Not only individuals but businesses are also turning to online shopping over the floor commerce (e-COMMERCE) as Shopee. Quick, convenient and cheap is the plus point that Shopee become the popular choice for the expenses stationery, IT equipment, even the raw material input.

However, little thing business to italy is: not any transaction on Shopee also has a VAT invoice. When purchasing goods without a valid invoice, the business will not be deducted VAT, do not count the cost in financial statements, lead to more risk of serious tax when the bar – check.

So “VAT invoice can be issued Shopee” what is it? Can't? How? How to control stock from the regulations? This article will comprehensive analysis from the perspective of business accounting, hints, solution for effective control.

1. VAT invoice can be issued Shopee is what?

Why “export VAT invoice Shopee” became the keyword is enterprise search? Because of the nature Shopee is a platform for e-COMMERCE intermediaries, should not all transactions on Shopee are given VAT invoice is valid.

Definition “VAT invoice Shopee” in business

- VAT invoice (or invoices) are legal documents important, which is issued by businesses, business organizations have registered to pay VAT according to the method of deduction, as defined in the Law on tax Administration, circular 78/2021/TT-BTC.

- Meanwhile, Shopee is a platform connecting sellers, buyers. On Shopee has:

- The individual seller (there is no tax code – no VAT)

- House for sale business (may BLACK if requested)

- So, “VAT invoice Shopee” are bills issued by the sales (not Shopee) if, and only if they are a business with a VAT registration.

Businesses need to understand this to avoid confusion when thinking that Shopee is the selling party to the bill, when in fact Shopee is only floor trading connections.

Shopee is the exporter's invoice?

No. Shopee no VAT invoice for the product of the sale. However, Shopee can export VAT invoice in the following cases:

- Businesses run ads via Shopee Ads

- Business use services integrated shipping of Shopee

- Business to buy booth Shopee Mall / service book

In the above cases, the bills were released under the name co., LTD. Shopee – is legal executive floor, e-COMMERCE Shopee in Vietnam.

In summary: If the business buying physical products on Shopee, the invoice is a sales, not Shopee. If buying services Shopee supply directly, can request Shopee VAT invoice can be issued.

Read more:

Why many business are interested in export VAT invoice Shopee?

Shopee is becoming the channel of purchase downloads of business

According to the report iPrice 2024, Shopee market-leading e-COMMERCE of Vietnam on the counter, with an average of over 60 million views/month. Business increasingly tend to purchase supplies – equipment drain on Shopee instead of losing travel time reference price, collect price quotes from suppliers tradition.

However, precisely because so convenient, many businesses skip test voucher valid, which made the latter when settlement tax new arising problems. This is the pain that the CFO, chief accountant should understand from the beginning.

No VAT invoice – Business damage single damage dual

When a business purchases, but no invoice VAT valid:

- Non-deductible input tax

- No expense was charged to a reasonable cost when calculating the corporate INCOME tax

- The risk of removal costs when settlement

- Easy-to-fined according to the Decree 125/2020/ND-CP (penalty 3-5 million for behavior using vouchers not valid)

What is the solution? Control bill from the beginning, even when buying on Shopee – ideally integrated system for electronic invoicing, which allows to manage the entire invoice input, automatically alert the bill invalid, easy storage, standardize processes, control of documents.

2. Guide business check & export VAT invoice Shopee

Although Shopee is a floor ecommerce, but not units sold on Shopee also provide VAT invoice, valid for business. Therefore, before – during – after ordering, businesses need to actively implement the 4 step check to ensure the following to avoid the risk of losing input VAT:

Before you purchase: Check the information of the seller may invoice VAT or not

How to make:

- Access the product details page on Shopee, pull down the information The sales.

- Find the description that read, “Have a VAT invoice on request” or similar.

- If you don't see clearly, proactive messaging for shop via chat Shopee to ask before: “his Side has a VAT invoice for business? Bill may is full company information is not?”

Note:

- Only the shop for business registration, tax declaration, new full can export VAT invoice is valid.

- Many shop personal, small business only provide coupons retail, not worth the tax deduction.

When ordering: specify invoice requests in order notes

How: When proceed to payment, in the last step are the “notes to seller” → record specific: “please VAT invoices to the company:

- Company name: ABC company

- Tax code: 0123456789

- Address: No. 1, Nguyen Van A ward, District 1, ho chi minh CITY.CITY”

Note:

- This is proof you have requested invoices from before receiving the goods.

- If the shop does not perform properly, you have the right to complain to Shopee.

Read more:

After receipt of goods: Check the type of vouchers received

Need to verify:

- Valid VAT invoices, must be bill electronic code of the tax authority, or the bills have to sign duly prescribed.

- Check out the information on the invoice:

- Name company – tax code – the address to exactly 100% as tax registration.

- Have the line be is the VAT rate 8% or 10%, total amount, tax amount is separate.

Not acceptable:

- Delivery receipt, internal, or bill of sale, retail, no tax code.

- Excel File/list of self-created, or vouchers not the standard.

If you do not receive an invoice: Handle complaints properly process

How to handle:

- Message back to the shop to remind: “Shop please send an electronic invoice as agreed. If not provided, I will quote with Shopee support.”

- If the shop does not respond or refuses to:

- → Visit Shopee > I > purchase > orders received > help

- → Select “complaint – do Not get VAT invoices”

Note: Shopee current't mandatory every home sales to produce VAT invoices, so only the shop belongs to organization/business registration full new obligation. If you need input voucher valid for tax declaration, only the best should choose the shop is verification is business, are committed to the invoice.

Tip: If accounting is not directly order, please ensure there are internal processes clearly between buyers, in the accounting department. AccNet eInvoice can integrate with the software purchasing, accounting to sync invoices, updating the status according to the flow approval.

3. The business case has the ability to export VAT invoice Shopee

Not trading Shopee are the same. Depending on the type of home sale, platforms, form of payment, the ability to export VAT invoice Shopee will be different. Analysis according to each situation will help the business easy to apply in practice.

Business to buy goods from the seller's business organizations have invoice

This is the most ideal case. The seller is a registered business in business, there are tax code, there are software electronic invoice. Then:

- Businesses may request a VAT invoice for your order.

- Need to actively contact us before ordering to confirm that they are bills or not.

- Some of the shop are clearly stated in the description: “Have red bills (VAT) if the client requests before”.

Process suggestions:

- The chat with the seller through Shopee Chat before order.

- Provides information invoice (business Name, TAX identification number, address, email address).

- Notes “required VAT invoice” in the notes section of the order.

- After you received the goods, check electronic invoices shall be sent on email or account.

Note: Electronic invoices have legal value, if granted from software electronic invoice legal code, the tax authority, the storage is valid. If the business has software that can:

- Automatically check the validity of the invoice (for passport, tax code, XML format, code lookup).

- Storage the entire focus of the bill input to service audit, tax, later.

Learn more:

Business to buy from the seller the individual does not have the ability to export VAT invoice

This is the most common situations, but also most risky in terms accounting – tax:

- The seller is an individual, there is no tax code, there is no software electronic invoice.

- Can't export the VAT invoice as prescribed.

- Many shop newspaper “can send receipts or invoices hand-written”, but this is not a VAT invoice valid under circular 78.

Risks:

- Non-deductible VAT.

- Do not count on a reasonable cost if exceeded 20 million cash payment.

- It is difficult to prove the legitimacy if test equipment tax arrears.

Recommendations - If goods of great value or purchase periodical:

- Find other vendors have VAT invoice (can sell outside Shopee).

- Use the filter tool shop has the legal clear, there is policy invoice right from the start.

Purchase through Shopee Mall – easy to get the bill better?

Shopee Mall is a system of genuine booth from a brand or distributor is Shopee authentication. However:

- Not every shop Shopee Mall are VAT invoice.

- Some of them just invoices or requests contact separately to release BIG.

Business need to do?

- See technical introduction shop on Shopee Mall (more shop can specify the conditions VAT).

- Proactive contact via hotline or email the shop if you don't see feedback via Shopee Chat.

- Carefully check the deadline for release of the bill – usually within 7-10 days after delivery.

4. Businesses need to note something when tax settlement with the bills from Shopee?

When the tax authority to check or settlement, all bills, the input must be collated, prove valid. If the business does not control the bill from the floor like ecommerce Shopee, the risk of tax will be great.

No VAT invoice – can be charged to cost valid?

As prescribed in circular 78/2021/TT-BTC, the Law on corporate income Tax, a cost is considered reasonable when:

- There are bills, vouchers legitimate

- Account details catering business activities

- Can prove non-payment of cash if > 20 million

=> If the purchase, Shopee but do not have VAT invoice Shopee valid, whether invoices or receipts are also not eligible to take into deductible expenses or reasonable cost to INCOME tax.

Consequences:

- Device type expenses when tax settlement, leading to increased profits taxable.

- Non-deductible VAT if purchases are input tax.

- Increase the risk of arrears of tax, penalties.

Risks common if not control bill when shopping online

Risk 1: administrative fine for use vouchers not valid

According to the Decree 125/2020/ND-CP, the penalty when using the bill invalid is from 3 to 8 million per case, not to tax arrears, fines for late payment.

Risk 2: Bill is lost – not stored properly defined

- If the business hosted electronic invoice via email or in paper removable, very easy to lost data discrepancies when need checking.

- Teen storage system focused business, it is difficult to prove the validity of the transaction when an inspector.

Risk 3: fraud or mistake when doing accounting

- No check engine code invoices, tax code suppliers.

- Vulnerable to fraud vouchers and use of counterfeit bills, influence corporate reputation.

Refer to: Quy trình lập và quản lý chứng từ điện tử trong thương mại hiện đại

5. Business can be integrated solution electronic invoice to control purchase, Shopee?

With online shopping becoming increasingly popular solution control bill input from the e-COMMERCE is mandatory. Instead of handling the craft, the business should deploy system electronic invoices have the ability to check – host – collated automatically.

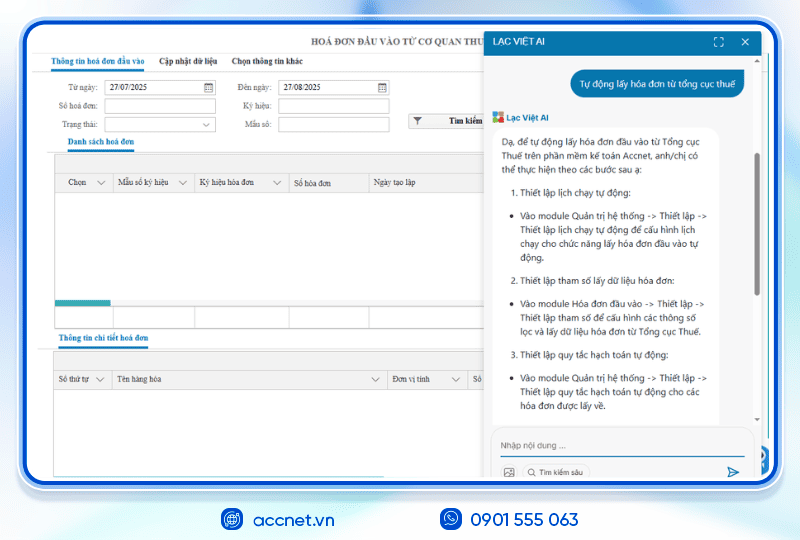

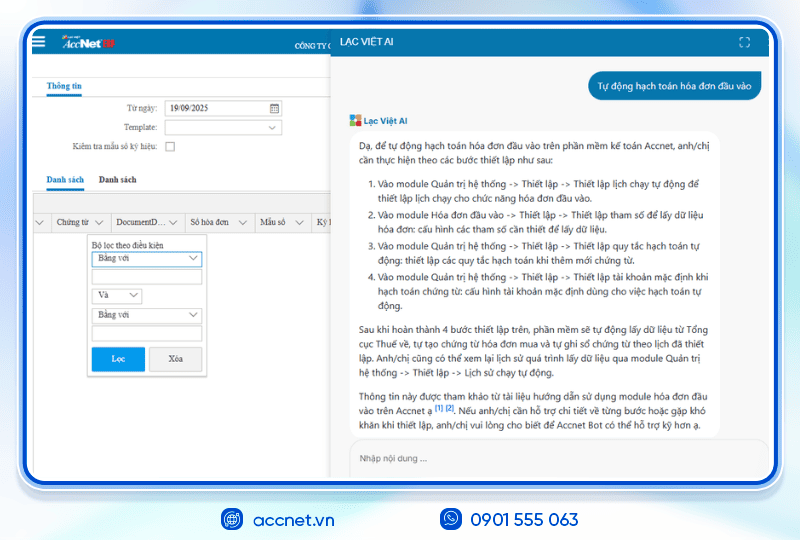

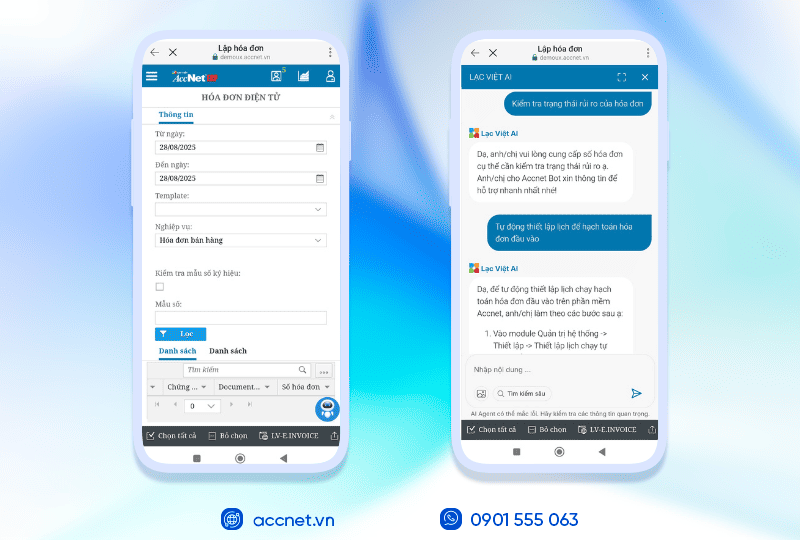

AccNet eInvoice – solution control bill Shopee effective. AccNet eInvoice system is electronic invoice for business English helps you to:

Automatically check for electronic invoices from suppliers

- Enter code lookup or attach the XML to verify valid.

- Check the tax code, the standard format circular 78.

Invoice management input according to each home sale

- Classification of bills under the floor, e-COMMERCE, supplier.

- Store vouchers on platform cloud – quick access at all times.

Integration with accounting software, ERP

- Data synchronization with the system AccNet ERP or accounting software outside.

- Recorded cost valid, joints bill – entry accounting.

Standardized test procedures – archive – report

- Limit the maximum errors in tax accounting.

- Automatically alert the bill late, duplicate, wrong data.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Purchase on Shopee bring advantage on price, speed, but the business can't see the light controlling, VAT invoice can be issued Shopee. If you skip this step, the business may be faced with:

- Arrears, penalties, tax

- Non-deductible VAT

- 't be charged a reasonable cost

To ensure safe, legal, financial transparency, reduce risk, businesses should:

- Active check suppliers on Shopee has a VAT invoice no

- The set up process a purchase – invoice clear

- Deployment system electronic invoice professional AccNet eInvoice to automate the entire process of invoice management input

AccNet eInvoice not only help control bill from Shopee, but also suitable for any transactions electronic shopping modern – optimal solutions for industry 4.0.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: