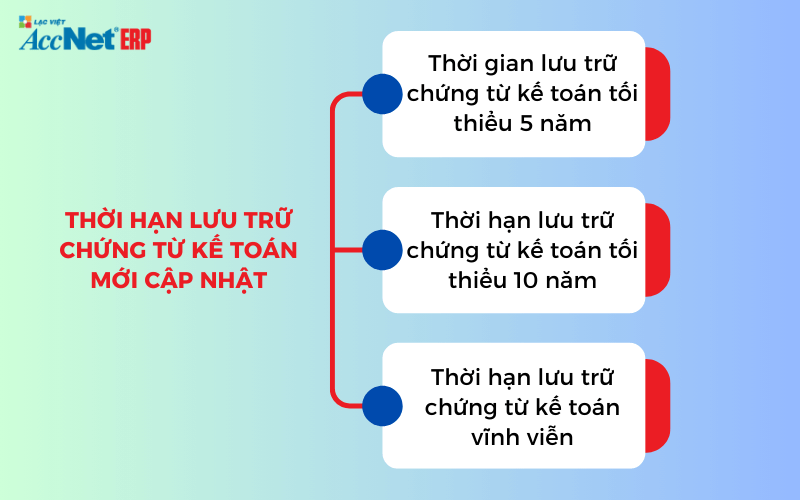

1. The term storage of accounting documents new updates

Storage time accounting vouchers specified at article 41 of Law, accounting 2015with the specific rules are as follows:

- Duration archive accounting documents must at least 5 years.

- The term storage of accounting documents a minimum of 10 years.

- Accounting documents need to be preserved permanently.

Read more:

1.1. Storage time accounting vouchers minimum of 5 years

Based on the provisions of Article 12 of Decree 174/2016/ND-CP, the term storage of accounting documents should be preserved for a minimum of 5 years, including the documents and accounting documents not directly used to record windows, such as:

- Accounting documents such as receipts and expenditure and coupons import export warehouse.

- Accounting document used for management and administration.

For other cases, if there are specific rules about term storage of other businesses need to adhere strictly according to regulations.

1.2. The term storage of accounting documents a minimum of 10 years

Based on the provisions of Article 13 of the Decree 174/2016/ND-CP, storage time accounting vouchers will be stored for at least 10 years, with the following:

- The time of storage since the end of the accounting year: Accounting vouchers directly related to bookkeeping and Financial reporting; The lists, tables, general ledger detail, window, general accounting; BC month, quarter or year; BC settlement; BC self-test accounting; destruction of documents,...

- The time of storage from when the transaction is completed: Documents accounting documents related to the operation, liquidation, sale of fixed assets; BC inventory results and evaluation assets.

- The time stored is calculated from the completion browse complete report settlement of investment projects: Documents related to the unit Owner, including documents in the accounting year; BC settlement completion of the project.

- The time of storage after completion of the procedure: Documents related to the activity change of the charter capital or the owner of the business, such as dissolution, bankruptcy, ipo,...

- The time stored is calculated from the report or results inspector from the competent authority: The accounting documents related to operation inspection and supervision of The state agency of competent jurisdiction.

- Other materials not covered in the provisions of Article 12, Article 14 of Decree 174/2016/ND-CP: If there are specific rules about term storage of other businesses will have to comply with those regulations.

Read more:

1.3. The term storage of accounting documents permanently

- In the field of accounting in the state, with respect to the units of accounting, the period of storage of accounting documents need to be stored permanently, including:

- Report the total settlement of the state budget has been approved by the National assembly;

- Settlement reports the local budget is the COUNCIL granted approval;

- Record, settlement reports complete project belongs to group A or project of national importance;

- The accounting documents other used materials, bearing important implications on the economy, security and national defense.

The decision on the permanent storage the term storage of accounting documents of the accounting documents will be paid by the legal representative of the unit of accounting, industry or local time given based on the determined properties using data and important sense of economic security and national defense.

- For business operations, accounting documents also need to be stored permanently, including:

- The accounting documents are historical documents and important sense of economic security and national defense.

Decide on the storage storage time accounting vouchers permanent of these documents will be borne by the head or the legal representative of the unit given, based on an assessment of the material and the long-term significance of information documents, to decide the specific and assigned to the accounting department/other parts stored in the form of originals or other form.

2. The time of calculation term storage of accounting documents

Article 15 of the Decree 174/2016/ND-CP detailing on the time of calculation the term storage of accounting documents as follows:

- The time of calculation term storage for accounting documents in accordance with Article 12 (paragraph 1, 2, 7), Article 13 and Article 14 of Decree 174/2016/ND-CP is determined from the date of the end of the accounting year.

- Time calculate the duration of storage for the accounting documents in accordance with paragraph 3 of Article 13 of the Decree 174/2016/ND-CP is determined from the date of settlement reports complete project was approved.

- Time calculator the term storage of accounting documents related to:

- Founded in units is calculated from the date of establishment.

- Split, merge, merger, transfer of ownership, type conversion from date of implementation of these measures.

- Dissolution, bankruptcy or termination of the operation, the end of the project from the date of completion of the relevant procedures.

- Record audit, inspection and examination by the competent authority from the date of the audit report or the conclusion of inspection, test.

3. AccNet ERP giúp bạn lưu giữ đúng, thông minh và an toàn

Lưu trữ chứng từ kế toán không chỉ là việc lưu giữ hồ sơ mà còn là hành động bảo vệ tính minh bạch và sự an toàn của doanh nghiệp. Theo luật (Luật Kế toán 2015, Nghị định 174/2016/NĐ-CP), doanh nghiệp cần lưu giữ chứng từ ít nhất 5 năm với các giấy tờ hành chính đơn giản như phiếu thu, phiếu chi; 10 năm với chứng từ quan trọng dùng để ghi sổ kế toán hoặc lập báo cáo tài chính; thậm chí, một số tài liệu có giá trị lịch sử hoặc chiến lược phải lưu vĩnh viễn. Tuy nhiên, để tuân thủ những yêu cầu này bằng phương pháp thủ công—Excel, file mềm, tủ hồ sơ—lại thường dễ phát sinh rủi ro về thất lạc, sai sót, thiếu kiểm soát.

Đó là lúc AccNet ERP vươn lên như một giải pháp thông minh, giúp doanh nghiệp không chỉ lưu trữ chứng từ đúng quy định, mà còn biến quy trình trở nên hiệu quả, an toàn và hiện đại hơn bao giờ hết.

Learn more:

Khi AccNet ERP biến quy định lưu trữ thành năng lực quản trị

-

Từ lưu trữ thủ công sang lưu trữ tự động và trung tâm: Tất cả chứng từ—từ phiếu thu, sổ sách chi tiết, đến báo cáo tài chính—đều được số hóa và lưu trữ tập trung. Hết hạn lưu trữ? Hệ thống sẽ cảnh báo; cần bảo mật hay truy xuất? Chỉ một cú nhấp, dữ liệu đã sẵn sàng.

-

Được “truy vết” từng bước – không bỏ sót chi tiết: Mọi chứng từ đều có lịch sử xử lý rõ ràng: ai lưu, ai chỉnh sửa, khi nào kiểm tra, khi nào phê duyệt. Điều này tạo thành audit trail hoàn chỉnh, tăng cường khả năng kiểm toán và tuân thủ nội bộ.

-

Tuỳ chỉnh nhắc nhở theo quy định pháp lý: Khi chứng từ theo lô cần tiêu hủy (5 năm, 10 năm…) đến hạn, hệ thống sẽ tự động gửi thông báo đến người phụ trách—giúp doanh nghiệp yên tâm tuân thủ pháp lý, tránh rủi ro phạt hành chính.

-

Bảo mật và sao lưu theo chuẩn: Chứng từ không còn nằm rải rác trong các ổ cứng cá nhân hay tủ file dễ hỏng—AccNet ERP quản lý tập trung, sao lưu định kỳ, đảm bảo không mất dữ liệu, bảo mật cao và dễ khôi phục.

-

Liên kết dữ liệu toàn hệ thống doanh nghiệp: Chứng từ lưu trữ không chỉ để lưu—mà còn để truy vấn, đối chiếu với các phân hệ Mua hàng, Kho, Tài sản cố định, Ngân sách, hay báo cáo tài chính BI. Dữ liệu vì vậy không hỏng nhịp mà bổ trợ lẫn nhau trong quản trị.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Phương pháp ghi nhận số dư tài sản, nợ và vốn doanh nghiệp

Hope you have more basic knowledge about the storage of accounting documents and will comply with the term storage of accounting documents properly prescribed. If there is any other question, please you read, please leave a comment to Accnet support for you best!

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: